Materials Dividend Stocks Of The Month: Luks Group (Vietnam Holdings) And More

The oil price recovery and strong economic momentum have benefited the materials sector with companies involved in steel, chemicals and mining. Therefore, this industry is a macroeconomic play with the opportunity of riding the wave in times of robust demand for commodities. Commodity prices are also a key determinant of these companies’ earnings, which in turn drives dividend payout and yield. If you’re a long term investor, these high-dividend materials stocks can boost your monthly portfolio income.

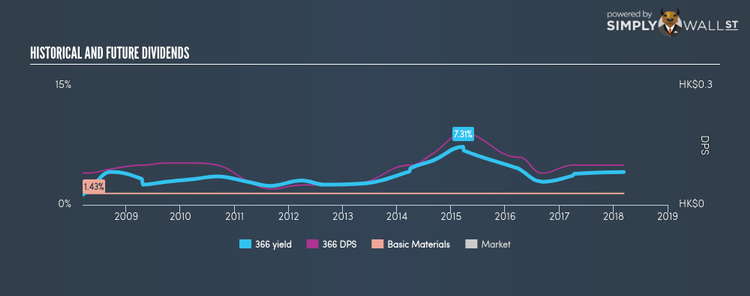

Luks Group (Vietnam Holdings) Company Limited (SEHK:366)

366 has an alluring dividend yield of 4.13% and is paying out 49.04% of profits as dividends . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from HK$0.08 to HK$0.10. The last 12 months have seen an earnings growth of 19.67% for Luks Group (Vietnam Holdings). More on Luks Group (Vietnam Holdings) here.

Tiande Chemical Holdings Limited (SEHK:609)

609 has a juicy dividend yield of 8.16% and the company has a payout ratio of 49.98% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from CN¥0.0063 to CN¥0.12. When we compare Tiande Chemical Holdings’s PE ratio with its industry, the company appears favorable. The HK Chemicals industry’s average ratio of 12.8 is above that of Tiande Chemical Holdings’s (5.5). More detail on Tiande Chemical Holdings here.

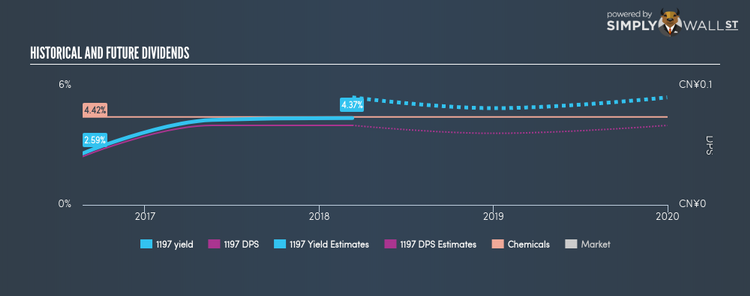

China Hengshi Foundation Company Limited (SEHK:1197)

1197 has a substantial dividend yield of 4.37% and distributes 35.36% of its earnings to shareholders as dividends . The company’s 4.37% dividend is both above the low risk savings rate and among the markets top payers. The company recorded earnings growth of 52.60% in the past year, comparing favorably with the hk chemicals industry average of 16.03%. Interested in China Hengshi Foundation? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers. Or create your own list by filtering SEHK companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.