Matthews China Fund's Top 5 Buys in the 4th Quarter

The Matthews China Fund (Trades, Portfolio) disclosed this week that its top five buys for fourth-quarter 2019 were China Merchants Bank Co. Ltd. (SHSE:600036), NAURA Technology Group Co. Ltd. (SZSE:002371), Meituan Dianping (HKSE:03690), Fuyao Glass Industry Group Co. Ltd. (HKSE:03606) and New Oriental Education & Technology Group Inc. (NYSE:EDU).

Overseen by Andrew Mattock and Winnie Chwang, the fund seeks long-term capital appreciation through equity investments primarily in China and Hong Kong. Matthews China's fourth-quarter letter said that the fund returned 16.56% during the three months ending December 2019 and 34.56% for the year, compared with the MSCI China Index benchmark return of 14.72% for the quarter and 23.66% for the year.

The letter discussed that despite major themes impacting the Chinese equity market, including the U.S.-China trade tensions and the Hong Kong protests, Chinese equities "climbed a wall of worry" during the year and posted strong returns, especially in the domestic A-share market.

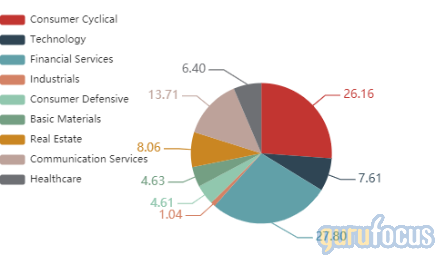

As of quarter-end, the fund's $894 million equity portfolio contains 44 stocks, of which 10 represent new holdings. The top three sectors in terms of weight are financial services, consumer cyclical and communication services, with weights of 27.80%, 26.16% and 13.71%.

China Merchants Bank

The fund purchased 7,404,026 shares of China Merchants Bank, giving the stake 4.48% weight in the equity portfolio. Shares averaged 36.65 yuan ($5.24) during the quarter.

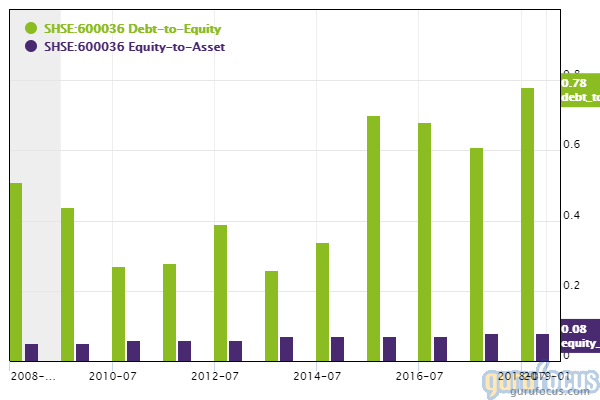

According to its website, the Shenzhen, Guangdong-based bank offers an all-in-one debit card, an online banking system and a wealth management product for high-end customers. GuruFocus data shows that the bank's equity-to-asset ratio of 0.08 underperforms approximately 70% of global competitors, suggesting high leverage. Despite this, China Merchants Bank's 16.17% return on equity outperforms approximately 88% of global banks.

NAURA Technology

The fund purchased 1,100,433 shares of NAURA Technology, giving the holding 1.56% weight in the equity portfolio. Shares averaged 75.92 yuan during the quarter.

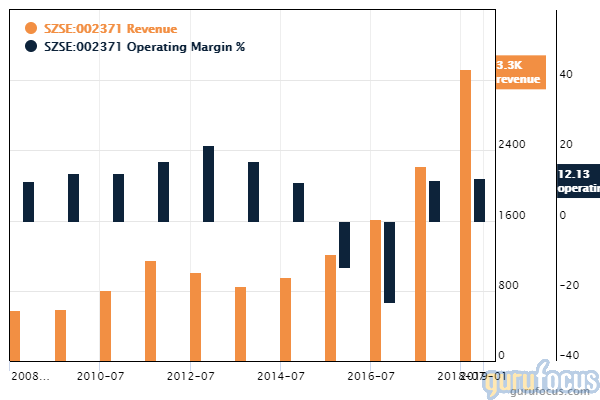

The Beijing-based company manufactures integrated circuits and electronic components. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and a three-year revenue growth rate that outperforms 94.19% of global competitors.

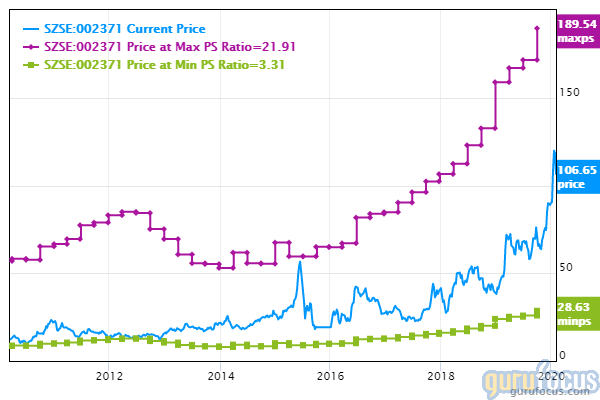

Despite high profitability, NAURA's valuation ranks 1 out of 10 on several signs of overvaluation, which include a share price and price-book ratio near a 10-year high and a price-earnings and price-sales ratio near a three-year high.

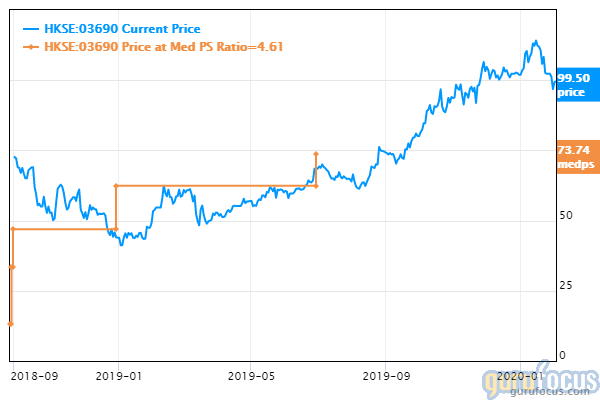

Meituan Dianping

The fund purchased 1,000,700 shares of Meituan Dianping, giving the position 1.46% weight in the equity portfolio. Shares averaged 96.47 Hong Kong dollars ($12.42) during the quarter.

Meituan Dianping provides food delivery services around China. According to the fund's letter, the company has gained market share as Chinese consumers "have embraced food-service delivery." The letter adds that China has a large network of local delivery people, keeping delivery costs "affordable for consumers."

GuruFocus data shows that Meituan Dianping's cash-to-debt ratio and debt-to-equity ratios are outperforming over 84% of global competitors, suggesting good financial strength.

Hong Kong-based Value Partners (Trades, Portfolio) also has a holding in Meituan Dianping.

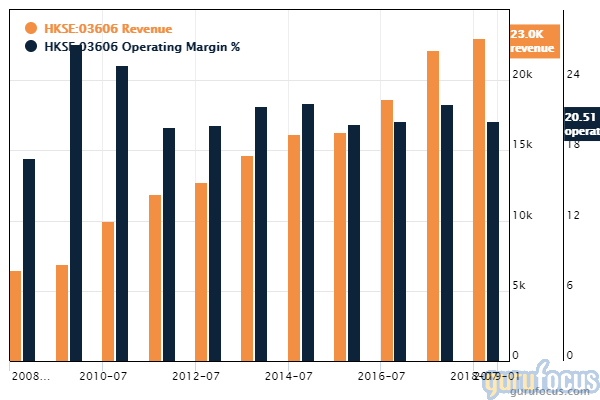

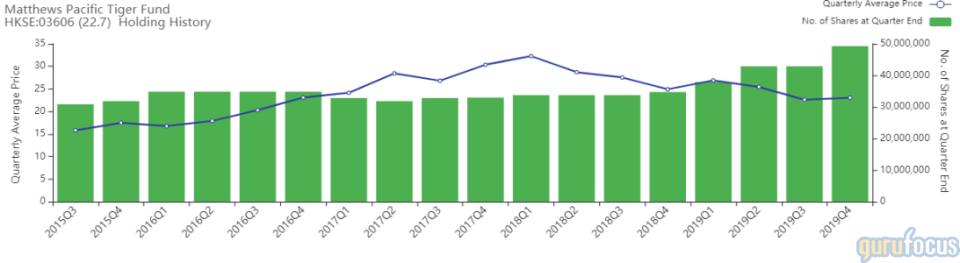

Fuyao Glass

The fund purchased 2,910,800 shares of Fuyao Glass, giving the stake 1% weight in the equity portfolio. Shares averaged HK$23.05 during the quarter.

The Fujian-based company manufactures and sells automobile glass products, industrial technology glass products and tinted float glass. GuruFocus ranks the company's profitability 9 out of 10 on several positive investing signs, which include a three-star business predictability rank and profit margins that are outperforming over 93% of global competitors.

The Matthews Pacific Tiger Fund (Trades, Portfolio) also has a holding in Fuyao Glass. During the quarter, the fund added 6,409,200 shares, increasing the stake 14.95%.

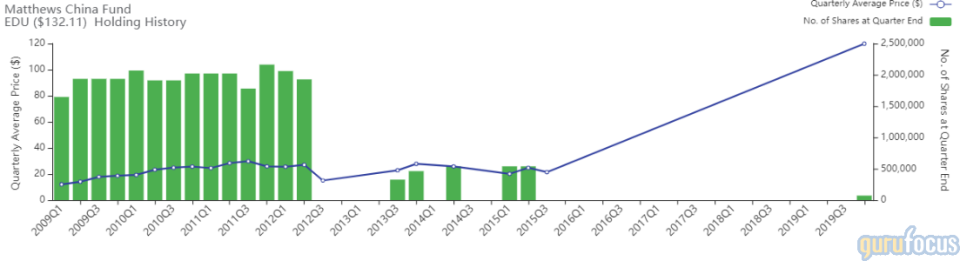

New Oriental Education

The fund purchased 71,600 shares of New Oriental Education, giving the position 0.97% weight in the equity portfolio. Shares averaged $119.84 during the quarter.

The Beijing-based company provides education programs, services and products for a wide range of languages. GuruFocus ranks the company's profitability 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank and a three-year revenue growth rate that outperforms 82.98% of global competitors.

Other gurus riding New Oriental Education's profitability include Chris Davis (Trades, Portfolio)' Davis Selected Advisors and Chase Coleman (Trades, Portfolio)'s Tiger Global Management.

See also

The fund's other buys include Sinopharm Group Co. Ltd. (HKSE:01099) and Beijing Capital International Airport Co. Ltd. (HKSE:00694).

Disclosure: No positions.

Read more here:

US Market Kicks Off February Significantly Overvalued

Eaton Vance Worldwide Health Sciences Fund Buys 3 Stocks in 4th Quarter

4 Diversified Media Companies With High Financial Strength and Returns

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.