Matthews Japan Fund Dumps 5 Stocks in 1st Quarter

- By Sydnee Gatewood

The Matthews Japan Fund (Trades, Portfolio) disclosed in its first-quarter portfolio, which was released earlier this week, that it exited five positions.

Warning! GuruFocus has detected 2 Warning Signs with TSE:8031. Click here to check it out.

The intrinsic value of TSE:8031

Managed by Taizo Ishida and Shuntaro Takeuchi, the fund, which is part of San Francisco-based Matthews International Capital Management, invests in Japanese companies that have sustainable growth in order to generate long-term capital appreciation.

Based on these criteria, the fund sold its holdings of Mitsui & Co. Ltd. (TSE:8031), Shin-Etsu Chemical Co. Ltd. (TSE:4063), Minebea Mitsumi Inc. (TSE:6479), Zozo Inc. (TSE:3092) and CKD Corp. (TSE:6407) during the quarter.

Mitsui & Co.

The fund shed 3.38 million shares of Mitsui, impacting the equity portfolio by -1.83%. The stock traded for an average price of 1,751.41 yen ($15.88) per share during the quarter. GuruFocus estimates the fund gained 21% on the investment since establishing it in the third quarter of 2016.

The Japanese conglomerate, which is involved in a wide range of industries, from energy and mining to real estate and health care, has a market cap of 2.92 trillion yen; its shares closed at 1,735 yen on Tuesday with a price-earnings ratio of 7.70, a price-book ratio of 0.70 and a price-sales ratio of 0.48.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Mitsui's financial strength 5 out of 10. In addition to poor interest coverage, the Altman Z-Score of 1.44 warns the company is at risk of going bankrupt.

The company's profitability and growth scored a 4 out of 10 rating. Although the operating margin is in decline, Mitsui is supported by returns that outperform competitors and a moderate Piotroski F-Score of 6, which suggests business conditions are stable. As a result of recording a decline in revenue per share over the last five years, the business predictability rank of one out of five stars is on watch. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per year.

No other gurus are currently invested in the stock.

Shin-Etsu Chemical

The Japan Fund sold its 569,200 remaining shares of Shin-Etsu Chemical, impacting the equity portfolio by -1.54%. The stock traded for an average price of 9,072.81 yen per share during the quarter. According to GuruFocus, the fund lost an estimated 43% on the investment since establishing it in first-quarter 2017.

The specialty chemical company has a market cap of 4.18 trillion yen; its shares closed at 10,020 yen on Tuesday with a price-earnings ratio of 12.76, a price-book ratio of 1.70 and a price-sales ratio of 2.78.

According to the Peter Lynch chart, the stock is undervalued.

Supported by comfortable interest coverage, Shin-Etsu's financial strength was rated 9 out of 10 by GuruFocus. In addition, the robust Altman Z-Score of 7.96 suggests the company is in good fiscal standing.

The company's profitability and growth scored a 7 out of 10 rating, driven by expanding margins and returns that outperform industry peers. Shin-Etsu is also supported by a moderate Piotroski F-Score of 5 and a one-star business predictability rank.

Shin-Etsu is currently not held by any other gurus.

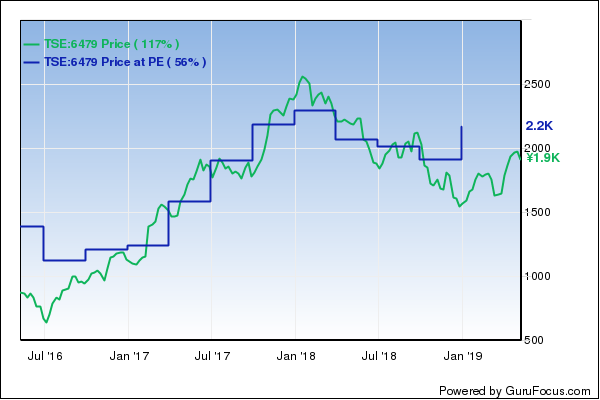

Minebea Mitsumi

Matthews divested of 2.2 million shares of Minebea Mitsumi, impacting the equity portfolio by -1.11%. The stock traded for an average price of 1,699.34 yen per share during the quarter. GuruFocus data shows the fund lost an estimated 14% on the stake since the third quarter of 2017.

The company, which manufactures electronics and machinery components, has a market cap of 770.49 billion yen; its shares closed at 1,856 yen on Tuesday with a price-earnings ratio of 12.85, a price-book ratio of 2.01 and a price-sales ratio of 0.87.

Based on the Peter Lynch chart, the stock appears to be undervalued.

GuruFocus rated Minebea Mitsumi's financial strength 7 out of 10. Boosted by adequate interest coverage, the Altman Z-Score of 3.42 suggests the company is in good fiscal health.

The company's profitability and growth scored an 8 out of 10 rating. In addition to an expanding operating margin, Minebea is supported by strong returns that outperform competitors and a moderate Piotroski F-Score of 5. The one-star business predictability rank is on watch as a result of a slowdown in revenue per share growth over the last 12 months.

No other gurus currently hold the stock.

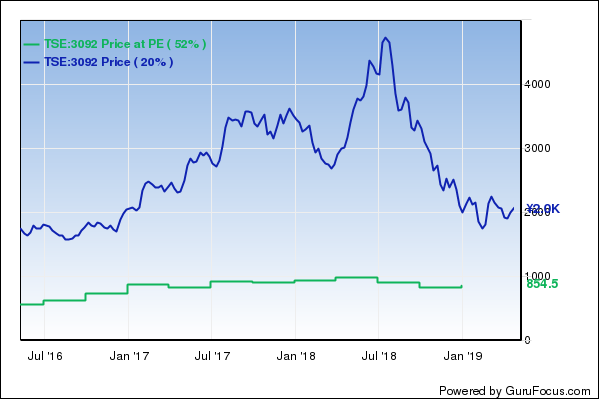

Zozo

The fund dumped its 1.3 million-share stake in Zozo. The trade had an impact of -0.86% on the equity portfolio. Shares averaged 2,050.91 yen during the quarter. According to GuruFocus, the fund lost approximately 37% on the investment since establishing it in the fourth quarter of 2015.

The retail company, which operates online shopping websites in Japan, has a market cap of 642.34 billion yen; its shares closed at 2,104 yen on Tuesday with a price-earnings ratio of 36.91, a price-book ratio of 31.80 and a price-sales ratio of 5.51.

The Peter Lynch chart suggests the stock is overvalued.

Boosted by sufficient interest coverage, Zozo's financial strength was rated 7 out of 10 by GuruFocus. In addition, the Altman Z-Score of 9.82 indicates the company is in good fiscal standing.

The company's profitability and growth scored an 8 out of 10 rating, driven by strong margins and returns that outperform industry peers. The low Piotroski F-Score of 3, however, suggests operating conditions are poor. Despite posting consistent earnings and revenue growth over the past decade, the five-star business predictability rank is on watch. GuruFocus says companies with this rank typically see their stocks gain an average of 12.1% per year.

The T. Rowe Price Japan Fund (Trades, Portfolio) holds 0.25% of Zozo's outstanding shares.

CKD

The Japan Fund closed its 2.8 million-share stake in CKD, impacting the equity portfolio by -0.64%. The stock traded for an average price of 1,016.41 yen per share during the quarter. GuruFocus estimates the fund lost 45% on the investment since the fourth quarter of 2017.

The company, which manufactures machinery components, has a market cap of 72.75 billion yen; its shares closed at 1,175 yen on Tuesday with a price-earnings ratio of 12.94, a price-book ratio of 0.93 and a price-sales ratio of 0.61.

According to the Peter Lynch chart, the stock is undervalued.

CKD's financial strength was rated 7 out of 10 by GuruFocus. Although the company has comfortable interest coverage, the Altman Z-Score of 2.73 indicates it is under some fiscal pressure.

The company's profitability and growth scored a 6 out of 10 rating. While the operating margin is expanding, its returns are underperforming competitors. CKD is also hurt by a low Piotroski F-Score of 1 and a one-star business predictability rank that is on watch.

The Matthews Asia Small Companies Fund (Trades, Portfolio) holds 0.32% of CKD's outstanding shares.

Additional trades

During the quarter, the fund also reduced several positions, including ORIX Corp. (TSE:8591), Mitsubishi UFJ Financial Group Inc. (TSE:8306), Murata Manufacturing Co. Ltd. (TSE:6981), KOSE Corp. (TSE:4922) and SoftBank Group Corp. (TSE:9984).

The Japan Fund's $2.8 billion equity portfolio, which is composed of 49 stocks, is largely invested in the technology and industrials sectors. According to its website, the fund returned -20.18% in 2018. Its benchmark, the MSCI Japan Index, posted a -12.58% return for the same period.

Disclosure: No positions.

Read more here:

Mylan Shares Tumble on Disappointing Revenue

Richard Pzena's Top 5 New Buys

Matthews Pacific Tiger Fund Buys 1 New Stock, Sells 2 in 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with TSE:8031. Click here to check it out.

The intrinsic value of TSE:8031