Matthews Pacific Tiger Fund's Top 4 Position Boosts in 4th Quarter

- By James Li

The Matthews Pacific Tiger Fund (Trades, Portfolio) disclosed it increased its exposure to four different Asian companies when it released its fourth-quarter 2018 portfolio.

Warning! GuruFocus has detected 2 Warning Signs with HKSE:00700. Click here to check it out.

The intrinsic value of HKSE:00700

According to its fact sheet, the fund seeks long-term capital appreciation through investments in Asian companies except for Japan. Additionally, the fund seeks companies that have strong balance sheets, cash flow stability, adaptability and integrity. For the December 2018 quarter, the fund's top position boosts were Tencent Holdings Ltd. (HKSE:00700), Inner Mongolia Yili Industrial Group Co. Ltd. (600887.SS), Housing Development Finance Corp. Ltd. (BOM:500010) and Naver Corp. (035420.KS).

Fund updates performance for 2018

The fund said in its letter it returned -3.72% for the final three months of 2018 and -11.11% for the year, compared to the MSCI All Country Asia ex Japan Index's return of -8.60% for the quarter and -14.12% for the year. Although the portfolio managers listed key macro headwinds like tightening federal policy in the U.S. and the ongoing trade war between the U.S. and China, the fund also emphasized "domestic" factors like financial sector concerns in India and the economic slowdown in China.

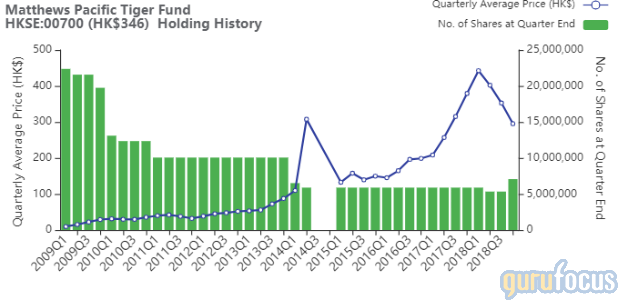

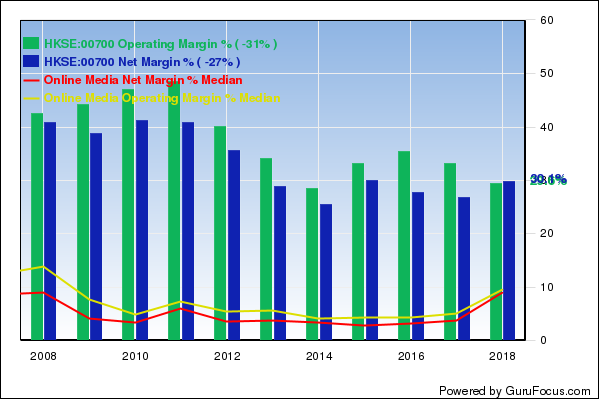

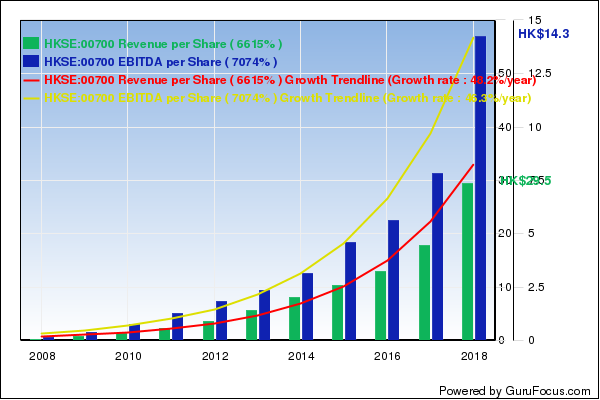

Tencent Holdings

The fund added 1,731,300 shares of Tencent Holdings for an average price of 295.26 Hong Kong dollars ($37.63) per share. With this transaction, the fund increased its equity portfolio 0.85%.

Tencent, the parent company of popular social media platform WeChat, connects users to a variety of internet services and content. GuruFocus ranks the company's profitability 8 out of 10 on several positive indicators, which include consistent revenue growth and operating margins that are outperforming 93% of global competitors, which include Alphabet Inc. (GOOG)(GOOGL) and social media giant Facebook Inc. (FB).

Tencent's business predictability ranks four stars out of five on strong revenue and earnings growth over the past 10 years.

Other gurus with large holdings in Tencent include Spiros Segalas (Trades, Portfolio) and the Matthews China Fund (Trades, Portfolio).

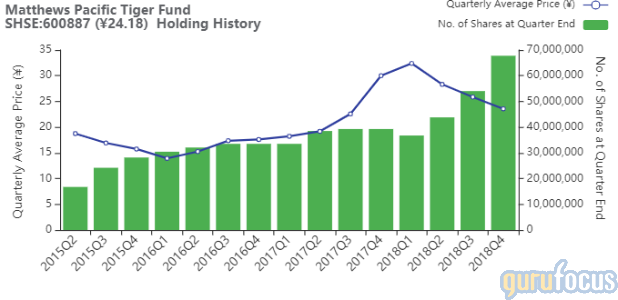

Inner Mongolia Yili Industrial

The fund added 13,735,331 shares of Inner Mongolia Yili Industrial for an average price of 23.57 yuan ($3.49) per share. With this transaction, the fund increased its equity portfolio 0.56%.

Inner Mongolia Yili produces and distributes dairy products like milk, ice cream, milk powder and yogurt. GuruFocus ranks the company's financial strength 8 out of 10 on several positive indicators, including solid interest coverage of 18.23 and Altman Z-score of 7.54. Other good signs include expanding profit margins and a dividend yield near a three-year high.

Other gurus with holdings in Inner Mongolia Yili include the Matthews China Fund and Value Partners (Trades, Portfolio).

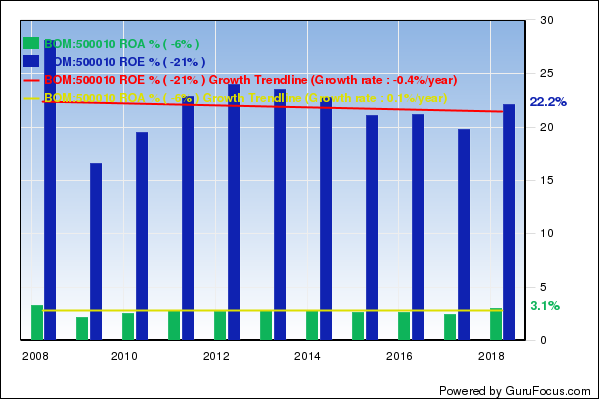

Housing Development Finance

The fund added 1,218,512 shares of Housing Development Finance for an average price of 1,840.85 Indian rupees ($25.76) per share. With this transaction, the fund increased its equity portfolio 0.42%.

The Indian financial services company primarily engages in conservative lending practices through its retail mortgage business. GuruFocus ranks the company's financial strength 3 out of 10 primarily due to a cash-to-debt ratio of 0.02 and a debt-to-equity ratio of 2.82, both underperforming over 94% of global specialty finance companies. Despite this, the company's return on equity and return on assets rank higher than over 99% of global competitors.

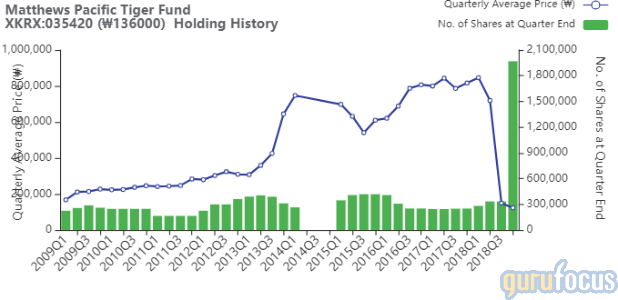

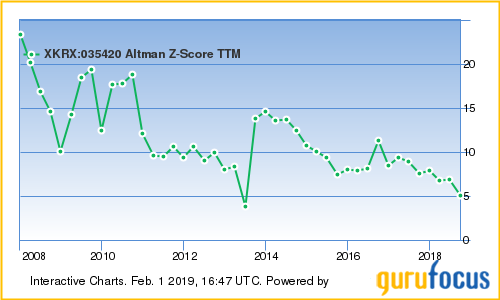

Naver

The fund added 1,635,710 shares of Naver, a company Steven Romick (Trades, Portfolio) established a position in during the quarter. Shares averaged 123,144 Korean won ($110.08) during the quarter; the Pacific Tiger Fund increased its equity portfolio 0.41% with this transaction.

Naver, a major search portal in South Korea, provides a wide variety of internet services like news, social media and digital comic content. GuruFocus ranks the company's financial strength 7 out of 10 on positive indicators like robust interest coverage and a strong Altman Z-score of 4.92.

Naver's business predictability ranks 3.5 stars out of five on consistent revenue and earnings growth over the past 10 years. Such metrics contribute to a profitability rank of 8.

Disclosure: No positions.

Read more here:

Matthews China Fund Starts 4 Positions in 4th Quarter

Mario Gabelli Sees Strong Global Growth in 2020

T. Rowe Price Japan Fund's Top 5 Position Boosts in 4th Quarter

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Signs with HKSE:00700. Click here to check it out.

The intrinsic value of HKSE:00700