Mawer Canadian Equity Fund's Top 5 Buys in 2nd Half of 2019

The Mawer Canadian Equity Fund (Trades, Portfolio), part of Mawer Investment Management, disclosed this week that its top five buys for the second half of 2019 included two new positions and increased bets in three existing holdings.

Jim Hall and Vijay Viswanathan, managers of the Calgary, Alberta-based fund, seek long-term capital returns primarily on midcap and large-cap Canadian companies. The fund managers employ a highly disciplined, research-driven, bottom-up process to select stock investments.

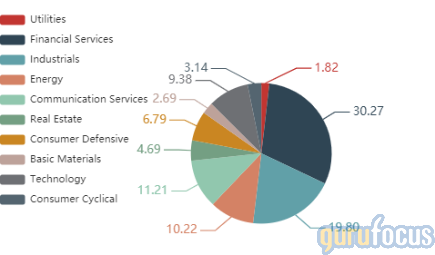

The fund releases its portfolio reports semiannually. As of the six months ending December 2019, the $3.11 billion equity portfolio contains 38 stocks with a turnover ratio of 7%. The top three sectors in terms of weight are financial services, industrials and communication services.

During the six-month period, the fund introduced CGI Inc. (TSX:GIB.A) and Enghouse Systems Ltd. (TSX:ENGH) to the equity portfolio and expanded its stakes in TELUS Corp. (TSX:T), Alimentation Couche-Tard Inc. (TSX:ATD.B) and Canadian Natural Resources Ltd. (TSX:CNQ).

CGI

The fund purchased 721,300 shares of CGI, giving the position 2.52% weight in the equity portfolio. Shares averaged 104.73 Canadian dollars ($74.17) during fourth-quarter 2019.

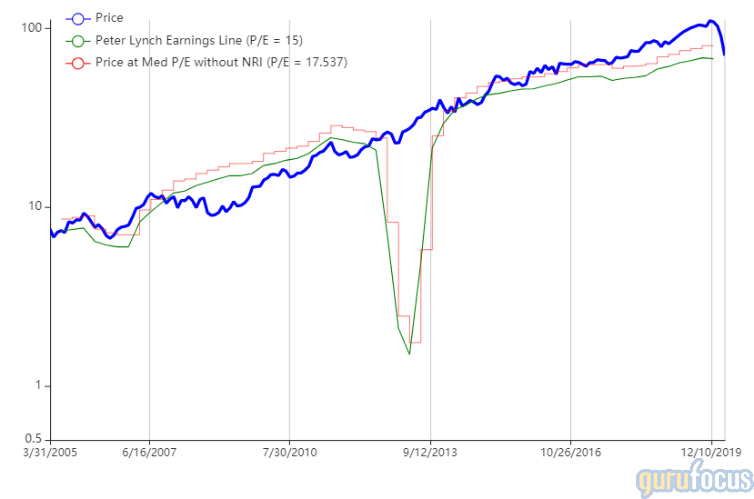

The Montreal, Quebec-based company provides a wide range of information technology services, including consulting, systems integration, application maintenance and business process outsourcing. GuruFocus ranks CGI's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and returns that are outperforming over 81% of global competitors. Additionally, operating margins have increased approximately 2.40% per year over the past five years.

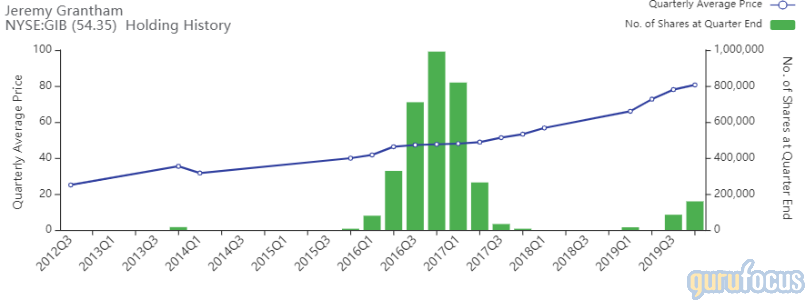

Gurus with large holdings in U.S.-based CGI shares (NYSE:GIB) include Pioneer Investments (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio)'s GMO and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates.

Enghouse

The fund purchased 557,999 shares of Enghouse, giving the position 0.87% weight in the equity portfolio. Shares averaged CA$38.48 during the December 2019 quarter.

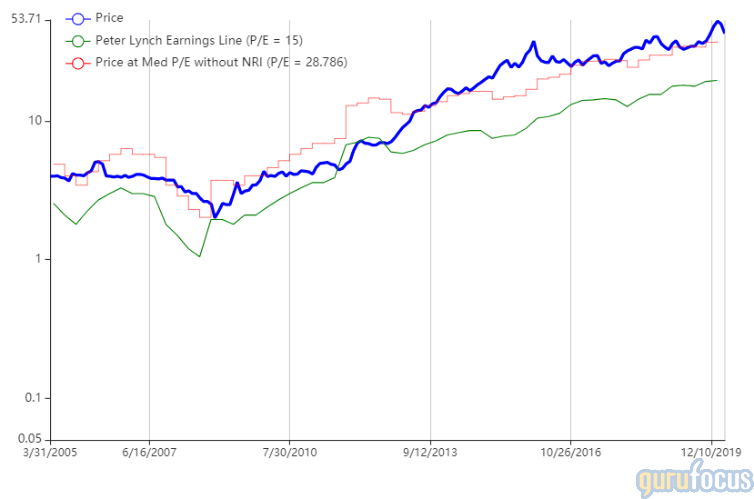

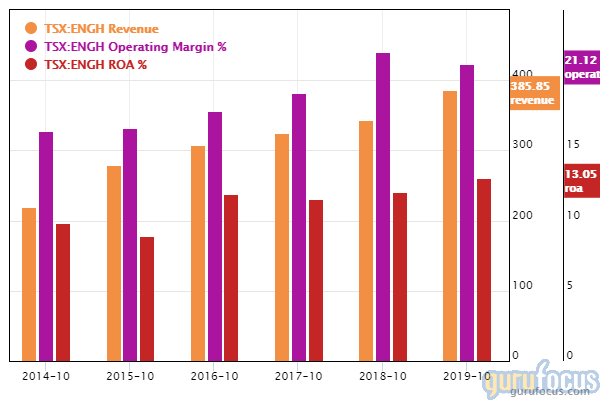

The Markham, Ontario-based company provides software and services to a wide range of end markets. GuruFocus ranks Enghouse's profitability 10 out of 10 on several positive investing signs, which include a 4.5-star business predictability rank, expanding operating margins and a return on assets that outperforms over 88% of global competitors.

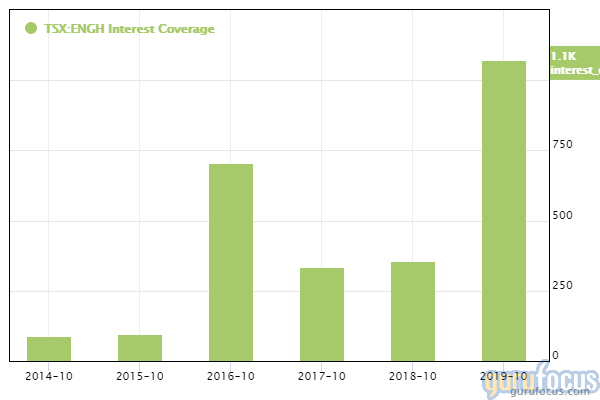

Enghouse's financial strength ranks 8 out of 10 on the heels of robust interest coverage and debt ratios outperforming over 70% of global competitors.

TELUS

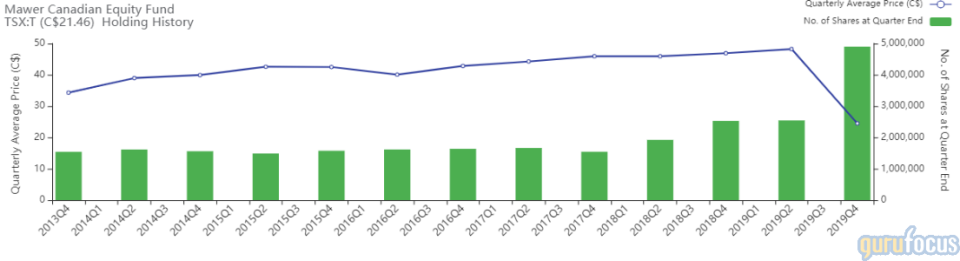

The fund added 2,356,942 shares of TELUS, increasing the position 92.68% and the equity portfolio 1.91%. Shares averaged CA$24.49 during the fourth quarter.

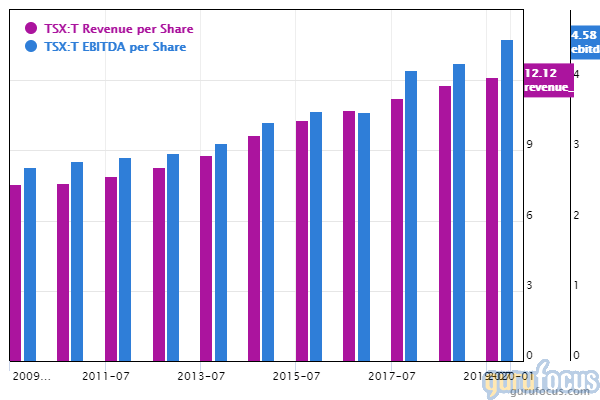

The Vancouver, British Columbia-based company provides internet, television and landline phone services around Canada. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and operating margins that outperform over 79% of global competitors.

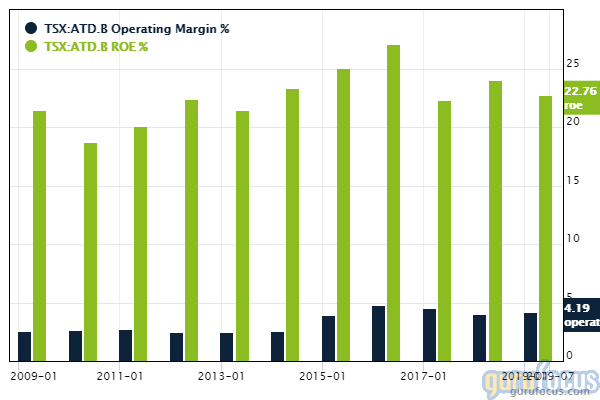

Alimentation

The fund purchased 654,600 shares of Alimentation, increasing the position 82.92% and the equity portfolio 0.87%. Shares averaged CA$41.21 Canadian dollars during the quarter.

The Laval, Quebec-based company operates a network of convenience stores around the globe. GuruFocus ranks the company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, expanding operating margins and returns that are outperforming over 87% of global competitors.

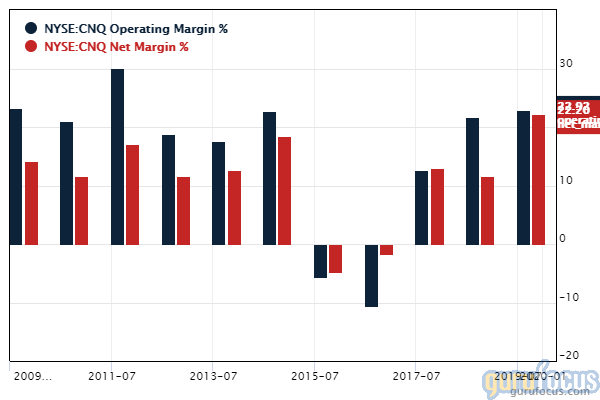

Canadian Natural Resources

The fund purchased 225,400 shares of Canadian Natural Resources, increasing the position 8.09% and the equity portfolio 0.30%. Shares averaged CA$35.06 during the quarter.

The Calgary, Alberta-based company produces light, medium and heavy oil; bitumen; synthetic oil and natural gas liquids. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 9 and net profit margins that outperform over 86.7% of global competitors.

Disclosure: The author has no positions mentioned. The holdings mentioned in this article reflect the fund's December 2019 portfolio report. Since the fund releases its portfolio reports semiannually, the holdings do not reflect any trades made during the first quarter of 2020.

Read more here:

5 Energy Companies With the Strength to Weather the Coronavirus Storm

Leon Cooperman 'Optimistic' About Stock Market Reaching a Bottom

6 High Financial Strength Stocks John Rogers and Paul Tudor Jones Agree On

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.