Maximus (MMS) Up on Strategic Acquisitions Amid High Debt

Maximus, Inc. MMS is currently benefiting from strategic acquisitions and long-term relationships with clients.

The company recently reported first-quarter fiscal 2022 adjusted earnings of $1.12 per share that surpassed the Zacks Consensus Estimate by 40% and increased 8.7% year over year. Revenues of $1.2 billion beat the consensus mark by 5% and increased 21.7% year over year.

How is MMS Doing?

With more than 40 years of experience, Maximus has grown to be a leading operator of government health and human services programs globally. The company’s business process management expertise, and its ability to deliver cost-effective, efficient and high-scale solutions, position it as a lucrative partner to governments. Maximus maintains solid relationships and strong reputation with governments and long-term contracts provide it predictable recurring revenue streams. The company continuously seeks long-term relationships with clients in both existing and adjacent markets. MMS is also focused on expanding its foothold in clinical services, as well as long-term services and supports. Moreover, complex health needs have increased the need for government social benefit and safety-net programs. This should continue driving demand for the company’s services.

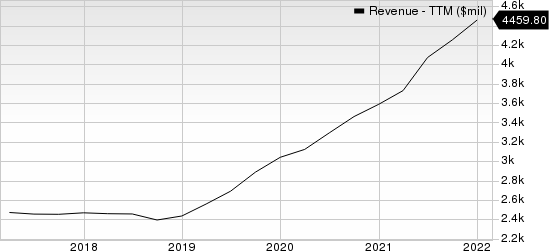

Maximus, Inc. Revenue (TTM)

Maximus, Inc. revenue-ttm | Maximus, Inc. Quote

Maximus has been active in undertaking acquisitions to expand its business processes, knowledge and client relationships, enhance technical capabilities, and gain additional skill sets. These acquisitions also complement the company’s long-term organic growth strategy. MMS recently purchased the Federal division of Attain. This buyout is expected to strengthen two core pillars of Maximus’ long-term corporate strategy, including accelerating digital transformation and the ongoing expansion into the U.S. federal market.

Maximus’ cash and cash equivalent balance of $182 million at the end of first-quarter fiscal 2022 was well below the long-term debt level of $1.5 billion. The cash level, however, can meet the short-term debt of $79 million.

Zacks Rank and Stocks to Consider

Maximus currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other stocks in the broader Business Services sector that investors may consider are Cross Country Healthcare CCRN, Accenture ACN and Clean Harbors CLH.

Cross Country Healthcare sports a Zacks Rank #1. The company has a long-term earnings growth of 21.5%.

Cross Country Healthcare has a trailing four-quarter earnings surprise of 41.5%, on average. CCRN’s shares have surged 85.5% in the past year.

Accenture carries a Zacks Rank #2 (Buy). The company has an expected earnings growth rate of 19.8% for the current year. The company has a trailing four-quarter earnings surprise of 5.3%, on average.

Accenture’s shares have surged 23.4% in the past year. The company has a long-term earnings growth of 10%.

Clean Harbors carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 43.2%, on average.

CLH’s shares have surged 7.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accenture PLC (ACN) : Free Stock Analysis Report

Clean Harbors, Inc. (CLH) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research