May Dividend Stock Picks

Dividend-paying companies such as China Oriental Group and China Mobile can diversify your portfolio cash flow by paying constant and large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. As a long term investor with a short term temperament, I highly recommend these top dividend stocks.

China Oriental Group Company Limited (SEHK:581)

China Oriental Group Company Limited, an investment holding company, manufactures and sells iron and steel products for downstream steel manufacturers in the People’s Republic of China. Established in 2003, and now run by Jingyuan Han, the company employs 9,700 people and has a market cap of HKD HK$22.34B, putting it in the large-cap group.

581 has a juicy dividend yield of 7.67% and pays 20.91% of its earnings as dividends , with analysts expecting the payout ratio in three years to be 54.67%. Although there has been some volatility in the company’s dividend yield, the DPS over a 10 year period has increased from CN¥0.063 to CN¥0.46. China Oriental Group’s earnings per share growth of 570.12% outpaced the hk metals and mining industry’s 53.96% average growth rate over the last year. Dig deeper into China Oriental Group here.

China Mobile Limited (SEHK:941)

China Mobile Limited, an investment holding company, provides mobile telecommunications and related services in Mainland China and Hong Kong. Founded in 1997, and currently lead by Yue Li, the company now has 464,656 employees and with the company’s market capitalisation at HKD HK$1.52T, we can put it in the large-cap category.

941 has a juicy dividend yield of 4.33% and pays 48.51% of its earnings as dividends , and analysts are expecting the payout ratio in three years to hit 51.55%. While there’s been some level of instability in the yield, 941 has overall increased DPS over a 10 year period from CN¥2.42 to CN¥3.21. Dig deeper into China Mobile here.

China Construction Bank Corporation (SEHK:939)

China Construction Bank Corporation provides various banking and related financial services in the People’s Republic of China. Founded in 1954, and currently run by Zuji Wang, the company provides employment to 352,621 people and with the market cap of HKD HK$2.08T, it falls under the large-cap group.

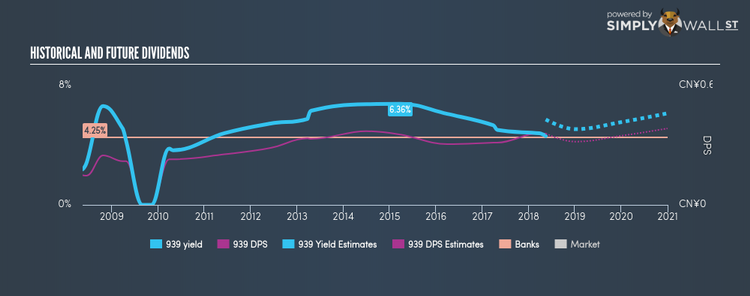

939 has a large dividend yield of 4.34% and is currently distributing 29.57% of profits to shareholders , with analysts expecting the payout in three years to be 30.19%. While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from CN¥0.15 to CN¥0.36. Continue research on China Construction Bank here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.