May Growth Stock Picks

Stocks that are expected to significantly grow their profitability in the future can add meaningful upside to your portfolio. Constellation Software and Vecima Networks are examples of many high-growth stocks that the market believe will be upcoming outperformers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

Constellation Software Inc. (TSX:CSU)

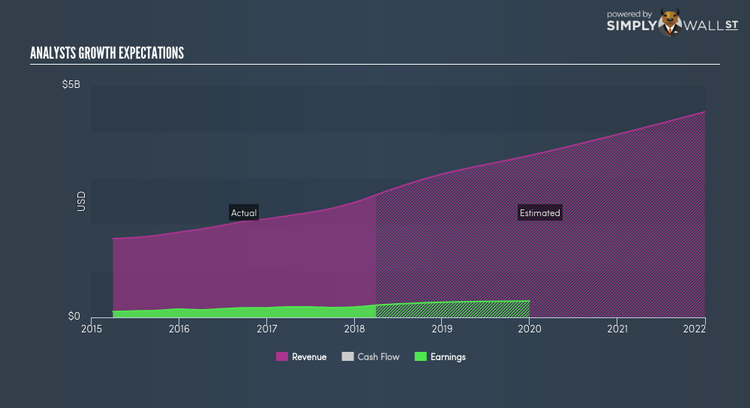

Constellation Software Inc., together with its subsidiaries, engages in the development, installation, and customization of software to various markets in the United States, Canada, the United Kingdom, Europe, and internationally. Founded in 1995, and currently lead by Mark Leonard, the company provides employment to 14,335 people and with the market cap of CAD CA$19.48B, it falls under the large-cap stocks category.

CSU’s projected future profit growth is a robust 13.44%, with an underlying 36.31% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 69.01%. CSU ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering CSU as a potential investment? I recommend researching its fundamentals here.

Vecima Networks Inc. (TSX:VCM)

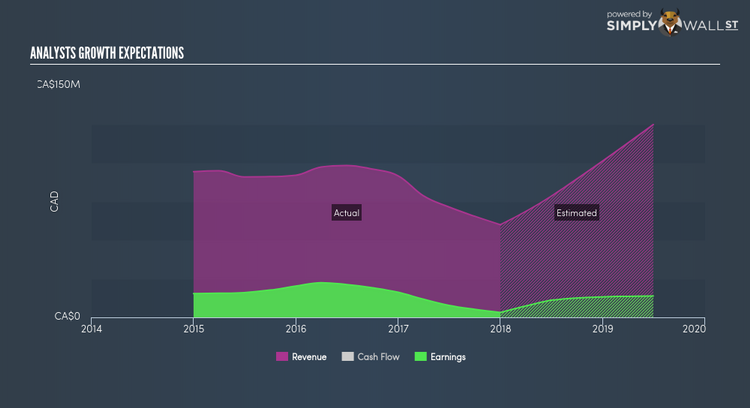

Vecima Networks Inc. provides technology solutions that empower network service providers to connect people and enterprises to information and entertainment worldwide. Started in 1988, and currently run by Sumit Kumar, the company currently employs 314 people and with the company’s market capitalisation at CAD CA$197.45M, we can put it in the small-cap group.

Want to know more about VCM? Have a browse through its key fundamentals here.

Trican Well Service Ltd. (TSX:TCW)

Trican Well Service Ltd., an oilfield services company, provides various specialized products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells primarily in Canada. Founded in 1979, and headed by CEO Dale Dusterhoft, the company provides employment to 2,067 people and with the market cap of CAD CA$1.13B, it falls under the small-cap category.

TCW’s forecasted bottom line growth is an exceptional 83.52%, driven by the underlying double-digit sales growth of 44.34% over the next few years. Although reduction in cost is not the most sustainable operational activity, the expanding top-line growth, on the other hand, is encouraging. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 7.35%. TCW ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Considering TCW as a potential investment? Check out its fundamental factors here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.