It May Be Possible That Volpara Health Technologies Limited's (ASX:VHT) CEO Compensation Could Get Bumped Up

The decent performance at Volpara Health Technologies Limited (ASX:VHT) recently will please most shareholders as they go into the AGM coming up on 18 August 2021. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

Check out our latest analysis for Volpara Health Technologies

How Does Total Compensation For Ralph Highnam Compare With Other Companies In The Industry?

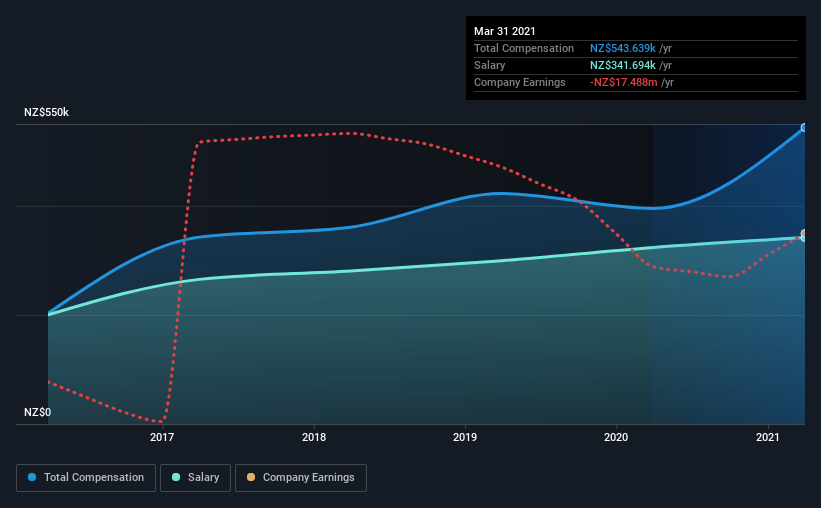

At the time of writing, our data shows that Volpara Health Technologies Limited has a market capitalization of AU$269m, and reported total annual CEO compensation of NZ$544k for the year to March 2021. We note that's an increase of 38% above last year. Notably, the salary which is NZ$341.7k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from AU$136m to AU$545m, the reported median CEO total compensation was NZ$905k. In other words, Volpara Health Technologies pays its CEO lower than the industry median. What's more, Ralph Highnam holds AU$17m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2021 | 2020 | Proportion (2021) |

Salary | NZ$342k | NZ$324k | 63% |

Other | NZ$202k | NZ$71k | 37% |

Total Compensation | NZ$544k | NZ$395k | 100% |

On an industry level, roughly 52% of total compensation represents salary and 48% is other remuneration. It's interesting to note that Volpara Health Technologies pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Volpara Health Technologies Limited's Growth Numbers

Over the last three years, Volpara Health Technologies Limited has shrunk its earnings per share by 13% per year. It achieved revenue growth of 57% over the last year.

The decrease in EPS could be a concern for some investors. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Volpara Health Technologies Limited Been A Good Investment?

Volpara Health Technologies Limited has served shareholders reasonably well, with a total return of 31% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

While the company seems to be headed in the right direction performance-wise, there's always room for improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for Volpara Health Technologies that investors should look into moving forward.

Switching gears from Volpara Health Technologies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.