May Top Defensive Stocks To Buy

Defensive investment strategies are those that maintain holdings in safe assets, which include stocks that meet a certain criteria that avoids losses in market value. To do this successfully, there are certain fundamentals that you should look for, which include but are not limited to: financial health, liquidity and reliable earnings capacity. Through my own research I found InterDigital, First Merchants and Washington Federal, which can be a good place for you to start your hunt.

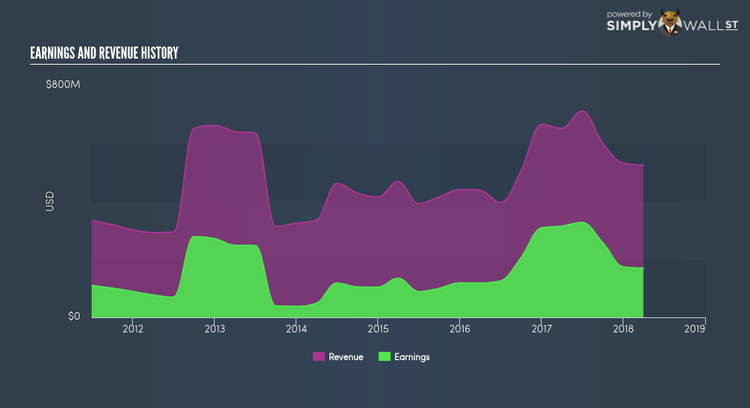

InterDigital, Inc. (NASDAQ:IDCC)

InterDigital, Inc. designs and develops technologies that enable and enhance wireless communications in the United States and internationally. Started in 1972, and headed by CEO William Merritt, the company employs 350 people and with the market cap of USD $2.76B, it falls under the mid-cap stocks category.

At present the company has a strong balance sheet , due to the high ratio of current assets to long-term liabilities, which is currently at 2.6x. Additionally, operating cash flow is at a good level relative to overall debt at 118.22%, making an investment in the company a safer bet if the cycle turns against you. Furthermore, at a US$2.76B market cap and a PE of 16.13x, greater liquidity is offered at a good price relative to the market, helping curtail the rate of decline in share price during periods of mass selling. The past 5 years show the company has grown earnings by 10.56% annually and recorded a ROA of 11.29% over the previous twelve months (compared to the industry’s 4.82%), showing IDCC contains many of the valuable traits in a defensive stock. Interested in InterDigital? Find out more here.

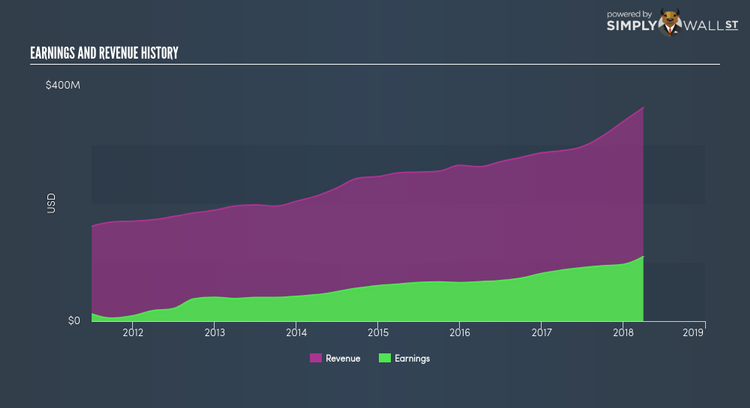

First Merchants Corporation (NASDAQ:FRME)

First Merchants Corporation operates as the financial holding company for First Merchants Bank that provides community banking services. Established in 1893, and currently lead by Michael Rechin, the company size now stands at 1,684 people and with the company’s market cap sitting at USD $2.21B, it falls under the mid-cap category.

FRME has a robust financial position because its liabilities are predominantly made up of low-risk deposits (89.80%). Additionally, of the lending they do engage in, only 0.41% fail to deliver on their initially expected yield, giving equity investors greater confidence in the safety of their investment. Furthermore, at a US$2.21B market cap , investors have the added benefit of solid liquidity, which minimises the potential for rapid share price falls in down cycles. Seeing that last year’s earnings growth continues the previous 5 years’ positive annual growth trajectory at 26.58% and 24.00% respectively, FRME holds many of the keys to avoiding the potentially destructive forces of a bear market. Dig deeper into First Merchants here.

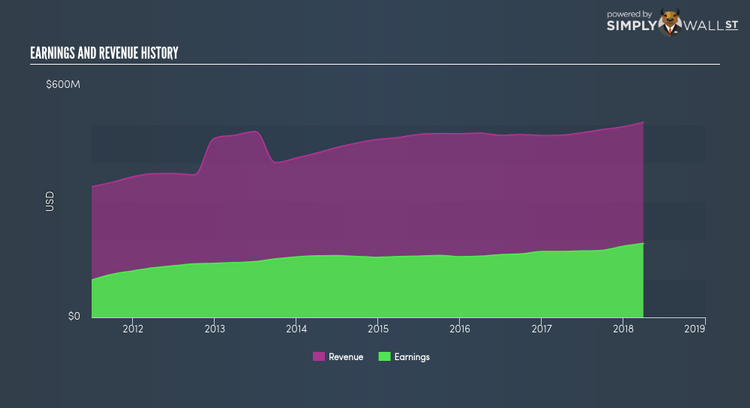

Washington Federal, Inc. (NASDAQ:WAFD)

Washington Federal, Inc. operates as the bank holding company for Washington Federal, National Association that provides lending, depository, insurance, and other banking services to consumers, mid-sized and large businesses, and owners and developers of commercial real estate in the United States. Established in 1917, and now run by Brent Beardall, the company employs 1,855 people and has a market cap of USD $2.74B, putting it in the mid-cap stocks category.

The company’s capital structureis attractive , with the majority of liabilities made up of low risk funding such as deposits which account for 81.64%. Additionally, of the lending they do engage in, only 0.43% fail to deliver on their initially expected yield, creating greater safety for investors in a fickle market. Moreover, as its price gives it a US$2.74B value on the market and a PE ratio of 14.81x, there are active participants in the market for the stock and there could still be room for value in the price, which reduces risk of firm price declines and allows you to sell without a large loss due to unattractive spreads. With that has also been annualised earnings growth of 6.18% for the last 5 years and an even greater 12.09% last year, which demonstrates WAFD has maintained attractive fundamentals for a defensive portfolio. More detail on Washington Federal here.

For more robust companies to add to your portfolio, explore this interactive list of defensive stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.