McDonald's Corporation Earnings: What to Watch

Fast food is in style on Wall Street again. Investors have made McDonald's (NYSE: MCD) one of the stock market's biggest winners so far in 2017, in hopes that the restaurant chain has finally broken out of the operating slump that produced declining market share in each of the past two years.

That raises the stakes for its next earnings report, slated for Tuesday, Oct. 24. So here's what to look for in that announcement.

Image source: Getty Images.

Market share momentum

Much of restaurant industry is struggling to achieve growth these days -- but not McDonald's. At its last quarterly outing, the chain managed its best comparable-store sales gain in over five years as global comps jumped 6.6%. That beat rival Burger King and its 3.9% increase and came in ahead of Starbucks (NASDAQ: SBUX), whose comps slowed to 4% last quarter.

The key to McDonald's rebound has been rising customer traffic. It handled 2% more guests over the past six months, compared to flat results over the prior-year period. Starbucks' comparable figure, in contrast, has dipped into negative territory.

Mickey D's got some help lately from popular menu tweaks like an expanded all-day breakfast offering and a new lineup of premium crafted sandwiches. That's why investors will be watching for evidence that the chain's traffic rebound is being driven by a reconnection with lost customers and not any single limited time offer or marketing push.

Financial improvements

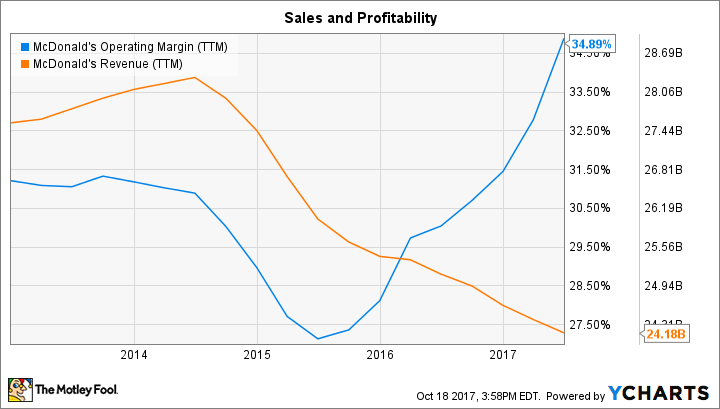

The company's sales are down 3% over the past six months, and yet operating income is up 21% thanks mainly to an aggressive refranchising initiative. The company has been busy selling company-owned locations to franchisees and giving up the restaurant sales they generated in exchange for a smaller, but more profitable, mix of rent and franchise fees.

Look for that shift to have a beneficial impact on operating margin this quarter. Profitability jumped to 37% of sales last quarter -- up 7 full percentage points from the prior year. But CEO Steve Easterbrook and his team believe that growth is just the start. Their long-term plan calls for operating margin to reach as high as 45% of sales by 2019, when the proportion of company-owned locations falls to 5% from about 15% at the start of the year.

MCD Operating Margin (TTM) data by YCharts.

Strategic updates

Finally, investors should be looking for management to discuss aggressive operating moves aimed at placing the company more firmly in the leadership position in the fast-food industry. The good news is McDonald's readily admits that it lost that footing in recent years. "As customers' expectations increased," the chain told investors recently, "McDonald's simply didn't keep pace with them."

Executives have hinted at a few of these strategic shifts already, including upgrading stores with new digital ordering kiosks. McDonald's is particularly excited about the prospects for home delivery, given that a huge proportion of the population in its biggest markets live within just a few miles of one of its restaurants.

That strategy risks neutralizing one of the company's core advantages -- namely, the efficient drive-thru system that helped it generate such impressive long-term growth over the past few decades. But investors should applaud McDonald's willingness to reinvent itself so that it has a good shot at dominating the fast food industry over the next few decades, too.

More From The Motley Fool

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

NVIDIA Scores 2 Drone Wins -- Including the AI for an E-Commerce Giant's Delivery Drones

Demitrios Kalogeropoulos owns shares of McDonald's and Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool has a disclosure policy.