Can McDonald's Keep Its Growth Streak Alive?

Buckle up, burger fans. McDonald's (NYSE: MCD) is set to post its third-quarter earnings results before the market opens on Tuesday, October 23.

It's a highly anticipated report for one key reason: the fast-food titan's recent struggles in the core U.S. market. Specifically, falling customer traffic has investors worried that its global growth rebound could stall.

With that bigger picture in mind, let's take a closer look at the trends to watch in the upcoming announcement.

Image source: Getty Images.

Getting back to traffic growth

Global demand looked strong last quarter, with comparable-store sales rising 4% to keep the chain well ahead of rivals like Dunkin' Brands and Starbucks. Looking beneath the headline sales result revealed key challenges, though.

That 4% expansion pace represented a slowdown from the 6% boost McDonald's notched in each of the past two quarters, for example. And customer traffic slipped for the second straight quarter in the key U.S. market.

Yes, McDonald's offset most of that slump with higher spending per visit in the U.S. and with faster growth in its international segment. However, the U.S. slowdown was significant enough to pull global traffic levels lower during the second quarter.

At a high level, the rebound initiatives that CEO Steve Easterbrook and his executive team have in place involve taking what's been working in outside markets like France and Japan and applying it to the U.S. segment. These strategies include a few quick fixes like menu updates.

Many more changes, such as store remodels and the rollout of enhanced digital and home delivery offerings, will take time before they begin lifting customer traffic. Broadly speaking, McDonald's is in the first year of an aggressive three-year investment plan that executives hope will lay the groundwork for many more years of market share gains on its home turf.

How investors benefit

Late last month, the company announced a hefty 15% increase to its dividend payout to mark its 42nd consecutive year of increases. The raise is part of a plan to return lots of cash to shareholders through a mix of dividends and stock buybacks. McDonald's expects to deliver $25 billion to investors through those channels in the three-year period that ends in 2019, in fact.

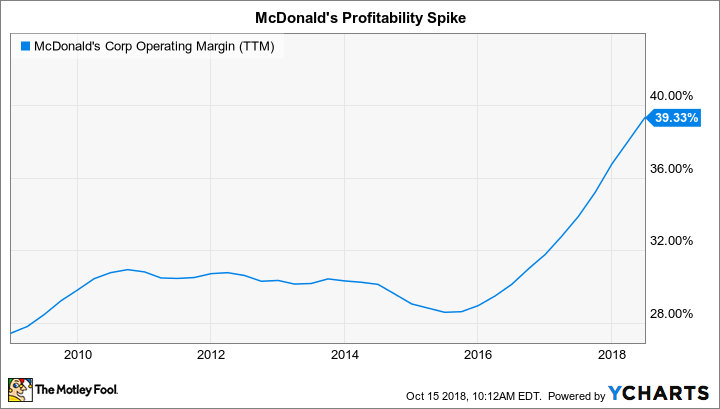

The company needs modest global sales growth to support those rising returns. But it also needs profit margins to keep marching up. That's why investors will be watching operating margin on Tuesday for signs that it is continuing to rise toward management's long-term goal in the mid 40% range.

It might seem odd that McDonald's can boost profitability while costs are rising and while the company doubles down on its value-based pricing strategy. Operating margin was far lower, at 33% of sales in 2016, after all.

MCD Operating Margin (TTM) data by YCharts.

Refranchising has been the key driver behind the recent gains. By selling company-owned locations to franchises, McDonald's has pushed its ratio down to below 8% of the global restaurant footprint from 14% just a year ago.

There are more gains to be won as the chain works toward its goal of operating just 5% of its restaurants and thus trading more volatile food sales for predictable, high-margin rent and franchise royalty fees.

The business -- and the stock -- performs best when McDonald's can pair that market-leading financial efficiency with robust sales growth. Revenue gains clocked in at a decent 4.7% over the first half of 2018, compared to the 5.3% boost it logged in 2017. The big question is whether that deceleration continues over the next few quarters, or stabilizes in response to the chain's aggressive moves around menu innovations, store upgrades, and home delivery.

More From The Motley Fool

Demitrios Kalogeropoulos owns shares of McDonald's and Starbucks. The Motley Fool owns shares of and recommends Starbucks. The Motley Fool recommends Dunkin' Brands Group. The Motley Fool has a disclosure policy.