McEwen Mining Reports Upbeat Exploration & Delineation Results

Including true width intervals of 6.08 g/t Au over 25.7 m at Stock West, 3.40 g/t Au over 24.3 m at Gold Bar, and 62.5 g/t Au & 5,571 g/t Ag over 2.0 m at San Jose

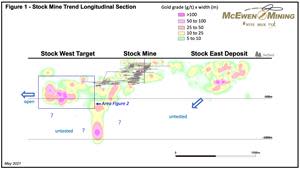

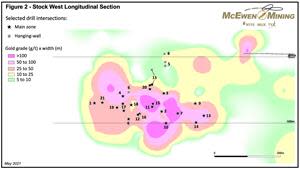

Figure 1

Stock Mine Trend Longitudinal Section

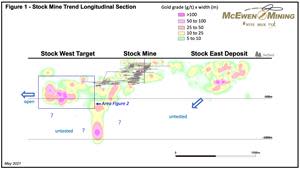

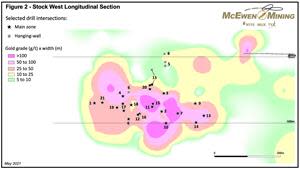

Figure 2

Stock West Longitudinal Section

Figure 3

Gold Bar Plan View

TORONTO, May 10, 2021 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report strong exploration results from the ongoing drilling at the Stock West project near Timmins, Ontario. The Stock West target, initially discovered in late-2019, is being drill-tested as part of a fully funded two-year $20 million exploration and delineation program at the Fox Complex. Drilling is designed to support a Preliminary Economic Assessment (PEA), currently underway, to evaluate the potential of expanding mining operations. The Company is also pleased to update progress on the $5 million drilling program at the Gold Bar mine property near Eureka, Nevada, where encouraging new results support our confidence in the geological and mineral resource model driving operational improvement. A new drill result from the San Jose Property in Argentina may have meaningful implications for ongoing exploration.

Stock West Drilling, Ontario

A total of 57 holes have been completed at the Stock West target since August 2020. The majority of these are designed to support litho-structural modeling and expand or infill an ongoing mineral inventory estimate. Encouraging new assay results (across true widths) from the 2020-2021 second exploration phase include the following:

8.43 g/t Au over 14.3 m including 23.68 g/t Au over 1.1 m – hole S20-138a

6.76 g/t Au over 15.6 m including 43.00 g/t Au over 0.4 m – hole S20-148

6.08 g/t Au over 25.7 m including 28.30 g/t Au over 0.6 m – hole S20-149

6.21 g/t Au over 19.0 m – hole S20-154

3.80 g/t Au over 7.3 m – hole S21-157

For several holes, some of which contain visible gold (VG), assay results that are pending. Figure 1 provides a longitudinal section view of the multiple target areas at Stock. Figure 2 focuses on Stock West with a longitudinal view of the mineralization showing the pierce points of the various intercepts detailed in Table 1.

Figure 1: https://www.globenewswire.com/NewsRoom/AttachmentNg/d7f7f562-351a-41e3-a51e-aaf8ea22c326

Data from the current drilling campaign is being integrated into the geological and resource models. For a complete list of drilling results at Stock West since August 2020, please visit www.mcewenmining.com.

Figure 2: https://www.globenewswire.com/NewsRoom/AttachmentNg/075f1df3-449f-470d-9460-21bae5c44bb2

Executive Vice President (Exploration) Stephen McGibbon commented: "The recent drilling results from Stock West are less than 1/3 of a mile (500 m) from our Fox Complex mill and are a great example of the near-term growth opportunities that will augment the Company's strategic decision-making over the next two years."

Table 1 - Highlight drill intercepts from the 2020-21 program at Stock West

Identifier | Hole-ID | From (m) | To (m) | Core Length (m) | True Width (m) | Au (g/t) | Comment |

1 | S20-129 | 463.8 | 471.6 | 7.8 | 5.5 | 4.23 | |

2 | S20-131 | 520.6 | 529.6 | 9.0 | 7.4 | 3.02 | |

3 | S20-133 | 482.2 | 488.5 | 6.3 | 5.4 | 4.32 | |

4 | S20-134 | 476.0 | 488.3 | 12.3 | 10.4 | 6.70 | VG |

including | 476.6 | 477.3 | 0.7 | 0.6 | 19.30 | ||

and | 483.0 | 484.0 | 1.0 | 0.8 | 12.10 | ||

5 | S20-135 | 373.5 | 378.9 | 5.4 | 4.7 | 3.48 | |

including | 374.2 | 374.7 | 0.5 | 0.4 | 19.60 | ||

488.0 | 491.2 | 3.2 | 2.8 | 4.13 | |||

6 | S20-137 | 441.0 | 450.0 | 9.0 | 6.9 | 2.25 | |

531.0 | 539.0 | 8.0 | 6.3 | 3.27 | |||

7 | S20-138A | 513.0 | 531.0 | 18.0 | 14.3 | 8.43 | |

including | 518.2 | 519.6 | 1.4 | 1.1 | 23.68 | ||

8 | S20-139 | 373.7 | 377.4 | 3.7 | 3.4 | 5.38 | |

9 | S20-143 | 518.0 | 524.3 | 6.3 | 5.5 | 3.09 | |

including | 523.6 | 524.3 | 0.6 | 0.6 | 17.10 | ||

10 | S20-148 | 534.0 | 554.7 | 20.7 | 15.6 | 6.76 | |

including | 539.1 | 539.7 | 0.6 | 0.4 | 43.00 | ||

11 | S20-149 | 476.0 | 509.0 | 33.0 | 25.7 | 6.08 | VG |

including | 503.5 | 504.3 | 0.8 | 0.6 | 28.30 | ||

12 | S20-150 | 505.8 | 510.9 | 5.1 | 3.6 | 5.36 | |

13 | S20-151 | 536.0 | 547.0 | 11.0 | 9.2 | 7.62 | VG |

14 | S20-152 | 547.0 | 561.1 | 14.1 | 10.9 | 4.26 | |

including | 551.0 | 552.0 | 1.0 | 0.8 | 16.80 | ||

15 | S20-154 | 374.1 | 376.1 | 2.0 | 1.6 | 24.15 | VG |

421.9 | 429.3 | 7.3 | 5.8 | 2.08 | |||

479.0 | 503.0 | 24.0 | 19.0 | 6.21 | |||

16 | S20-155 | 507.9 | 517.0 | 9.0 | 6.8 | 4.25 | VG |

17 | S21-157 | 535.1 | 543.3 | 8.1 | 7.3 | 3.80 | |

558.8 | 574.0 | 15.3 | 13.6 | 2.04 | |||

18 | S21-158 | 539.8 | 549.0 | 9.2 | 7.8 | 2.43 | |

including | 539.8 | 541.3 | 1.5 | 1.2 | 10.54 | ||

19 | S21-162A | 544.0 | 551.0 | 7.0 | 6.0 | 5.78 | VG |

20 | S21-165 | 442.3 | 449.7 | 7.4 | 6.2 | 2.21 | |

458.3 | 466.0 | 7.7 | 6.4 | 3.64 | |||

21 | S21-166 | 537.0 | 540.3 | 3.3 | 2.9 | 5.64 |

Mineralization at Stock West is characterized by a bright-green fuchsite-ankerite alteration. This alteration system has now been traced over a 1,600-foot (500-meter) segment of the east-west trending structural corridor. It currently remains poorly tested for two miles (3 km) to the west and below 2,000 feet (600 meters) vertical depth.

Modeling efforts indicate that mineralization shows continuity that may represent an attractive mineable body. This is being evaluated in the upcoming PEA as a potential operation alongside the Grey Fox resource. The goal of the PEA is to evaluate opportunities in the district, including the Fuller and Davidson-Tisdale deposits near Timmins, to understand the potential value represented for future exploration and development work. A total of seven surface drills are active on the Fox Complex, including four at Stock West, one at Stock Main and two drills recently activated at Grey Fox. Drilling will continue during the remainder of 2021.

Gold Bar Drilling, Nevada

McEwen Mining has committed $5 million toward drilling at the Gold Bar Mine in order to delineate new mineral resources, replace mining depletion, and further de-risk the geological and metallurgical models that are the basis of future production planning. During Q1 2021, the resource model reconciliation of actual mining depletion performed within 5% on contained ounces. Recent results are summarized in Table 2 and Figure 3. Core holes drilled partly for metallurgical purposes returned strong mineralization and potentially high gold recoveries (Au:CN Ratio %) from lab-based cyanidation work.

Table 2 - Drill intercepts from metallurgical targeted holes at Gold Bar Mine

Hole-ID | From (m) | To (m) | Core Length (m) | True Width (m) | Au g/t | Au:CN Ratio% | |

RGM043M | 25.0 | 57.1 | 32.1 | 28.9 | 1.50 | 86.0% | |

61.3 | 67.7 | 6.4 | 5.7 | 0.86 | 93.4% | ||

RGM044M | 28.3 | 46.0 | 17.7 | 15.1 | 1.04 | 89.5% | |

54.3 | 103.1 | 48.8 | 43.9 | 2.02 | 89.7% | ||

including | 68.0 | 95.0 | 27.0 | 24.3 | 3.40 | 90.8% | |

RGM045M | 3.7 | 5.8 | 2.1 | 1.9 | 0.38 | 97.8% | |

11.6 | 32.9 | 21.3 | 18.1 | 3.07 | 90.9% | ||

44.5 | 49.1 | 4.6 | 3.3 | 15.47 | 90.6% | ||

49.1 | 64.0 | 14.9 | 13.4 | 1.72 | 33.8% | ||

RGM046M | 69.3 | 100.6 | 31.3 | 28.2 | 1.54 | 93.0% | |

including | 78.6 | 95.4 | 16.8 | 2.43 | 94.1% | ||

Several holes have samples whose assays remain pending and are expected to be reported on in the near future.

The Ridge oriented core drill program successfully confirmed mineralization, locally increasing the average grade of existing resource model blocks and extending mineralization into new areas. This phase of the 2021 program consists of twenty reverse circulation holes and seven oriented core holes for a cumulative 3,417 meters.

Figure 3: https://www.globenewswire.com/NewsRoom/AttachmentNg/a2898b55-a1f1-4ca1-9224-598bcc07cace

San Jose Drilling, Argentina (49% MUX)

McEwen Mining’s joint venture partner and mine operator Hochschild Mining is undertaking a $9.3 million drill program in 2021 at San Jose, of which $5.7 million is earmarked for exploration drilling of priority targets including the Escondida Vein and the Telken target (located proximal to Newmont’s Cerro Negro Mine). In Q1, 1,396 m of drilling was completed at Escondida and Telken. The Escondida Vein is a high-grade exploration target hosting both gold and silver mineralization. Recently, hole SJM-529 intersected 2.0 meters of Escondida vein material containing 62.5 g/t Au and 5,571 g/t Ag. Mineralization to-date has been outlined over a 100-meter strike length by 180-meter vertical extent. Drilling will continue during the second quarter with 1,000 meters planned for resource delineation at Escondida.

Want News Fast?

Subscribe to our email list by clicking here: https://www.mcewenmining.com/contact-us/#section=followUs and receive news as it happens!

TECHNICAL INFORMATION

Technical information pertaining to Stock West and Gold Bar geology and exploration contained in this news release has been prepared under the supervision of Ken Tylee, P.Geo., a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects." Technical information pertaining to Gold Bar geology and exploration contained in this news release has been prepared under the supervision of Kevin Kunkel, P.Geo., a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining's joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, contain McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to the calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by the management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a diversified gold and silver producer and explorer focused in the Americas with operating mines in Nevada, Canada, Mexico and Argentina. It also owns a large copper deposit in Argentina.

CONTACT INFORMATION: | ||

Investor Relations: | Website: www.mcewenmining.com | 150 King Street West |

Facebook: facebook.com/mcewenminin | ||

Mihaela Iancu ext. 320 | ||

Twitter: twitter.com/mcewenmining | ||

Twitter: twitter.com/robmcewenmux | ||

Instagram: instagram.com/mcewenmining | ||