McKesson (MCK) Enters Deal to Divest Some European Businesses

McKesson Corporation MCK recently inked a deal with the PHOENIX group to sell its European businesses in France, Italy, Ireland, Portugal, Belgium and Slovenia to the latter. The transaction is expected to close in 2022, subject to customary closing conditions, including receipt of essential regulatory approvals.

For investors’ note, the PHOENIX group is a well known integrated healthcare provider in the European healthcare sector.

The business sell offs are expected to enable McKesson to focus on future investments in its strategic growth areas, including oncology and biopharma services, and core pharmaceutical and medical distribution.

Insights Into the Deal

McKesson’s decision to sell off its European businesses includes those in France, Italy, Ireland, Portugal, Belgium and Slovenia. The sell-off deal also includes McKesson’s Germany-based AG headquarters in Stuttgart, Recucare GmbH, its German wound-care business, its shared services center in Lithuania, and its minority (45%) ownership stake in its joint venture (“JV”) in the Netherlands — Brocacef.

McKesson’s remaining European businesses in the U.K., Norway, Austria and Denmark are outside the purview of this transaction, and will continue to be operated by the company. McKesson is on track to explore strategic alternatives for all of its remaining European businesses and focus future investments on growth strategies outside of Europe.

The company will also retain its minority equity stake in the company’s Germany JV with Walgreens Boots Alliance, Inc. WBA.

Significance of the Deal

Per McKesson’s management, the sell off will aid the company in simplifying its business and prioritizing investments in areas where it has better expertise and which are central to its long-term growth strategy.

Although the company will continue to operate its remaining businesses in the U.K., Norway, Austria and Denmark, it will be exploring a strategic path going forward, in order to fully exit the European region. McKesson’s goal is to advance its growth strategies, which will allow it to become a more focused organization and drive its mission to provide better care in every setting.

Industry Prospects

Per a report by Research and Markets published on GlobeNewswire, the global pharmaceuticals market is expected to grow from $1228.45 billion in 2020 to $1250.24 billion in 2021 at a CAGR of 1.8%. Factors like companies rearranging their operations and recovering from the COVID-19 impact are likely to drive the market.

Given the market potential, McKesson’s decision to sell-off its business to concentrate on its strategic growth areas is expected to significantly boost its business.

Notable Developments

McKesson has witnessed a few notable developments across its business over the past few months.

The company, in June, announced that Biologics by McKesson was selected by QED Therapeutics, an affiliate of BridgeBio Pharma, Inc. (BridgeBio) and Helsinn Group as a specialty pharmacy provider for TRUSELTIQTM (infigratinib) for the treatment of patients with previously treated locally advanced or metastatic cholangiocarcinoma harboring an FGFR2 fusion or rearrangement. Biologics by McKesson is an independent specialty pharmacy specializing in oncology and rare disease areas.

The same month, Biologics by McKesson was selected by Amgen Oncology as a specialty pharmacy provider for LUMAKRASTM (sotorasib) for the treatment of patients with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer, following at least one prior systemic therapy.

McKesson, in May, reported its fourth-quarter fiscal 2021 results where it registered market growth and higher volumes from retail national account customers in the U.S. Pharmaceutical segment.

Price Performance

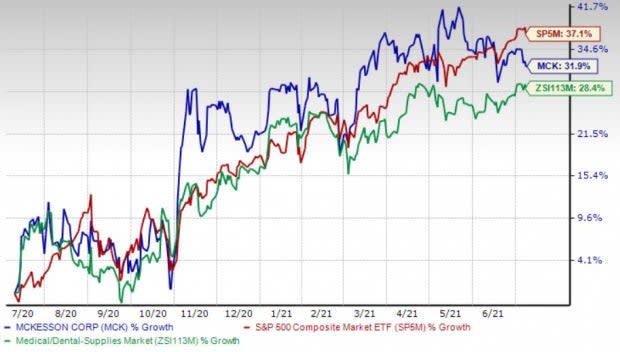

Shares of the company have gained 31.9% in the past year compared with the industry’s 28.4% rise and the S&P 500 composite’s 37.1% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, McKesson carries a Zacks Rank #3 (Hold).

A couple of better-ranked stocks from the broader medical space are Veeva Systems Inc. VEEV and National Vision Holdings, Inc. EYE.

Veeva Systems’ long-term earnings growth rate is estimated at 15.8%. The company presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

National Vision’s long-term earnings growth rate is estimated at 23%. It currently sports a Zacks Rank #1.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

National Vision Holdings, Inc. (EYE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research