MDNA: Enrollment Continues in the Fifth Dosing Cohort of the ABILITY Trial…

NASDAQ:MDNA

READ THE FULL MDNA RESEARCH REPORT

Business Update

Update on ABILITY Trial

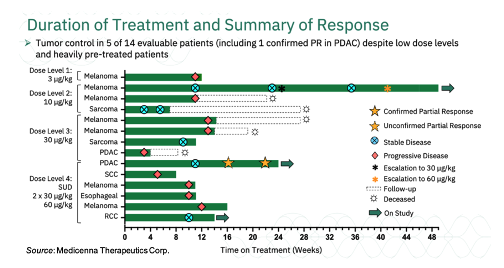

Medicenna Therapeutics Corp. (NASDAQ:MDNA) is currently conducting the Phase 1/2 ABILITY Study (A Beta-only IL-2 ImmunoTherapY Study) of MDNA11 in patients with advanced solid tumors (NCT05086692). In September 2022, the company provided updated anti-tumor activity data from the first four dosing cohorts. The data included a confirmed partial response (PR) in a patient with metastatic pancreatic ductal adenocarcinoma (PDAC) that had failed prior chemotherapy and checkpoint inhibitor therapies. The confirmatory scan for that patient showed that they continue to show tumor reduction when compared to prior scans. Overall, of the 14 evaluable patients, five have achieved tumor control (PR or stable disease [SD]) with MDNA11 monotherapy. The five patients that have achieved tumor control are listed below, with a summary of all patients treated thus far in the following chart:

1. Fourth-line (4L) PDAC Stage IV (Dose Level 4 @ 60 μg/kg following two divided doses of 30 μg/kg); confirmed PR

2. 3L non-clear cell renal cell carcinoma (Dose level 4 @ 60 μg/kg); SD

3. 4L sarcoma (Dose level 3 @ 30 μg/kg); SD

4. 3L melanoma (initial dose level 2 @ 10 μg/kg; escalated to dose level 3 @ 30 μg/kg and dose level 4 @ 60 μg/kg); SD

5. 3L sarcoma (initial dose level 2 @ 10 μg/kg); SD

A summary of the treatment duration and responses for each of the 14 evaluable patients is shown below:

Importantly, MDNA11 continues to demonstrate a favorable tolerability profile as a monotherapy. To date, there have been no reports of dose-limiting toxicities, dose interruptions, dose de-escalations, or treatment discontinuations due to safety issues. Enrollment is currently underway in the fifth dosing cohort, which consists of two 30 μg/kg “priming” doses of MDNA11 followed by fixed doses of 90 μg/kg.

On November 10, 2022, Medicenna presented new safety, pharmacokinetic (PK), and pharmacodynamic (PD) data were presented at the Society for Immunotherapy of Cancer (SITC) 37th Annual Meeting. Of note, the company reported that PK data remained consistent with repeat dosing, which suggests that there is no anti-drug antibody response. In addition, MDNA11 continues to show a selective and dose-dependent stimulating of anti-cancer immune cells in the low- and mid-dose cohorts, which suggests that there may be additional anti-tumor activity in the higher dose cohorts. PD data shows that MDNA11’s effects on anti-cancer immune cells is sustained beyond serum exposure (>11 days), which indicates a prolonged PD effect. In regards to safety, 92% of treatment-related adverse events have been Grade 1-2 and transient, with the majority resolving within 1-2 days.

We anticipate updated anti-tumor activity data from the ABILITY trials dose escalation cohorts in the first quarter of calendar 2023; early anti-tumor activity data from the single agent expansion phase of the trial in mid-calendar 2023; and early anti-tumor activity data from the combination arm of the trial in the fourth quarter of calendar 2023.

In September 2022, Medicenna announced a clinical collaboration and supply agreement with Merck to evaluate MDNA11 in combination with Keytruda® (pembrolizumab) in the ABILITY study. Under terms of the agreement, Medicenna will continue to sponsor the study and Merck will supply pembrolizumab. A Joint Development Committee has been established by the two companies to advance the combination portion of the study. The combination portion of the trial is likely to start in mid-2023.

Competitive IL-2 Candidates Falling Short

With the release of its third quarter 2022 financial update, Sanofi disclosed that it was discontinuing the ongoing Phase 2 trial of SAR444245 (a modified IL-2; formerly THOR-707) with the current every 3-week dose schedule. The company stated that “the efficacy observed in the early look of the data was lower than projected.” Sanofi also noted that the decision was not based on any safety-related issues. In addition, a new Phase 1/2 program is being planned, focused on schedule intensification. Sanofi acquired SAR444245 through its $2.5 billion buyout of Synthorx in 2019.

While discouraging for the IL-2 space as a whole, we believe there are a number of differences between MDNA11 and SAR444245 that preclude using the setback for SAR444245 as a read-through for MDNA11. First, MDNA11 contains two additional mutations to abolish binding to CD25, while SAR444254 is pegylated at a unique site on the protein to block binding to CD25. We believe pegylation is an inferior strategy to eliminate binding to CD25 that is less consistent than altering the affinity of the protein itself. Second, MDNA11 contains multiple amino acid mutations that enhance binding to CD122, while SAR444245 does not have enhanced affinity to CD122. Lastly, SAR444245 uses pegylation to extend the half-life of the molecule while MDNA11 uses human albumin. Pegylated proteins require a more complicated and less consistent manufacturing process than albumin-fusion proteins. In addition, while pegylation does serve to extend the half-life of the molecule, it does not impact biodistribution. In contrast, albumin-fusion proteins tend to accumulate in tumor and lymphoid tissues while also maintaining an extended serum half-life.

The early efficacy data shown for MDNA11 as a monotherapy is supportive evidence that the differences between it and SAR444245 are clinically relevant and that the setback for SAR444245 and other modified IL-2 candidates should not be used as a proxy for MDNA11’s potential.

Financial Update

On November 4, 2022, Medicenna announced financial results for the second quarter of fiscal year 2023 that ended September 30, 2022. The company reported a net loss for the second quarter of fiscal year 2023 of CAD$0.9 million, or CAD$0.01 per share, compared to a net loss of CAD$8.2 million, or CAD$0.15 per share, for the three months ending September 30, 2021. R&D expenses for the second quarter of fiscal year 2023 were CAD$2.4 million compared to CAD$6.3 million for the second quarter of fiscal year 2022. The decrease in expenses was primarily due costs associated with the development of MDNA11 incurred in the prior year including IND enabling studies and manufacturing of GMP material for the ABILITY trial. G&A expenses for the second quarter of fiscal year 2023 were CAD$2.4 million compared to CAD$2.0 million for the second quarter of fiscal year 2021. The increase was primarily due to one-time transaction costs of CAD$0.7 million related to the warrant liability derivative associated with the August 2022 financing.

As of September 30, 2022, Medicenna had approximately CAD$40.0 million in cash, cash equivalents, and marketable securities. We estimate the company has sufficient capital to fund operations into the second quarter of calendar 2024, and importantly is sufficiently financed to complete both the monotherapy and combination therapy trials of MDNA11 as well as to perform IND-enabling studies and clinical manufacturing for at least one BiSKIT compound. As of November 4, 2022, Medicenna had approximately 69.6 million common shares outstanding and, when factoring in stock options and warrants, a fully diluted share count of approximately 91.4 million.

Conclusion

The confirmed PR in the ABILITY trial, along with four additional patients that have achieved tumor control, is very exciting and provides compelling evidence of MDNA11’s single-agent activity. The safety, PK, and PD update at SITC was encouraging as the drug continues to show excellent tolerability as well as a prolonged PD effect on anti-cancer immune cells. We look forward to additional efficacy updates in the first quarter of 2023. While the setback for other modified IL-2 compounds could leave investors concerned with the prospects for MDNA11, we believe there are enough fundamental differences that distinguish MDNA11 as a potential best-in-class molecule, which is supported by the early signs of efficacy. With no changes to our model our valuation remains at $7 per share.

SUBSCRIBE TO ZACKS SMALL CAP RESEARCH to receive our articles and reports emailed directly to you each morning. Please visit our website for additional information on Zacks SCR.

DISCLOSURE: Zacks SCR has received compensation from the issuer directly, from an investment manager, or from an investor relations consulting firm, engaged by the issuer, for providing research coverage for a period of no less than one year. Research articles, as seen here, are part of the service Zacks SCR provides and Zacks SCR receives quarterly payments totaling a maximum fee of up to $40,000 annually for these services provided to or regarding the issuer. Full Disclaimer HERE.