Medical Device Maker Could Surprise Analysts With a Quick 20% Gain

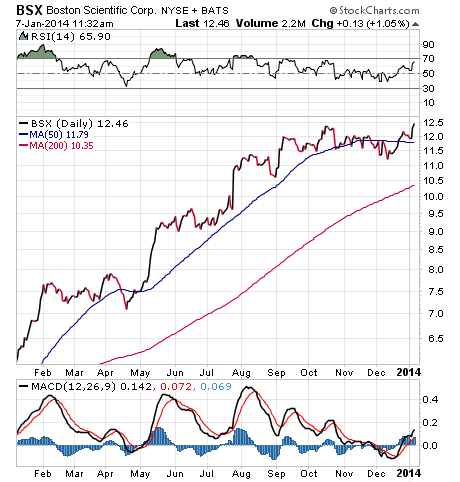

When you're hot, you're hot, and medical device maker Boston Scientific (BSX) is sizzling. On Monday, the stock spiked 3.35% to a four-year high after receiving a double dose of upgrades from analysts at Morgan Stanley (MS) and Oppenheimer (OPY).

Shares continued to climb Tuesday, and the latest move in the stock is telling us that the bull run in BSX just doesn't want to stop -- and hey, why should it?

According to David Lewis, who follows the stock for Morgan Stanley, BSX deserves his bullish "overweight" rating in large part because of the strength in the company's pipeline and its opportunities for margin expansion.

"Over the past several years, the company has targeted investments across several markets to accelerate growth and drive leverage," wrote Lewis in a note to clients. "We believe better recognition of this strategy will drive future outperformance even after a robust 2013 as accelerating sales and earnings growth drive improving financial performance over the next several years."

[More from ProfitableTrading.com: This Einhorn Favorite Should be a Big Winner in 2014]

According to Lewis, BSX stands to benefit in the short term from growth in its new subcutaneous implantable cardioverter defibrillator (ICD) product line. Lewis also thinks that Boston Scientific's ICD products are different enough from other ICD medical devices made by its competitors, including St. Jude Medical (STJ) and Medtronic (MDT), to essentially give BSX a leg up in the space.

Interestingly, MDT captured an upgrade from JPMorgan (JPM) on Monday, which caused its shares to spike higher as well. The upgrades in BSX and MDT show that the bullishness on the part of Wall Street firms isn't just stock specific, but also industry wide.

Now, being cautious by nature, and all-too-often late to the party, it's no surprise to me that both Morgan Stanley and Oppenheimer have set what I think is a conservative one-year price target on BSX of $15. I think the shares will reach that level, but I think they'll do so by this spring.

[More from ProfitableTrading.com: 'Blood in the Streets' Gold Miner Play Could Pay Off Big]

If we see a strong earnings showing in late January when BSX reports, that could be the catalyst that sends this medical device maker's shares well on their way to $15 over the next three months, a move that represents a 20% gain from current levels.

[More from ProfitableTrading.com: High-Flying Stock's Sell-off Presents Great Buying Opportunity]

Recommended Trade Setup:

-- Buy BSX at the market price

-- Set stop-loss at $11.46, approximately 8% below recent prices

-- Set initial price target at $15 for a potential 20% gain in three months

Related Articles

Related Articles