Medical Products' Nov 4 Earnings Roster: BDX, ZBH & More

The Medical Products companies’ quarterly results are likely to have witnessed stability in the quarter to be reported, backed by the gradual reopening of the economy despite the rise of the Delta variant. However, supply chain disruptions persist due to international restrictions across several geographies. Also, many parts of the COVID-affected international market are still suffering due to lower cash flows and difficult economic conditions.

Although the industry participants, which are an integral part of the broader Medical sector, saw collective business growth in the second quarter (thanks to the easing of restrictions), there has been a sequential decline in terms of the legacy business of the companies in the third quarter. Nonetheless, ramped-up vaccinations in the United States and outside along with fiscal and monetary stimulus aided the process of gradual reopening of the economy.

With the increase in the number of COVID-19 cases, testing, vaccine and therapeutic makers witnessed huge market adoption of their COVID-related healthcare support products and services in the third quarter. In fact, diagnostic testing stocks, which had registered a slowdown in demand for COVID-19 testing in the second quarter, picked up momentum in the third quarter, in line with industry trend.

The Medical sector has delivered an encouraging quarterly performance so far this reporting cycle. According to the latest Earnings Preview, this sector’s third-quarter earnings are expected to improve 19.5% on 12.6% revenue growth.

Let’s take a look at four Medical Product stocks that are scheduled to announce results on Nov 4.

Becton, Dickinson and Company BDX: Becton, Dickinson and Company’s, popularly known as BD, Life Sciences segment is likely to have exhibited substantial strength in the fourth quarter of fiscal 2021. Over the past few months, BD has launched a slew of products, which includes the launch of its FACSymphony A5 SE (the first BD spectral analyzer and provides a higher cellular parameter analysis) and FACSymphony A1 Cell Analyzer (that offers high-end technology and a cost-effective bench top design). Apart from this, BD boasts of a robust pipeline of modular, scalable new instruments and next-generation dyes that enable its customers to fully leverage its complete and integrated solution suite. All these factors are likely to have contributed to the Life Sciences segment, thereby might have aided revenues. (Read more: BD Gears Up for Q4 Earnings: What’s in the Offing?)

Our proven model predicts an earnings beat for BD this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The company has a Zacks Rank #3 and an Earnings ESP of +1.36%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

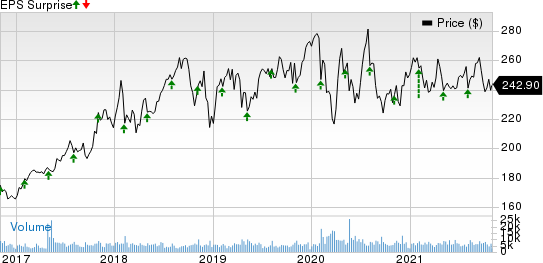

Becton, Dickinson and Company Price and EPS Surprise

Becton, Dickinson and Company price-eps-surprise | Becton, Dickinson and Company Quote

Zimmer Biomet Holdings, Inc. ZBH: Zimmer Biomet has been witnessing improvement in its legacy business since the beginning of 2021 owing to an expanded vaccination drive and gradual opening up of the economy, which resulted in people opting for non-COVID elective orthopedic and musculoskeletal procedures. The company’s third-quarter 2021 top-line result is expected to reflect this procedure volume improvement. Besides, we expect the company’s Hips and Knees product portfolio in the United States, which is better equipped for pandemic support compared to the non-U.S. markets of Zimmer Biomet, to have witnessed strong performance in the quarter under review. The nature of the business, which is non-elective, might have continued with year-over-year growth in the third quarter. (Read more: Zimmer Biomet to Report Q3 Earnings: What’s in Store?)

Zimmer Biomet has a Zacks Rank #4 (Sell) and an Earnings ESP of -1.87%.

Zimmer Biomet Holdings, Inc. Price and EPS Surprise

Zimmer Biomet Holdings, Inc. price-eps-surprise | Zimmer Biomet Holdings, Inc. Quote

AmerisourceBergen Corporation ABC: AmerisourceBergen is likely to have witnessed revenue growth at its Pharmaceutical Distribution segment in the fiscal fourth quarter of 2021 on the back of sustained growth in specialty product sales, including COVID-19 treatments and overall market growth. Solid organic growth rates in the U.S. pharmaceutical market and population demographics might get reflected in the to-be-reported quarter’s results. (Read more: AmerisourceBergen to Post Q4 Earnings: What's in Store?)

AmerisourceBergen has a Zacks Rank #3 and an Earnings ESP of -0.78%.

AmerisourceBergen Corporation Price and EPS Surprise

AmerisourceBergen Corporation price-eps-surprise | AmerisourceBergen Corporation Quote

DENTSPLY SIRONA Inc. XRAY: DENTSPLY SIRONA’s Consumables segment is likely to have witnessed improvement in revenues in the third quarter of 2021. Rebound in sales of all product categories might have driven the upside. Apart from this, sustained improvement in sales trends owing to reopening of dental offices and rise in patient visits may have favored the company’s performance in the to-be-reported quarter. (Read more: DENTSPLY SIRONA to Post Q3 Earnings: What’s in Store?)

DENTSPLY SIRONA has a Zacks Rank #4 and an Earnings ESP of -1.92%.

DENTSPLY SIRONA Inc. Price and EPS Surprise

DENTSPLY SIRONA Inc. price-eps-surprise | DENTSPLY SIRONA Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.