Medical Professionals Can Play Key Role In Preventing Financial Exploitation Of Seniors

FA Insights is a daily newsletter from Business Insider that delivers the top news and commentary for financial advisors.

Medical Professionals Can Play Key Role In Preventing Financial Exploitation Of Seniors (Investment News)

A national survey of 603 medical professionals, and cited by Investment News, found that 59% of doctors and nurses think cognitive impairment "very often" makes seniors vulnerable to financial exploitation. 33% think it makes seniors vulnerable "somewhat often."

“Doctors and nurses must play an important front-line role if we are going to do a better job of spotting older Americans who have been or are being victimized by investment fraud and other financial exploitation,” said Don Blandin, CEO of Investor Protection Trust told Investment News. 80% said they could help fight such financial exploitation if they were taught to spot red flags.

5 Reasons Not To Abandon Non-U.S. Dividend Stocks Completely (Advisor Perspectives)

BlackRock's Russ Koesterich tells investors there are five reasons to be selective when abandoning non-U.S. dividend stocks at a time when bond yields are rising.

1. "Over the long term, dividend paying stocks tend to outperform in both bull and bear markets." 2. Overseas U.S.-dividend companies still have attractive yields. 3. "The stocks are likely to continue to pay higher yields for the foreseeable future." 4. Non-U.S. dividend stocks are cheaper than those of dividend stocks in the U.S. 5. And the offer diversification.

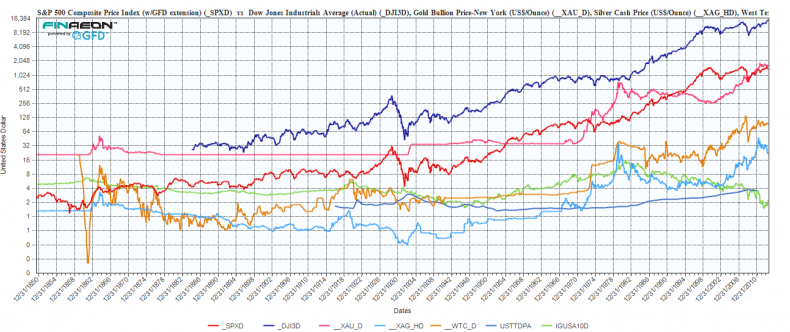

A Chart Of Stocks, Bonds, Oil, Gold, And The National Debt Since 1850 (Global Financial Data)

The folks at Global Financial Data looked at the S&P 500, DJIA, gold, silver, West Texas Intermediate, total debt as a % of GDP, and the U.S. 10-year dating back to 1850. This chart shows that they are "they are all at or very close to all time highs with the exception of the US 10yr Yield which of course just bounced off an all time low."

Global Financial Data/Ralph Dillon

Former CFP Chair To Get Public Letter Of Admonition (Reuters)

Alan Goldfarb, the former chairman of the CFP Board, expects a "public letter of admonition" for violating its ethical standards, according to Reuters. The CFB board is expected to admonish him for misrepresenting himself as a fee-only advisor, when is said to have received a salary from one of his ventures as well. Goldfarb resigned from his position in November 2012.

Investors Have To Completely Rethink Their 2013 Playbook (The Reformed Broker (The Reformed Broker)

Investment strategies that worked at the start of the year aren't working as well anymore writes Josh Brown. This is because of two key reasons. "First, U.S. stocks are now coping with rising interest rates and the bond back-up. No one knows whether or not that's done for now. The yield on the 10-year, at 2.29%, is sitting at 14 month highs. Can't be ignored. This means the yield plays at best can stabilize but should probably not be loaded up on. Secondly, we're starting to pay more attention to the overseas stuff."

With that in mind Josh Brown says investors need to brace for much more volatility. "'d say position-sizing should probably come down as well. Lastly, I'd imagine that getting accustomed to gap-up and gap-down opens would be a good idea as well."

More From Business Insider