MedTech Thrives on Healthcare IT in 2021: 4 Stocks to Focus on

Use of information technology (IT) in healthcare has been prevalent for quite some time now. Health IT is aimed at enhancing patient outcome and improving community health and quality of care.

Following a pandemic-battered healthcare infrastructure where general hospital services took a backseat to prioritize COVID-19 care, digital health and reliance on AI-based platforms to provide remote as well as efficient patient-centric care services have been emerging as potential areas capable of changing the face of care provision.

With a potential upside on this front, IT-driven MedTech stocks seem to be prudent investment choices for the times to come.

Healthcare and Technology in 2021: A Snapshot

The pandemic prompted a large number of healthcare practices and hospitals to embrace virtual care. Per a report by StrategyR, the global market for healthcare IT was estimated to be $201.8 billion in 2020 and is anticipated to reach $484 billion by 2026, at a CAGR of 15.1%.

Given that, AI has, of late, been increasingly adopted by the medical sector to not only transform patient diagnosis and management, and drug development businesses, but the overall healthcare business as well. AI is now being pitched as the tool to provide a more personalized, proactive and smarter care via early and accurate detection of any preventive healthcare emergency. Per a report by Research and Markets, the global AI in healthcare market is expected to rise from $6.1 billion in 2021 to $39.5 billion by 2026, at a CAGR of 45.3%. Factors like increasing volume of healthcare data and growing complexities of datasets, improving computing power, and rising imbalance between health workforce and patients are driving the need for improvised healthcare services and in turn the need for AI.

Another aspect of dependence of the MedTech sector on technology is remote patient monitoring. Per a report by MarketsAndMarkets, the global patient monitoring devices market is projected to reach $55.1 billion by 2025 from $36.4 billion in 2020, at a CAGR of 8.6%. Factors like technological advancements and growing preference for telehealth services amid the pandemic are expected to drive the market.

Realizing the potential in the remote patient monitoring, well-known MedTech player Masimo Corporation MASI has been making impressive progress to strengthen its foothold in the niche space. The company, in June, announced receipt of the FDA 510(k) clearance for its wearable, wireless thermometer — Radius T° — for both prescription and over-the-counter use on patients and consumers above the age of five.

4 Stocks to Focus on

Here we have picked four stocks from the MedTech space which have been quite active on the technology-based healthcare front and have performed impressively in recent times.

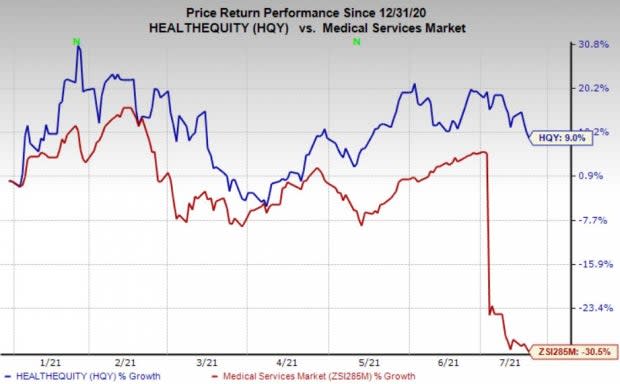

HealthEquity, Inc. HQY is a well-known MedTech player and provider of technology-enabled services platforms that aid consumers to make healthcare saving and spending decisions. In June, this Zacks Rank #1 (Strong Buy) company reported robust year-over-year increase in its total health savings accounts (HSA) assets and HSAs in the first quarter of 2021. You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 14.5%. The company is expected to report fiscal 2022 revenue growth of 3.9%. Year to date, the stock has gained 9.1% against the industry’s 30.5% fall.

Veeva Systems Inc. VEEV, a renowned cloud solutions provider, announced in June that Oval Medical Technologies Ltd and inveox GmbH are using Veeva Vault Quality Suite applications to modernize quality management and drive greater GxP compliance. The Zacks Rank #2 (Buy) company had also reported impressive first-quarter fiscal 2022 results in May where it continued to benefit from its flagship Vault platform and received positive feedback for Data Cloud. The company also saw robust progress of Veeva Link during the quarter.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 15.8%. The company is expected to report fiscal 2022 earnings and revenue growth of 19.1% and 24.4%, respectively. Year to date, the stock has gained 14.9% against the industry’s 7.3% fall.

Renowned healthcare technology company, Tabula Rasa Healthcare Inc. TRHC, announced in June that it is collaborating with four more state pharmacy associations (California, Arizona, Michigan and Washington) to bring its MedWise technology to association members. This Zacks Rank #2 company, in May, reported first-quarter 2021 results, wherein it reported a robust uptick in total revenues along with strength in its CareVention HealthCare segment’s performance.

Image Source: Zacks Investment Research

Its expected earnings growth rate for 2022 is pegged at 95.7%. The company is expected to report 2021 revenue growth of 15%. Year to date, the stock has gained 9.3% against the industry’s 26.1% fall.

Allscripts Healthcare Solutions, Inc. MDRX is a renowned IT solutions and services providers to healthcare organizations. In May, the Zacks Rank #3 (Hold) company announced that Veradigm, a renowned data and technology solutions provider and a business unit of Allscripts, entered into a collaboration with Lash Group — a patient-support services business and part of AmerisourceBergen Corporation ABC. The tie-up aims at enabling specialty medications, supported by Lash Group to be available for management within the Veradigm AccelRx platform. Allscripts, in April, reported first-quarter 2021 earnings wherein it maintained its Provider business momentum on the back of key client wins.

Image Source: Zacks Investment Research

Its long-term expected earnings growth rate is pegged at 9.1%. The company is expected to report 2022 earnings and revenue growth of 9.6% and 2.1%, respectively. Year to date, the stock has gained 22.7% against the industry’s 26.1% fall.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Allscripts Healthcare Solutions, Inc. (MDRX) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Tabula Rasa Healthcare Inc. (TRHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.