Medtronic, Other Medtech Providers Could Face Additional Tariffs

Among health care companies, those with medical device businesses are likely to be the hardest hit by the ongoing tariff war with China. One consolation is that industry members aren't slated to be as heavily impacted as many other businesses. But that could change.

USA Today reported in early July that Brandon Henry, an analyst with RBC Capital Markets, wrote in a note that the U.S. imports about $6 billion in medical technology from China, while China imports about $4 billion in U.S. medical tech.

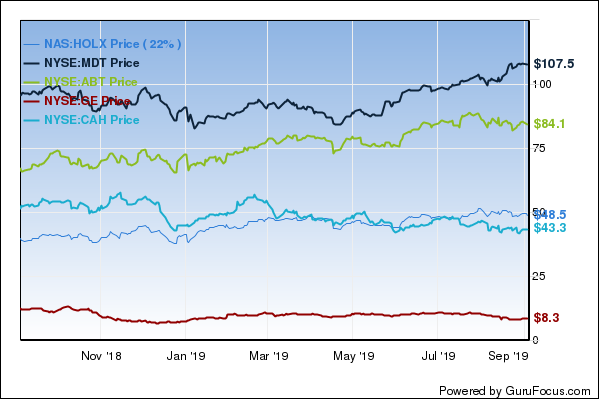

The biggest U.S. medical device companies include Medtronic (NYSE:MDT), Thermo Fisher Scientific (NYSE:TMO), General Eelectric (NYSE:GE), Abbott Laboratories (NYSE:ABT), Cardinal Health (NYSE:CAH) and Stryker Corp. (NYSE:SYK). The tariff impact will probably be felt less by the more diversified companies among the group, specifically Abbott and GE.

The duties on the medical device industry have been ratcheted down from earlier estimates. It was originally thought they would be about $5 billion, according to the Advanced Medical Technology Association, or AdvaMed. That figure was then whittled down to $2.8 billion and is now estimated to be less than $1 billion.

Through its lobbying efforts, AdvaMed is credited with getting some types of medical devices dropped from the list, at least for now, said Henry. Included are defibrillators, hearing aids, artificial joints, artificial teeth and fillings. He added that the overall effect on the industry is manageable at this point.

"While we believe this was a positive for medtech, given the magnitude of future tariffs proposed by President Trump, medical devices may not escape the upcoming 10% tariffs," Henry said.

Even though it will be more costly to import these products, the trade association doesn't know whether patient care will be affected. But it's possible that the cost of the services will be higher.

Read more here:

Investors don't seem to be that worried. The iShares U.S. Medical Devices Exchange-Traded Fund (IHI) is trading near its 52-week high of $250. Abbott, Stryker and Thermo Fisher have substantially outperformed the index during the past year. Medtronic matched its gains, while Cardinal trailed the field and was the only member of the group that finished in negative territory with a 17% dip in share price.

Perhaps investors are too optimistic.

The list of products affected by the 25% tariff includes imaging equipment, diagnostic reagents used in X-ray examinations and dental drills. The Medical Imaging & Technology Association said the tariffs could cause other damage. Members of the industry who responded to a MITA survey said the tariffs could stifle investments in research and development and lead to employee layoffs..

Among U.S. companies, the biggest manufacturers of imaging products are GE Healthcare and Hologic (NASDAQ:HOLX). Shareholders of Marlborough, Massachusetts-based Hologic also don't seem concerned. The company's stock is selling near its 52-week high of $52.

The tariffs could also impact metal alloys such as aluminum and steel, which are used in the manufacturing of many medical devices.

Should tariffs be brought in on the remaining $300 billion worth of Chinese imports, Medical Device-Network said many more categories of devices will be affected.

Disclosure: The author has no positions in any of the stocks mentioned in this article.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.