Meta Platforms Is Back

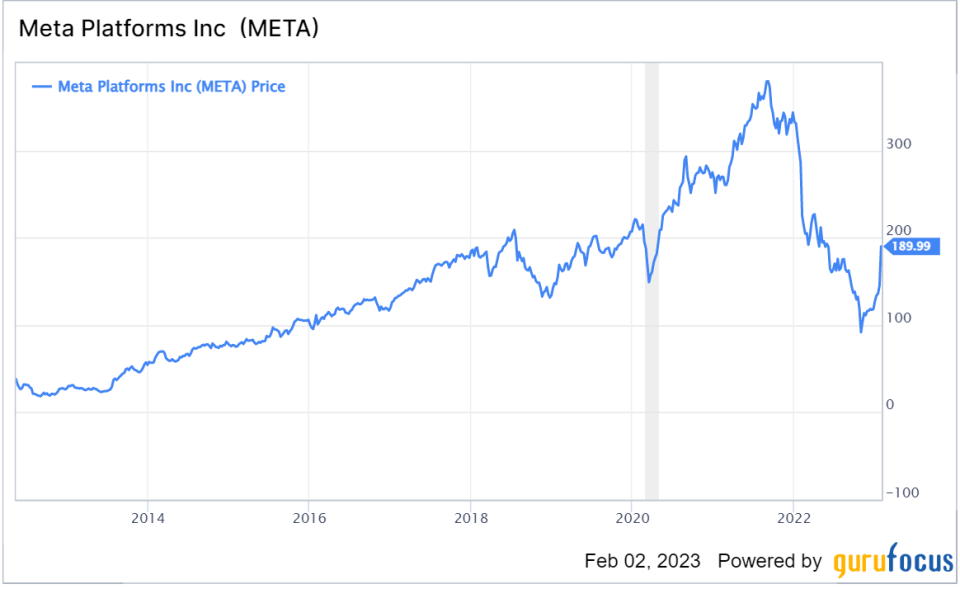

2022 was one of the worst years in recent history for Meta Platforms Inc. (NASDAQ:META) with the company losing more than half of its market value in a year that was characterized by falling stock prices. Part of the decline may have been justified due to the company's huge business shift, but other investors have held that the seloff was overdone.

On Feb. 1, Meta proved the bears wrong when it reported financial results for the fourth quarter of 2022, exceeding analyst estimates for revenue by more than $480 million. Meta's stock surged by almost 20% in after-hours trading on the back of renewed investor enthusiasm toward the long-term prospects for Meta.

META Data by GuruFocus

Even on the back of this stellar market performance following the release of recent earnings, Meta stock is still down more than 50% in the last 12 months, which goes on to highlight the recent struggles faced by the tech giant. Yet, in order to determine whether the stock is a value opportunity or not, we need to conduct a close evaluation of what the future holds for Meta. Personally, I think the signs suggest the company still has a long runway for growth, which makes it one of my favorite tech stocks in the market today.

Meta finally delivers good news

For the fourth quarter of 2022, Meta reported revenue of $32.17 billion, a year-over-year decline of 4.5%. Although revenue declined, the reported revenue came ahead of analyst expectations, triggering a positive market response. Despite macroeconomic challenges for its main source of revenue, advertising, the company still reported year-over-year growth in family daily active people, family monthly active people, Facebook daily active users and Facebook monthly active users. This strong performance was a testament to how Metas crown jewel, Facebook, continues to attract new users despite the increasing threat of competition from TikTok, Twitter and other social media.

Source: Earnings presentation

The company also unveiled a $40 billion stock buyback program, which was one of the major reasons behind the positive market response to its quarterly earnings. Buybacks can add value to long-term shareholders as the number of shares in circulation will decrease when a company buys back its own shares in the open market. Metas buyback announcement also helped in uplifting investor sentiment toward the company as this sent a signal that Meta may see its stock as currently undervalued in the market according to the company management.

Concerns about profitability are overblown

For the fourth quarter, Meta reported net income of $4.65 billion, which was a substantial decline from the net income of $10.28 billion reported in the fourth quarter of 2021. For the full financial year of 2022, Metas net income came to $23.2 billion, which was a 41% decline from net income of $39.37 billion reported in 2021. However, a closer look at the company's financial statements reveals that two major reasons have played a part in this negative development.

First, the aggressive investments in the Metaverse have cost the company short-term profits. According to company filings, Meta spent a staggering $32 billion in capital expenditures in 2022, a sharp rise from $19 billion a year ago. Most of these investments were directed toward achieving the companys Metaverse goals. Although the Metaverse is seen as the future of the Internet by many people, the market is still not convinced about Metas future as a Metaverse-oriented company. Although these investments are dragging operating margins down and resulting in a deterioration of profitability, Meta seems well-positioned to yield lucrative results from these investments in the long run. Historically, Meta has been a company that has focused on long-term-oriented investments, and things are no different this time around as well.

Second, advertising revenue has declined from the previous year due to a global slowdown in the economy. When economic growth slows, many companies slash their marketing budgets to save costs. This is exactly what is happening today with economists predicting a recession this year. Meta, as the owner of massive social media platforms such as Facebook, Instagram and WhatsApp, has faced the wrath of this decline in marketing spending. Empirical evidence suggests that the global advertising industry recovers fast from economic recessions when the economy enters the next business cycle. Going by this, it is reasonable to expect the advertising industry to recover sharply in the future this time around as well, and Meta is well-positioned to retain its leading market share of the social media advertising space in the long run.

Metas profitability has deteriorated in recent quarters, but I believe this negative development is more likely to be a short-term phenomenon that will have little to no impact on long-term profitability.

Long runway for growth

There are a few reasons to believe that Metas growth story is far from over.

For one, WhatsApp remains under-monetized globally, but the company has unveiled new features such as WhatsApp Pay to monetize its 2 billion user base in the coming years. WhatsApp, similar to WeChat in China, has the potential to become a super app that touches every aspect of human lives.

Asia accounts for the largest share of active Facebook users, but the company is still generating the bulk of its revenue from the North American segment. This suggests that Facebooks Asian userbase is deeply under-monetized, but the company is beginning to see improvements from this front along with the trillion-dollar IT infrastructure investment campaigns launched by leading Asian countries.

Reels, the short-form video content format introduced by Meta to compete with TikTok, remain under-monetized on both Facebook and Instagram. Influencer marketing is one of the most rapidly growing sectors in the advertising industry, and Instagram is the number one social media platform used by influencers. This could help Meta book better-than-expected growth from Instagram in the next few years.

The companys Metaverse investments should start yielding results in the next five years, thereby adding another revenue stream to the company. I'm a firm believer that people will love the Metaverse.

Takeaway

Meta Platforms, despite its massive scale, is still a growth company at heart. It is perfectly normal for a growth-oriented company to sacrifice short-term profits to boost its long-term profitability, which is exactly what Meta Platforms is doing today. Although the company still has years of growth ahead, Meta is valued at a forward price-earnings ratio of just 23 today, tilting the odds in favor of investors.

This article first appeared on GuruFocus.