MetLife (MET) Keeps Streamlining Business by Partial Sell-Offs

MetLife, Inc. MET will be divesting a portion of its Europe business to NN Group for $740 million. This is yet another move in a series of recent strategic actions to streamline its overseas operations.

Its EMEA segment (representing 5% of total revenues in 2020), which comprises the Europe business, grew revenues by 3% last year. Growth across the region was driven by its credit life business in Turkey, accident & health business in Europe and pension business in Romania.

The Europe business contributes modestly to the company’s earnings and therefore does not hold much significance to its core activities. Thus, shedding this unprofitable business should help consolidate the company’s main operations.

MetLife’s Several Exits

MetLife has been busy streamlining its business over the years. It continues to focus on businesses with growth potential and fix or exit businesses that do not create value. One of the most significant steps taken in this direction was the spin-off of its U.S. Retail business named BrightHouse Financial, completed in 2018. This business required MetLife to block a huge capital buffer and place it at a significant competitive disadvantage. The move freed MetLife from a capital-intensive business. It also saved the company from exposure to interest rate and equity market volatility related to the business.

In 2017, the company closed its UK Wealth Management business, which was suffering low interest rates. The company sold MetLife Afore, S.A. de C.V., its pension fund management business in Mexico.

In 2020, it closed the sale of its Hong Kong business besides divesting its Argentina Annuity and Russia businesses.

Recently, the company completed the sale of MetLife Auto & Home to Farmers Insurance. This divestiture will see accretion benefits materializing in 2021 and also drive double-digit earnings per share growth in 2022.

The termination of these businesses is likely to dent bottom-line growth to a certain extent in the form of fees and premium lost. Nevertheless, these strategic steps will transform MetLife into a company with less volatility and more free cash flow in the long term, which should lead to higher return on equity.

Business Addition

The company is also building business in high-growth areas. To this end, MetLife acquired Versant Health, which is a leader in vision care. This acquisition positions the MetLife as the third largest vision insurer in the U.S by membership and will be accretive to its cash flow and earnings. The company also penetrated the pet insurance space with the buyout of PetFirst. It has also been keen on foraying into the digital estate planning space for long as evident from its Willing acquisition in 2019. These buyouts will lead to business diversification and enrich the company’s inorganic growth profile.

In 2020, MetLife revenues slipped less than 0.8%, which is not a muted performance, given the difficult COVID-19 environment. Its premiums were almost unchanged year over year. In fact, the company’s business started picking up in the last two quarters, which is evident from its premium growth.

Looking ahead, profitability will improve as the COVID-19 outbreak is expected to subside. A better earnings profile along with a strong cash position will back the company’s dividend payment and share repurchase strategy.

Capital Position

As of Mar 31, 2021, its cash and liquid assets were $3.8 billion, well within the target cash buffer of $3-$4 billion. This cash buffer will grow further as a result of the divestment of Auto and Home Business to Farmers Insurance

Recently, the company hiked its dividend by 4.3% from the first-quarter 2021-level. Over the last decade, the company witnessed a dividend CAGR of 10%. The company expects to generate approximately $20 billion of free cash flow over the five-year period from 2020 through 2024, an amount equal to more than 40% of its current market capitalization.

Its business continues to generate strong free cash flow that allows investment in business and return capital to its shareholders.

A Value Stock

The company looks a good investment bet. The stock has a Zacks Rank #2 (Buy) at present and a Value Style Score of A. Our research shows that stocks with a Zacks Rank of #1 (Strong Buy) or 2 along with a Value Style Score of A or B provide best investment returns. You can see the complete list of today’s Zacks #1 Rank stocks here.

It price-to-book value of 0.81x is lower than the industry’s average of 1.62x, which makes it a good buy.

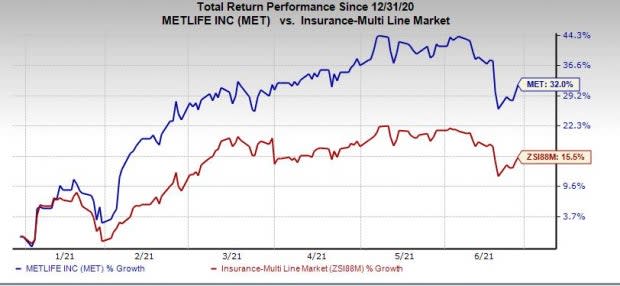

Year to date, the stock has gained 32% compared with its industry’s growth of 15.6%.Other stocks in the same space include Prudential Financial, Inc. PRU, American International Group, Inc. AIG and Principal Financial Grou, Inc. PFG, which too have rallied 37%, 31.2% and 32.3% each in the same time frame.

Image Source: Zacks Investment Research

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American International Group, Inc. (AIG) : Free Stock Analysis Report

MetLife, Inc. (MET) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

Principal Financial Group, Inc. (PFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research