MetLife (MET) Q2 Earnings Surpass Estimates, Increase Y/Y

MetLife, Inc.’s MET second-quarter 2019 operating earnings of $1.38 per share beat the Zacks Consensus Estimate by 5.34%. The bottom line rose 6.2% year over year. Earnings benefited from lower expenses, partly offset by decline in revenues.

Behind the Headlines

The company generated operating revenues of $16.5 billion, down 22% year over year, and missed the Zacks Consensus Estimate by 0.25%.

Adjusted premiums, fees & other revenues, excluding pension risk transfer, grew 4% year over year to $11.3 billion. Net investment income of $4.55 billion increased 5.2% year over year.

Total expenses of $14.7 million were down 25% year over year due to lower policyholder benefits and claims, and interest expenses.

Book value per share was $37.09, up 11.6% year over year.

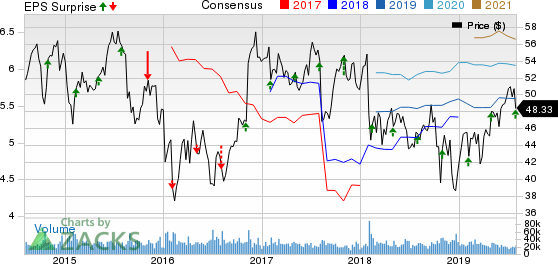

MetLife, Inc. Price, Consensus and EPS Surprise

MetLife, Inc. price-consensus-eps-surprise-chart | MetLife, Inc. Quote

Quarterly Segment Details

United States

Adjusted earnings in this segment increased 9% year over year to $732 million, driven by volume growth, lower expenses and favorable underwriting. Adjusted premiums, fees & other revenues were $6.2 billion, up 6% year over year.

Asia

Operating earnings of $359 million were down 1% (up 2% on constant-currency basis) year over year, driven by volume growth, partly offset by less favorable underwriting. Adjusted premiums, fees & other revenues were $2.1 billion, flat year over year (up 2% on constant-currency basis).

Latin America

Operating earnings were $159 million, up 10% (and 18% at constant currency) year over year, driven by capital markets and volume growth.

Adjusted premiums, fees & other revenues were $1.1 billion, up 9% (up 15% at constant currency), primarily driven by higher annuity sales in Chile.

Europe, the Middle East, and Africa (EMEA)

Operating earnings from EMEA decreased 10% (flat on constant-currency basis) year over year to $77 million, driven by investment margins, favorable underwriting, and volume growth that were offset by the impact of favorable expense margins in the prior-year period.

Adjusted premiums, fees & other revenues were $669 million, down 1% year over year but up 5% at constant currency.

MetLife Holdings

Adjusted operating earnings from MetLife Holdings came in at $299 million, up 7% year over year.

Operating premiums, fees & other revenues were $1.3 billion, down 4% year over year.

Zacks Rank & Other Releases

MetLife has a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some other insurers that have recently reported earnings this season are W.R. Berkley Corp. WRB, The Progressive Corp. PGR and Chubb Ltd. CB, each beating their estimate by 28.13%, 16.08% and 0.8%, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

To read this article on Zacks.com click here.