The Metropolitan Bank Holding (NYSE:MCB) Share Price Is Up 111% And Shareholders Are Boasting About It

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Metropolitan Bank Holding Corp. (NYSE:MCB) share price had more than doubled in just one year - up 111%. Also pleasing for shareholders was the 22% gain in the last three months. However, the stock hasn't done so well in the longer term, with the stock only up 19% in three years.

View our latest analysis for Metropolitan Bank Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

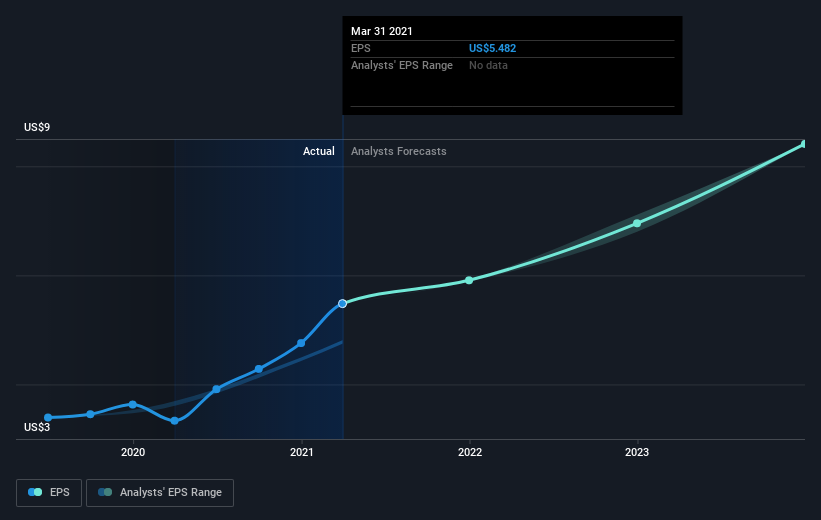

Metropolitan Bank Holding was able to grow EPS by 64% in the last twelve months. This EPS growth is significantly lower than the 111% increase in the share price. So it's fair to assume the market has a higher opinion of the business than it a year ago.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Metropolitan Bank Holding has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's nice to see that Metropolitan Bank Holding shareholders have gained 111% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 6%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Metropolitan Bank Holding that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.