The Mettler-Toledo International (NYSE:MTD) Share Price Has Gained 250%, So Why Not Pay It Some Attention?

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. One great example is Mettler-Toledo International Inc. (NYSE:MTD) which saw its share price drive 250% higher over five years. It's also good to see the share price up 24% over the last quarter. But this could be related to the strong market, which is up 9.8% in the last three months.

Check out our latest analysis for Mettler-Toledo International

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

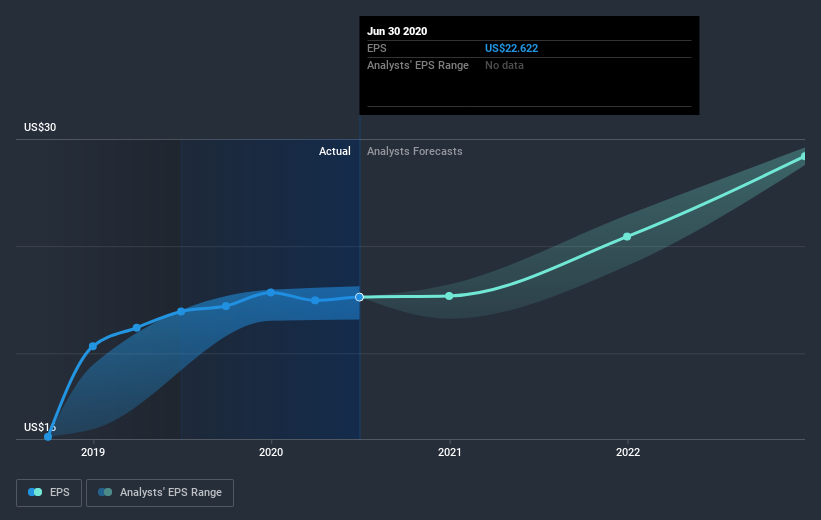

During five years of share price growth, Mettler-Toledo International achieved compound earnings per share (EPS) growth of 13% per year. This EPS growth is lower than the 28% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Mettler-Toledo International's key metrics by checking this interactive graph of Mettler-Toledo International's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Mettler-Toledo International has rewarded shareholders with a total shareholder return of 39% in the last twelve months. That's better than the annualised return of 28% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Mettler-Toledo International .

But note: Mettler-Toledo International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.