Michael Burry's Top 5 Holdings

According to current portfolio statistics, the top five holdings of Michael Burry's Scion Asset Management as of the third quarter are GameStop Corp. (NYSE:GME), Tailored Brands Inc. (NYSE:TLRD), Alphabet Inc. (NASDAQ:GOOG), Sportsman's Warehouse Holdings Inc. (NASDAQ:SPWH) and Bed Bath & Beyond Inc. (NASDAQ:BBBY).

Burry, the investor famous for his "Big Short" investment in collateralized mortgage obligations during the subprime mortgage crisis in 2008, started Scion Asset Management in 2013 and has been reporting his holdings in public companies.

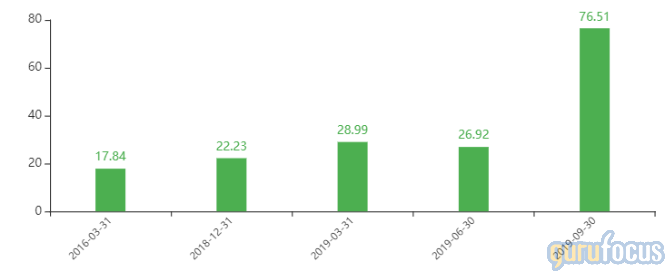

Scion's $60 million equity portfolio contains seven holdings as of quarter-end, including four new positions. The consumer cyclical sector represents 76.51% of the equity portfolio, approximately three times greater than the 26.92% weight as of June quarter-end.

GameStop

Scion disclosed a holding of 3 million shares of GameStop, dedicating 27.78% of the equity portfolio to the stake. While shares averaged $4.33 during the third quarter, shares were trading around $5.66 on Thursday.

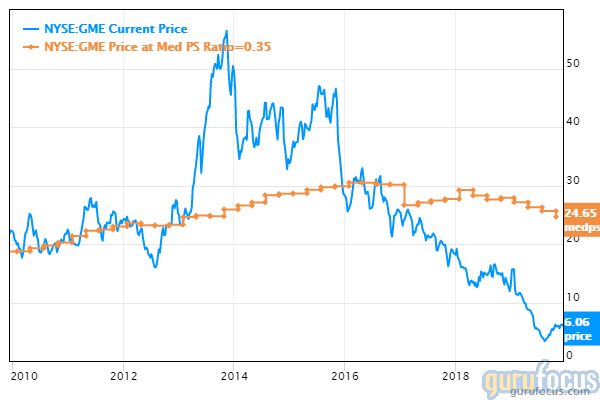

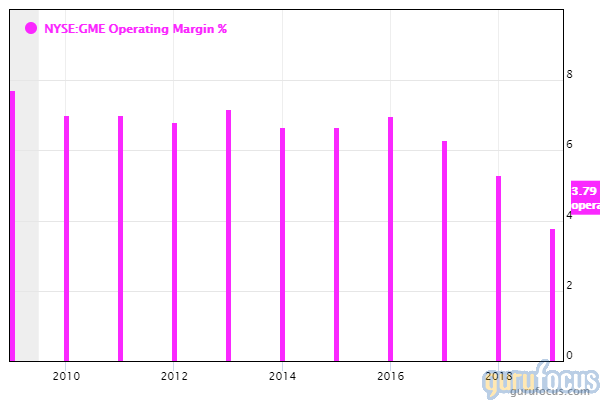

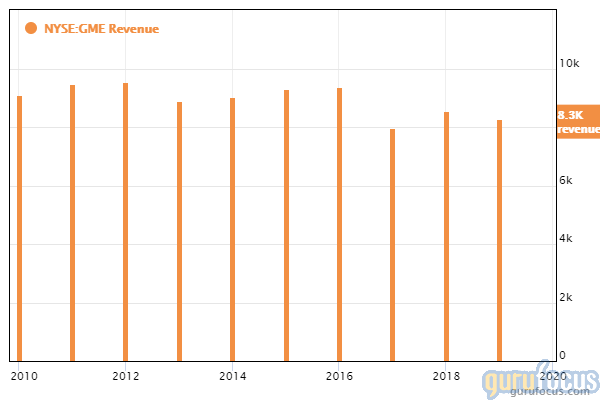

The Grapevine, Texas-based company retails multichannel video games and consoles. GameStop said on Tuesday that total global sales of $1.4 billion declined 25.7% year over year on the heels of comparable store sales plummeting 23.2%. GuruFocus warns that GameStop's operating margin have declined approximately 9.8% per year on average over the past five years, while revenues have declined approximately 2.60% per year on average over the past three years. The company's three-year revenue decline rate underperforms 66.74% of global competitors.

CEO George Sherman said prevailing industry trends, which included the "unprecedented decline in new hardware sales," contributed to the revenue decline. He added that console makers are set to introduce new consoles in late 2020, reducing demand for current-generation gaming consoles and pressuring sales for the first nine months of the year.

Burry said in an Aug. 16 letter that his firm established an activist position in GameStop and urged the company to complete its $236.7 million share repurchase with cash on hand, which amounts to over $424 million as of July. The share repurchase transaction will still leave enough cash to invest in the business and pay down debt.

Mario Gabelli (Trades, Portfolio) also purchased a stake in Game Stop during the quarter.

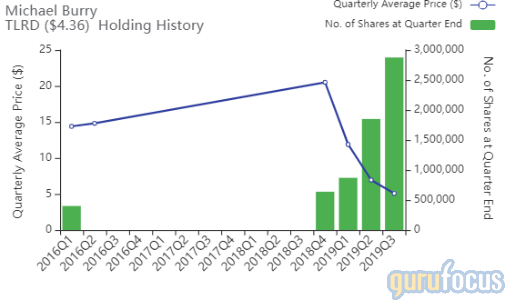

Tailored Brands

Scion owns 2,875,000 shares of Tailored Brands, giving the position 21.22% weight in the equity portfolio. During the quarter, the firm added 1.025 million shares, increasing the stake 55.41% and the equity portfolio 7.57%. Although shares averaged $5.08 during the third quarter, shares were trading around $4.40 on Thursday, down over 9% from Wednesday's close of $4.85.

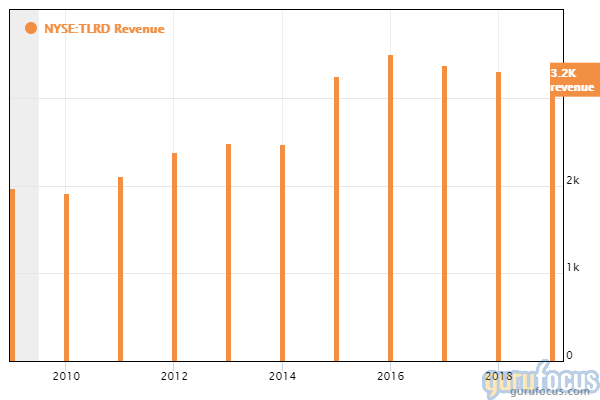

Headquartered in Houston, Tailored Brands retails men's apparel, including suits, sports coats and shirts. Tailored Brands owns retail brands like Men's Warehouse, Jos. A. Bank, Moore's and K&G.

The company said on Wednesday that net sales of $729.5 million declined 3% year over year, driven primarily to a 2.2% decline in comparable sales. Men's Warehouse comparable sales for clothing declined due to lower average unit retail costs, while comparable rental services revenue declined due to lower rental transactions during wedding season compared to 2018. GuruFocus warns that Tailored Brands' revenue has declined approximately 4.1% per year over the past three years, a rate that underperforms 71.16% of global apparel retail competitors.

Burry said in an Aug. 19 letter that his firm suggested Tailored Brands make share repurchases using the funds from the sale of the company's Corporate Apparel business for $62 million. The investor reiterated that share repurchases most efficiently reward long-term shareholders when the share price is "heavily discounted."

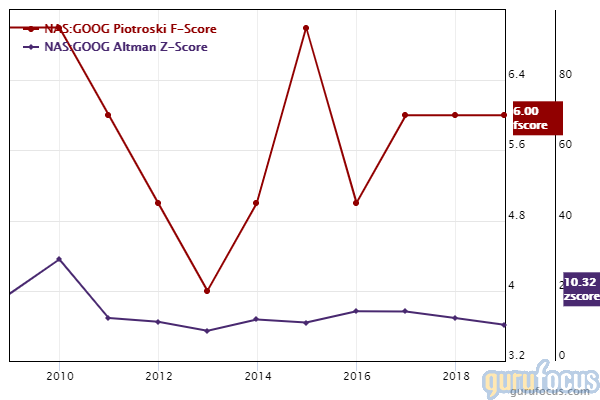

Alphabet

Scion owns 8,000 Class C shares of Alphabet, giving the holding 16.36% equity portfolio weight. Shares averaged $1,182.53 during the quarter.

The Mountain View, California-based company operates platforms like Google, YouTube and Android. GuruFocus ranks the online media giant's financial strength and profitability 9 out of 10 on several positive investing signs, which include robust interest coverage, a strong Altman Z-score of 10.53 and net profit margins that are outperforming 83.37% of global competitors even though operating margins have contracted approximately 2.3% per year over the past five years.

Other gurus with holdings in Alphabet include Al Gore (Trades, Portfolio)'s Generation Investment Management, Dodge & Cox and PRIMECAP Management (Trades, Portfolio).

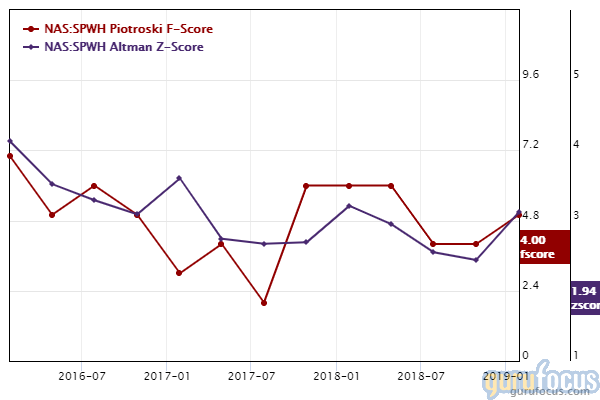

Sportsman

Scion owns 1.625 million shares of Sportsman, giving the stake 14.12% equity portfolio weight.

The Midvale, Utah-based company provides a one-stop shop for outdoor sporting goods. GuruFocus ranks the company's financial strength 4 out of 10 on several weak signs, which include a low Altman Z-score of 1.87 and an interest coverage ratio that underperforms 62% of global competitors. Other warning signs include declining profit margins and a weak Piotroski F-score of 3, suggesting poor business operations.

Bed Bath & Beyond

Scion owns 750,000 shares of Bed Bath & Beyond, giving the position 13.39% equity portfolio weight.

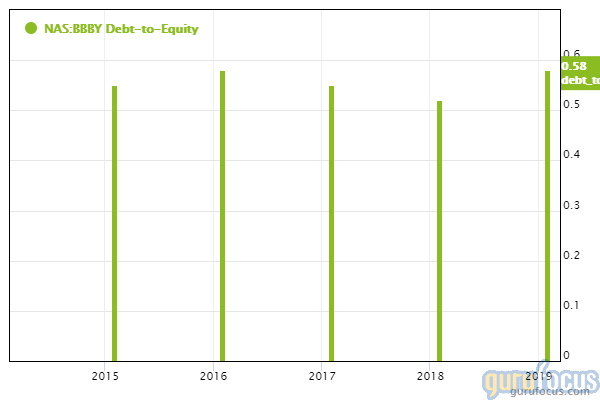

The Union, New Jersey-based company operates home furnishing stores that carry a wide range of bed and bath accessories, kitchen textiles and cooking supplies. GuruFocus ranks the company's financial strength 4 out of 10 on several weak indicators, which include a poor Piotroski F-score of 3 and debt ratios that underperform over 82% of global competitors.

See also

Scion's four new positions for the third quarter were GameStop, Bed Bath & Beyond, Canadian Natural Resources Ltd. (NYSE:CNQ) and Nuvectra Corp. (NVTRQ). The firm sold out of its holdings in Western Digital Corp. (NASDAQ:WDC) and Cleveland-Cliffs Inc. (NYSE:CLF), its top two holdings as of the June quarter.

Burry is one of our popular Premium Plus gurus. Our Premium Plus package contains advanced features like backtesting, the Manual of Stocks and unlimited usage of the Excel Add-in.

Disclosure: No positions.

Read more here:

Top 4 Holdings of Howard Marks' Oaktree

Wasatch International Growth's Top 5 Buys of the 3rd Quarter

Charles de Vaulx's Top 5 Buys of the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.