Michael Dell"s MSD Capital Exits Asbury Automotive

- By Sydnee Gatewood

Michael Dell (Trades, Portfolio)"s MSD Capital disclosed Friday it exited its stake in Asbury Automotive Group Inc. (ABG) on Dec. 5.

Warning! GuruFocus has detected 3 Warning Sign with ABG. Click here to check it out.

The intrinsic value of ABG

The private investment firm, which was established in 1995 to manage the assets of the Dell Technologies (DVMT) founder and CEO and his family, manages an extremely concentrated portfolio, which, before the most recent trade, was composed of five holdings.

MSD sold its remaining 1.7 million shares of Asbury for an average price of $67 per share, impacting the portfolio by -46.82%. GuruFocus estimates the firm has gained 54% on the investment since the third quarter of 2013. Year to date, the stock has gained approximately 10%.

The Georgia-based automotive retailer has a market cap of $1.41 billion; its shares were trading around $67.85 on Friday with a price-earnings (P/E) ratio of 8.86, a price-book (P/B) ratio of 4.03 and a price-sales (P/S) ratio of 0.23.

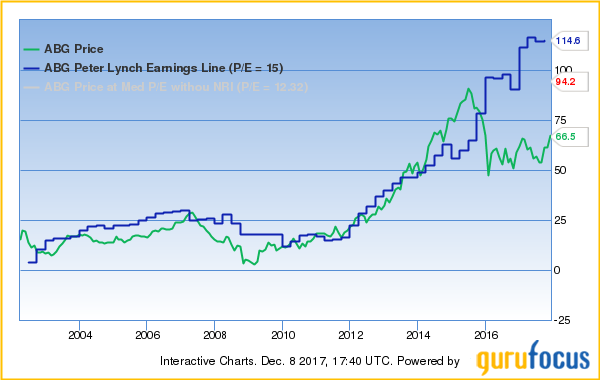

According to the Peter Lynch chart below, the stock is trading below its fair value.

GuruFocus ranked Asbury"s financial strength 5 of 10 and its profitability and growth 8 of 10.

In its earnings report for the third quarter, Asbury recorded EPS of $1.48, missing expectations of $1.57, on $1.6 billion in revenue, which missed estimates of $1.68 billion and declined 4.8% year over year.

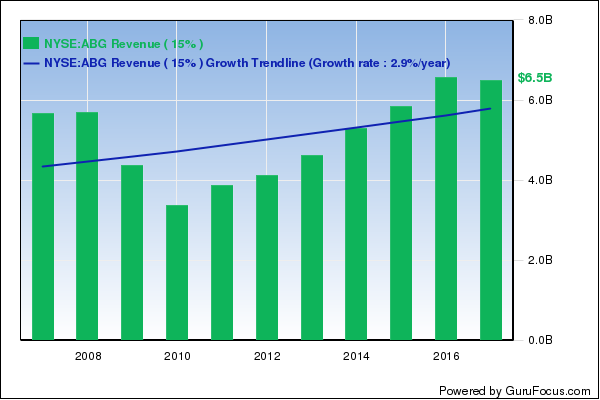

The trend in Asbury"s revenue growth over the past decade is illustrated in the graph below.

Of the gurus invested in Asbury, David Abrams (Trades, Portfolio) now has the largest stake with 4.8% of outstanding shares. While Joel Greenblatt (Trades, Portfolio) and Jim Simons (Trades, Portfolio) increased their holdings in the third quarter, Steven Cohen (Trades, Portfolio) and Jeremy Grantham (Trades, Portfolio) reduced their positions. Paul Singer (Trades, Portfolio) is also a shareholder.

MSD Capital"s four remaining holdings are DineEquity Inc. (DIN), Townsquare Media Inc. (TSQ), Wesco Aircraft Holdings Inc. (WAIR) and PVH Corp. (PVH).

Disclosure: I do not own any stocks mentioned.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with ABG. Click here to check it out.

The intrinsic value of ABG