Micro Focus - Substantial Progress but Still a Long Way to Go

- By Praveen Chawla

I wrote about Micro Focus International, PLC (LSE:MCRO) in a previous article entitled Deep Value in Micro Focus International on Sept. 11, 2020. The stock is up over 65% since then, which is a good start, but the company has still a long way to go to fully recover and return to revenue growth.

I think there is a chance the stock could double from here in the next 12 to 18 months because the market is still too focused on its recent revenue decline and is not giving enough credit to the high cash generation and recovery potential of the business. Realization of value by the market is not usually a smooth curve but occurs in spurts as resuutls improve.

About Micro Focus

Micro Focus is a UK-based developer of enterprise software. It is also dual-listed in the U.S. (MFGP). The company specializes in acquiring infrastructure software from larger companies who want to focus on other strategic priorities.

Though it has a long history of successfully acquiring and integrating software companies, it bit off more than it could chew when, in 2017, it acquired the software business of Hewlett Packard Enterprise Co (HPE). Micro Focus paid $2.5 billion in cash (financed via debt) to Hewlett Packard and then proceeded to merge with its software business as well as listing on the NYSE. The transformative deal, together with debt and equity, was valued at over $8 billion.

After the transaction, Hewlett Packard shareholders owned 50.1% of the combined company. However, the execution did not go smoothly, and both the company's revenue and the stock tanked.

Mirco Focus finished its last fiscal year on Oct. 31, 2020 and reported that revenue decline slowed during the year, to ~11% in the first half and ~9% in the second. It generated a total of $3 billion in revenue for the full year.

Source: Company earnings presentation, figures in $ millions

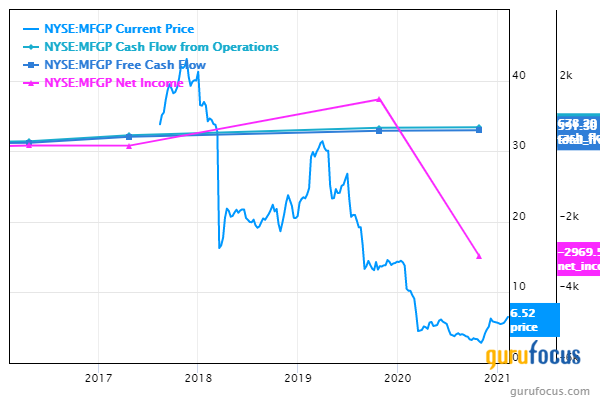

Adjusted Ebitda was reported at $1.2 billion, with a 39% Ebitda margin. Meanwhile, the company took a $2.79 billion goodwill impairment charge for the year. Some $1.1 billion of cash was generated from operating activities. As can be seen in the below chart, cash flow is still healthy:

While the company carries $4.1 billion in long-term debt, it has no term loan maturities until June 2024, following the refinancing of a $1.4 billion term loan. Micro Focus has decided to reinstate its dividend, with a 15.5 British pence ($0.21) per share final dividend payment proposed. Below is a chart showing Micro Focus's stock price and cash flows since 2017:

Conclusion

Micro Focus is the largest software company in the UK, and before its ill-fated acqusition, it was a star perfomer, as the performance chart of its UK listing demonstrates:

It is now in the process of digging itself out of a deep hole. Once you cut through the noise of impairment and revenue declines can you see that the company is generating a lot of free cash with a free cash yield of more than 20%.

The company is focusing on revenue stabilization over the next year. If they show good progress and the market is persuaded that they are not in terminal decline, the shares could see continued gains.

Disclosure: The author owns shares of Micro Focus International.

Read more here:

Dixons Carphone Is the Best Buy of the UK

Ingles Market Is Having a Nice Pandemic

Goodyear: A Good Opportunity for Value Investors

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.