Micron (MU) Lifts Q2 Outlook on Stellar Memory Chip Demand

Ahead of CFO David Zinsner's participation at a Morgan Stanley conference on Mar 3, Micron MU raised its revenue and earnings outlook for the second quarter of fiscal 2021.

For the quarter ending Mar 4, the memory chip maker now anticipates reporting revenues between $6.2 billion and $6.25 billion, up from previous guided range of $5.6-$6 billion. The company’s updated revenue guidance is also higher than the Zacks Consensus Estimate of $5.83 billion.

Micron also raised its adjusted earnings forecast to 93-98 cents per share from the 68-82 cents per share projected earlier. The new adjusted earnings guidance is significantly higher than the consensus estimate of 72 cents per share.

The company lifted its GAAP earnings guided range to 51-56 cents per share from 34-48 cents per share.

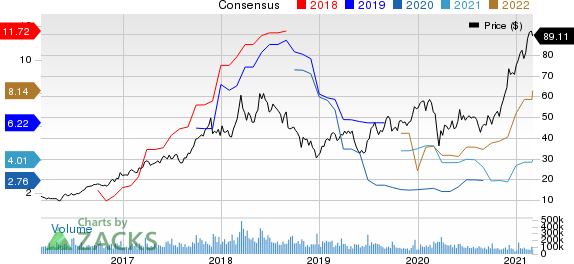

Micron Technology, Inc. Price and Consensus

Micron Technology, Inc. price-consensus-chart | Micron Technology, Inc. Quote

Solid Demand and Tight Supply Aid Micron

Per a Bloomberg report, Zinsner pointed out during the conference that the upbeat guidance is mainly driven by higher memory chip demand and tight supply.

The CFO stated that surging sales of mobile phones and computers are fueling demand for its dynamic random access memory chips or DRAM memory chips. He noted that elevated DRAM chip demand, coupled with tightness in supply, will make it difficult to meet orders for the rest of the year.

However, Zinsner cautioned that sales of NAND flash memory chips, which provides storage solution, might be negatively impacted by excess supply.

Recovery in Smartphone Shipments

A solid recovery in smartphone shipments will boost memory chip sales significantly in 2021 for Micron.

According to the latest forecast by Gartner, worldwide sales of smartphones will likely be up 11.4% year over year to 1.5 billion units in 2021. This suggests a sharp improvement from the 10.5% decline registered in 2020.

Gartner analyst Anshul Gupta noted that “The combination of delayed smartphone replacements and the availability of lower end 5G smartphones are poised to increase smartphone sales in 2021.” The global research and advisory firm stated that 5G smartphones will account for 35% of total shipments during the current year.

Rising PC Sales Stoking Memory Chip Demand

The COVID-19 pandemic-induced lockdown and social-distancing measures are spurring demand for PCs and notebooks as more and more workers and students are now working and learning from homes.

Per the latest data released by Gartner, PC shipments in the fourth quarter of 2020 were up 10.7% year over year to 79.4 million units. For full-year 2020, shipments grew 4.8% to 275 million units.

The pandemic has necessitated the use of PC systems, be it for remote work, web-based learning, video conferencing, video gaming, social media, consumer entertainment and streaming or online shopping.

Moreover, as vaccine distribution and democratization takes its own time, apprehensions regarding contracting the new COVID-19 mutant strain are expected to keep people confined to the safety of their homes, for quite some time. This, in turn, boosts the prospects of the PC market for the days ahead.

Being a leading DRAM memory chip supplier, Micron is likely to continue benefiting from the aforementioned trend.

Zacks Rank & Key Picks

Micron currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include Zoom Video Communications ZM, Apple AAPL and Facebook FB. While Zoom sports a Zacks Rank #1, Apple and Facebook hold a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Zoom, Apple and Facebook is currently pegged at 25%,11.5% and 19.2%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research