Microsoft Looks Set to Give Its Shareholders a Raise in 2019

I recently called Microsoft (NASDAQ: MSFT) a "great dividend growth stock." The company has all of the elements that dividend growth investors should look for -- a strong business that's not only exposed to a wide range of growth markets, but a healthy competitive positioning within those markets as well as a history of consistent, meaningful dividend growth.

While Microsoft isn't a stock that's likely to make you rich in a short period of time, it's a stock that offers investors a solid chance of meaningful capital appreciation over the long haul topped off with a reasonable and growing dividend.

Image source: Microsoft.

I can't tell you by how much Microsoft's stock will rise or decline this year -- my crystal ball, unfortunately, doesn't work. What I can tell you, though, is that the software giant will almost certainly reward its shareholders with another dividend raise in 2019. Here's why.

Microsoft's business can easily support it

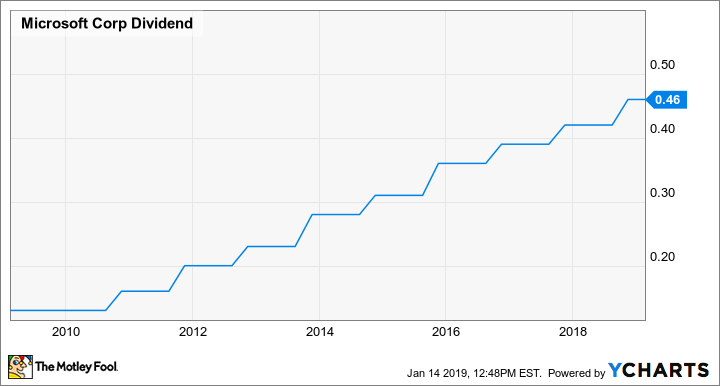

It's clear from Microsoft's dividend history that annual dividend increases are a way of life for the software giant -- check out the chart below:

MSFT Dividend data by YCharts

Now, it's clear that the company aims to raise its dividend each year, but history -- though a good guide -- isn't the only thing we should look at to try to figure out if a company will actually follow through with a dividend boost in a given year. We need to dive into how the business has performed in recent quarters to make sure the company can afford to actually raise its dividend.

The good news is that Microsoft has investors covered. In its fiscal 2018, the company saw its revenue climb to $110.36 billion from $96.57 billion in the prior year. The company's operating income surged to $35.06 billion from $29.03 billion in the same period a year ago. Net income was down substantially year over year, but this was due entirely to a "$13.7 billion net charge related to the Tax Cuts and Jobs Act, which decreased net income and diluted earnings per share ("EPS") by $13.7 billion and $1.75, respectively," according to the company.

Another thing to look at is Microsoft's free cash flow generation over the last 12 months (since free cash flow is ultimately what funds regular dividend payments), and that figure has been moving in the right direction: up!

MSFT Free Cash Flow (TTM) data by YCharts

Microsoft's free cash flow over the last 12 months works out to around $4.12 per share -- more than twice the company's current annualized dividend payment of $1.84. Even if Microsoft's free cash flow generation were to stagnate in the coming year, the business can readily support a meaningful dividend boost. (Although, it's important to keep in mind that a company can only boost its dividend so much in the face of stagnant free cash flow before it'll be forced to stop; the best dividend growth companies deliver free cash flow growth over time.)

When will you get your dividend increase?

Microsoft's history suggests that it raises its dividend late in a given calendar year. Indeed, the company's last dividend increase came with the dividend that it paid on Dec. 13, 2018. That means you're going to have to wait until the end of 2019 before you see Microsoft raise its dividend. While that might feel like a long wait, at least the odds are really good that Microsoft will ultimately come through with a dividend bump.

More From The Motley Fool

Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of Microsoft. The Motley Fool has a disclosure policy.