Microsoft (MSFT) Q3 Earnings & Revenues Beat, Stock Slumps

Microsoft MSFT reported third-quarter fiscal 2021 non-GAAP earnings of $1.95 per share, which beat the Zacks Consensus Estimate by 10.8%. The bottom line also surged 39% on a year-over-year basis (up 34% at constant currency or cc).

Revenues of $41.706 billion increased 19% from the year-ago quarter’s levels (up 16% at cc). Further, the top line surpassed the Zacks Consensus Estimate by 1.9%.

Strong demand trends across industries and improving adoption of commercial cloud offerings drove the top line performance. Solid uptick in Teams on the back of coronavirus-led work-from-home, stay-at-home, telehealth and online learning wave remained noteworthy.

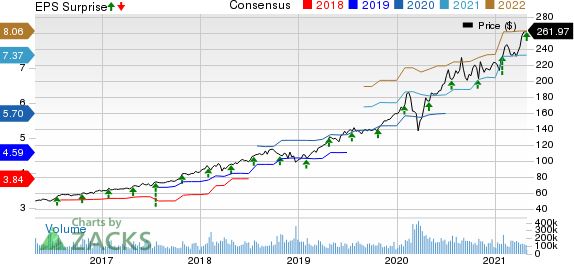

Microsoft Corporation Price, Consensus and EPS Surprise

Microsoft Corporation price-consensus-eps-surprise-chart | Microsoft Corporation Quote

Moreover, strong Commercial business on digital transformation wave positively impacted earnings and revenues. Commercial bookings climbed 39% year over year (up 38% at cc), courtesy of consistent sales execution as well as growth in Azure contracts and Microsoft 365 momentum.

Commercial remaining performance obligation amounted to $117 billion, up 31% year over year (up 32% at cc). Commercial revenue annuity mix was 94%, up 2% year over year owing to ongoing shift to cloud infrastructure.

Commercial cloud revenues were $17.7 billion, up 33% (up 29% at cc) year over year.

Despite better-than-expected results, shares of the company moved down more than 2.6% in the pre-market trading on Apr 28.

Segmental Details

Productivity & Business Processes segment, which includes the Office and Dynamics CRM businesses, contributed 32.5% to total revenues. Revenues increased 15% (up 12% at cc) on a year-over-year basis to $13.552 billion.

Office Commercial products and cloud services revenues climbed 14% (up 10% at cc) on a year-over-year basis backed by growth in Office 365 commercial revenues, which rallied 22% (up 19% at cc). The upside can be attributed to strong installed base growth and average revenues per user (ARPU) expansion.

E5 revenue growth was driven by strength in advanced security, compliance, and voice components.

Paid Office 365 Commercial seats improved 15% year over year to 300 million, driven by growth across small- and medium-sized businesses as well as first-line worker offerings.

Office Consumer products and cloud services revenues rose 5% (up 2% at cc), driven by growth in Microsoft 365 subscription revenues. However, transactional weakness in Japan served as a headwind in the quarter under review.

Microsoft 365 Consumer subscribers totaled 50.2 million, compared with 47.5 million reported in the prior quarter. The figure was up 27% year over year, driven by coronavirus crisis-led increased demand courtesy of work-from-home wave.

Dynamics products and cloud services business improved 26% (up 22% at cc). Dynamics 365 revenues surged 45% (40% at cc).

LinkedIn revenues advanced 25% from the year-ago quarter’s levels (up 23% at cc). The better-than-expected performance was driven by advertising demand growth in Marketing Solutions business.

Microsoft is gaining from expanding user base of different applications including Microsoft 365 E5 and Teams. Both solutions continue to witness record adoption. The uptick can be attributed to continuation of work-from-home, stay-at-home, telehealth and online learning wave. The company noted that Microsoft Teams has daily active user base of 145 million. Microsoft added the number of organizations with more than 1,000 users increased nearly three times on a year over year basis.

In the fiscal third quarter, Microsoft’s Power Platform reported revenue growth of 84% year over year. The platform now has more than 16 million monthly active users (MAUs), suggesting 97% year-over-year growth.

Increasing popularity of the company's products is expected to instill confidence in the stock. Notably, shares of the company have rallied 47.7% in the past year compared with the industry’s return of 46.5%.

Microsoft currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Integration of Teams with Microsoft’s various inhouse offerings including PowerPoint presentations, SharePoint, Stream, Dynamics 365 makes it a winner as it makes collaboration easy and engaging, while simultaneously driving outcomes and saving time.

In the quarter under review, Microsoft rolled out Microsoft Viva to help business organizations to boost employee experiences. Microsoft Viva unifies learning, communication, and insights as an integrated experience directly within Teams app and Microsoft 365 suite of applications.

The company is also witnessing significant demand for Windows 10 PCs. The company added that Windows 10 has more than 1.3 billion monthly active devices.

Intelligent Cloud segment, which includes server, and enterprise products and services, contributed 36.2% to total revenues. The segment reported revenues of $15.118 billion, up 23% (up 20% at cc) year over year.

Server product and cloud services revenues rallied 26% year over year (up 23% at cc). The high point was Azure's revenues, which surged 50% year over year (up 46% at cc), driven by robust growth in consumption-based business.

On-premise server products revenues improved 3% (flat at cc) year over year, on strong annuity performance led by robust demand for hybrid and premium offerings.

Further, enterprise mobility installed base revenues rallied 30% to more than 174 million seats.

Enterprise service revenues improved 10% (up 8% at cc) in the reported quarter, owing to growth in Microsoft Consulting Services.

More Personal Computing segment, which primarily comprises Windows, Gaming, Devices and Search businesses, contributed 31.3% to total revenues. Revenues were up 19% (up 16% at cc) year over year to $13.036 billion, driven by Windows OEM, Search and online gaming trends.

Windows commercial products and cloud services revenues increased 10% year over year (up 7% at cc), on the back of higher customer adoption of Microsoft 365 offerings and robust improvement in advanced security solutions.

Windows OEM revenues increased 10% on a year-over-year basis owing to robust PC demand.

Windows OEM non-Pro revenues advanced 44%, on strong consumer PC demand driven by remote working and online learning wave.

However, Windows OEM Pro revenue declined 2%.

Search advertising revenues, excluding traffic acquisition costs (TAC), increased 17% (up 14% at cc) on recovering advertising market.

Surface revenues climbed 12% (up 7% at cc) from the year-ago quarter’s levels to $1.504 billion.

Gaming revenues increased a whopping 50% (up 48% at cc) driven by increased engagement led by stay-at-home wave. Revenues from Xbox hardware soared 232% (up 223% at cc), driven by the new consoles.

Moreover, Xbox content and services revenues increased 34% year over year (up 32% at cc), driven by solid growth in first-party titles. Post the completion of ZeniMax acquisition, Microsoft’s Game Pass service now includes 20 highly popular ZeniMax gaming titles.

Operating Results

Non-GAAP gross margin increased 19% (up 16% in cc) to $28.66 billion. This can be attributed to revenue growth across Productivity & Business Processes, Intelligent Cloud and More Personal Computing segments. Non-GAAP gross margin (in percentage terms) of 69% was flat on a year-over-year basis, on change in accounting estimate.

Commercial cloud gross margin was 70%, up 300 basis points (bps) year over year, driven by change in accounting estimate.

Operating margin expanded 400 bps on a year-over-year basis to 41%.

Productivity & Business Process operating income grew 26% (up 20% at cc) to $6.03 billion. Intelligent Cloud operating income surged 41% (up 36% at cc) to $6.43 billion.

More Personal Computing operating income rallied 27% (up 22% at cc) to $4.59 billion. Gross margin (as a percentage of segment income) contracted 200 bps on a year-over-year basis, as sales mix moved to Gaming.

Balance Sheet & Free Cash Flow

As of Mar 31, 2021, Microsoft had total cash, cash equivalents, and short-term investments balance of $125.4 billion, compared with $131.97 billion as of Dec 31, 2020. As of Mar 31, 2021, long-term debt (including current portion) was $58.06 billion compared with $60.52 billion as of Dec 31, 2020.

Operating cash flow during the reported quarter was $22.2 billion compared with $12.5 billion in the previous quarter. Free cash flow during the quarter was $17.1 billion compared with $8.3 billion in the prior quarter.

In the reported quarter, the company returned $10 billion to shareholders in the form of share repurchases and dividends.

Guidance

For fourth-quarter fiscal 2021, Productivity and Business Processes revenues are anticipated between $13.8 billion and $14.05 billion.

Strong upsell opportunity for Microsoft E5 and momentum in Office 365 is expected to drive growth in Office commercial. However, on-premises business is anticipated to decline in the high-teens range due to customers’ shift to cloud.

Office consumer revenues are expected to witness growth in mid- to high teens driven by increases in Microsoft 365 subscription revenues.

LinkedIn revenue growth is anticipated to be in mid-30% range driven by improving ad and jobs market. Revenue growth for Dynamics is expected to be at similar levels seen in the fiscal third quarter of 2021 driven by continued Dynamics 365 momentum.

Intelligent Cloud revenues are anticipated between $16.2 billion and $16.45 billion. Azure's revenue growth is likely to reflect continued strength in the consumption-based services.

Further, gains from Microsoft 365 suite adoption is expected to boost growth in per-user business. However, the company noted that it was expecting some moderation in growth given the large size of the installed base.

However, in Enterprise Services business, management expects revenues to be in line on a sequential basis. On-premises server business is projected to grow in the mid-single digits range driven by continued demand for hybrid and premium offerings.

More Personal Computing revenues are expected between $13.6 billion and $14 billion. The company expects overall Windows revenues to grow in the mid-single digits range. The improvement is likely to be led by continued momentum seen in Windows Commercial products and cloud services growth and robust PC demand partly offset by supply chain disruptions,

Search advertising revenues, excluding TAC, are anticipated to grow in the mid-40% range on improving advertising market.

In the fiscal fourth quarter, Surface revenues are anticipated to decline in the mid-teens range on a year-over-year basis due to tougher year over year comparison.

Gaming revenues are anticipated to be up in mid- to high single digits year over year. Xbox content and services revenue are projected to decline in the mid- to high single digits range owing to tougher year over year comparisons. Demand for Xbox Series X and S will continue to be negatively impacted by supply issues.

Management expects COGS between $13.7 billion and $13.9 billion, and operating expenses in the range of $13.1-$13.2 billion.

Stocks to Consider

Some better-ranked stocks worth considering in the broader technology sector are Qorvo QRVO, Vishay Intertechnology VSH and Citrix Systems CTXS. All the stocks carry a Zacks Rank #2 (Buy).

Citrix is scheduled to release earnings on Apr 29. Vishay InTechnology and Qorvo are slated to announce results on May 4 and May 5, respectively.

Long-term earnings growth rate for Qorvo, Vishay and Citrix are currently pegged at 14%, 20.3%, and 13.0%, respectively.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Citrix Systems, Inc. (CTXS) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Qorvo, Inc. (QRVO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research