MicroStrategy (MSTR) Q3 Earnings & Revenues Increase Y/Y

MicroStrategy MSTR reported third-quarter 2020 adjusted earnings of $2.06 per share that jumped 82% year over year.

Excluding share-based compensations, earnings were $1.79 per share that comfortably beat the consensus mark of 4 cents.

Revenues of $127.4 million outpaced the Zacks Consensus Estimate by 8.7% and improved 6.4% year over year.

Quarter Details

Total product licenses & subscription services revenues were $37.9 million, up 41% year over year. However, product support revenues decreased 2.1% year over year to $71.4 million. Other services revenues were $18.2million, down8.8%.

MicroStrategy witnessed strong adoption of HyperIntelligence in the reported quarter. The federal government and a large big-box retailer became its client.

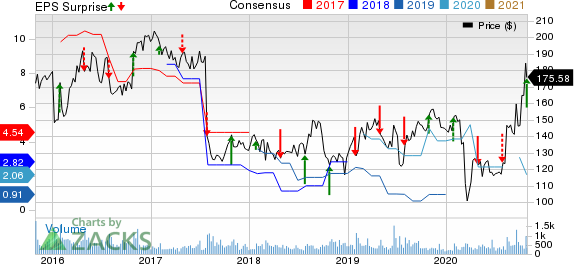

MicroStrategy Incorporated Price, Consensus and EPS Surprise

MicroStrategy Incorporated price-consensus-eps-surprise-chart | MicroStrategy Incorporated Quote

Moreover, the company witnessed strong adoption of cloud with significant increase in bookings including financial services institutions. Management stated that the COVID-19 outbreak is driving cloud adoption. Subscription billings jumped 85% year over year.

Further, MicroStrategy’s modern, open, independent and enterprise-grade embedded platform is now being readily offered by technology partners, which drove the top line in the reported quarter.

Gross margin expanded 280 basis points (bps) on a year-over-year basis to 82.9%.

Sales and marketing expenses as a percentage of revenues decreased 900 bps from the year-ago quarter to 27.7%.

Research and development expenses as a percentage of revenues decreased 200 bps from the year-ago quarter to 20.9%.

General and administrative expenses as a percentage of revenues decreased 110 bps on a year-over-year basis to 15.5%.

Non-GAAP operating margin surged from 5.4% in the year-ago quarter to 20.8% in the reported quarter.

Balance Sheet

As of Sep 30, 2020 MicroStrategy’s cash and cash equivalents and short-term investments total $52.7 million.

Moreover, as of Sep 30, the carrying value of MicroStrategy’s digital assets (comprised solely of bitcoin) was $380.8 million, which reflects cumulative impairments of $44.2 million since acquisition.

During the reported quarter, the company purchased roughly 38,250 bitcoins for an aggregate price of $425 million. This equates to an average price of approximately $11,111 per bitcoin.

Guidance

MicroStrategy plans to run day-to-day business with approximately $50 million in operating cash. The company also plans to use bitcoin as primary treasury reserve asset.

For 2021, MicroStrategy targets $60-$90 million in GAAP operating income.

Zacks Rank & Stocks to Consider

Currently, MicroStrategy carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are AMETEK AME, Digital Turbine APPS and Arrow Electronics ARW. All three stocks have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

All three stocks are set to release their quarterly results on Oct 29.

Zacks’ 2020 Election Stock Report:

In addition to the companies you learned about above, we invite you to learn more about profiting from the upcoming presidential election. Trillions of dollars will shift into new market sectors after the votes are tallied, and investors could see significant gains. This report reveals specific stocks that could soar: 6 if Trump wins, 6 if Biden wins.

Check out the 2020 Election Stock Report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research