Is Mid-Southern Bancorp, Inc. (MSVB) A Good Stock To Buy?

Many prominent investors, including Warren Buffett, David Tepper and Stan Druckenmiller, have been cautious regarding the current bull market and missed out as the stock market reached another high in recent weeks. On the other hand, technology hedge funds weren't timid and registered double digit market beating gains. Financials, energy and industrial stocks aren't doing great but many of the stocks that delivered strong returns since March are still going very strong and hedge funds actually increased their positions in these stocks. In this article we will find out how hedge fund sentiment to Mid-Southern Bancorp, Inc. (NASDAQ:MSVB) changed recently.

Hedge fund interest in Mid-Southern Bancorp, Inc. (NASDAQ:MSVB) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that MSVB isn't among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks). At the end of this article we will also compare MSVB to other stocks including Bank of the James Financial Group, Inc. (NASDAQ:BOTJ), WidePoint Corporation (NYSE:WYY), and CSI Compressco LP (NASDAQ:CCLP) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are assumed to be worthless, outdated financial tools of the past. While there are over 8000 funds trading today, We look at the top tier of this club, around 850 funds. These hedge fund managers administer the majority of the smart money's total capital, and by observing their first-class equity investments, Insider Monkey has uncovered many investment strategies that have historically exceeded the market. Insider Monkey's flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 13% since February 2017 (through November 17th) even though the market was up 65% during the same period. We just shared a list of 6 short targets in our latest quarterly update .

Lawrence Seidman of Seidman Investment Partnership

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Keeping this in mind we're going to view the latest hedge fund action encompassing Mid-Southern Bancorp, Inc. (NASDAQ:MSVB).

What does smart money think about Mid-Southern Bancorp, Inc. (NASDAQ:MSVB)?

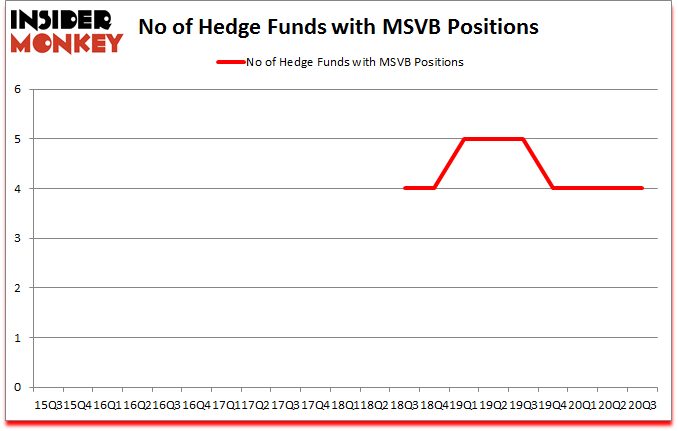

At Q3's end, a total of 4 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in MSVB over the last 21 quarters. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, MFP Investors, managed by Michael Price, holds the number one position in Mid-Southern Bancorp, Inc. (NASDAQ:MSVB). MFP Investors has a $2.2 million position in the stock, comprising 0.4% of its 13F portfolio. The second largest stake is held by Lawrence Seidman of Seidman Investment Partnership, with a $2.1 million position; 3.2% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism comprise Austin Wiggins Hopper's AWH Capital, David P. Cohen's Minerva Advisors and . In terms of the portfolio weights assigned to each position Seidman Investment Partnership allocated the biggest weight to Mid-Southern Bancorp, Inc. (NASDAQ:MSVB), around 3.15% of its 13F portfolio. AWH Capital is also relatively very bullish on the stock, designating 0.83 percent of its 13F equity portfolio to MSVB.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren't any hedge funds dumping their holdings during the third quarter, there weren't any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven't identified any viable catalysts that can attract investor attention.

Let's now take a look at hedge fund activity in other stocks - not necessarily in the same industry as Mid-Southern Bancorp, Inc. (NASDAQ:MSVB) but similarly valued. We will take a look at Bank of the James Financial Group, Inc. (NASDAQ:BOTJ), WidePoint Corporation (NYSE:WYY), CSI Compressco LP (NASDAQ:CCLP), Ampco-Pittsburgh Corp. (NYSE:AP), Manhattan Bridge Capital, Inc (NASDAQ:LOAN), OpGen, Inc. (NASDAQ:OPGN), and Ocugen, Inc. (NASDAQ:OCGN). This group of stocks' market valuations match MSVB's market valuation.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position BOTJ,1,3979,0 WYY,3,1807,1 CCLP,2,952,0 AP,5,10752,2 LOAN,1,648,0 OPGN,1,38,0 OCGN,1,115,-2 Average,2,2613,0.1 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 2 hedge funds with bullish positions and the average amount invested in these stocks was $3 million. That figure was $5 million in MSVB's case. Ampco-Pittsburgh Corp. (NYSE:AP) is the most popular stock in this table. On the other hand Bank of the James Financial Group, Inc. (NASDAQ:BOTJ) is the least popular one with only 1 bullish hedge fund positions. Mid-Southern Bancorp, Inc. (NASDAQ:MSVB) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for MSVB is 66.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 30.7% in 2020 through November 27th and still beat the market by 16.1 percentage points. Hedge funds were also right about betting on MSVB as the stock returned 13.7% since the end of Q3 (through 11/27) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Get real-time email alerts: Follow Mid-Southern Bancorp Inc. (NASDAQ:MSVB)

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.

Related Content