It Might Not Be A Great Idea To Buy Picton Property Income Limited (LON:PCTN) For Its Next Dividend

Picton Property Income Limited (LON:PCTN) is about to trade ex-dividend in the next 3 days. If you purchase the stock on or after the 8th of August, you won't be eligible to receive this dividend, when it is paid on the 30th of August.

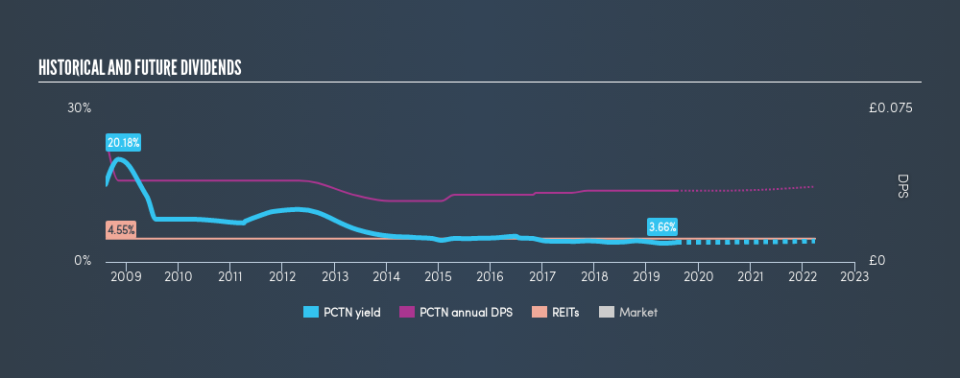

Picton Property Income's next dividend payment will be UK£0.0088 per share. Last year, in total, the company distributed UK£0.035 to shareholders. Last year's total dividend payments show that Picton Property Income has a trailing yield of 3.9% on the current share price of £0.901. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Picton Property Income

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Picton Property Income is paying out an acceptable 75% of its profit, a common payout level among most companies. That said, REITs are often required by law to distribute all of their earnings, and it's not unusual to see a REIT with a payout ratio around 100%. We wouldn't read too much into this. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out more than half (75%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Picton Property Income's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Picton Property Income's earnings per share have dropped 11% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Picton Property Income's dividend payments per share have declined at 5.6% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

Final Takeaway

From a dividend perspective, should investors buy or avoid Picton Property Income? While earnings per share are shrinking, it's encouraging to see that at least Picton Property Income's dividend appears sustainable, with earnings and cashflow payout ratios that are within reasonable bounds. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Curious what other investors think of Picton Property Income? See what analysts are forecasting, with this visualisation of its historical and future estimated earnings and cash flow .

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.