MMM, UTX Q2 Earnings on Jul 24: Here Are the Key Predictions

Last week, a handful of U.S. conglomerates reported their numbers for the April-June quarter of 2018. Results and projections given by these companies drove the Zacks Conglomerates sector up by 0.1%. It’s worth noting here that roughly 0.5% gain in the sector till Jul 19 in the week was partially offset by 0.4% decline recorded on Jul 20.

With a meager improvement in the sector last week, we believe that important releases in this week and the next are going to be a major determinant in the movements of the Conglomerates sector.

Per the Earnings Preview report published on Jul 20, the Conglomerates sector is one of the two sectors that are expected to record poor bottom-line performance. Earnings in the second quarter are predicted to decline 6.3% year over year compared with 5.6% growth registered in the last reported quarter. Revenues are anticipated to grow 5%, below 7% recorded in the first quarter.

Looking at the numbers of the S&P 500 group, results released so far gives us a rosy picture. Till Jul 20, roughly 17.4% of the group members have reported results. Earnings, so far, have increased 20.9% year over year while revenues have expanded 10.3%. Beat was measured at 86.2% for earnings and 77% for revenues.

We believe that it will be interesting to watch how the earnings season unfolds for the S&P 500 group. For the second quarter, as a whole, earnings of the S&P 500 group is projected to grow 21% year over year while revenues are anticipated to increase 8.3%. Earnings releases by basis material, industrial products, oil/energy, technology and construction companies are anticipated to be prime earnings drivers in the quarter under review.

What's in Store for Conglomerates: MMM & UTX?

Below, we briefly discussed the expectations from the two conglomerate stocks, slated to report their numbers for the second quarter tomorrow, before the market opens.

3M Company MMM: This conglomerate delivered better-than-expected results in two of the last four quarters while lagging estimates in one and posting in-line results in one. Average earnings surprise was a positive 2.12%.

3M Company Price, Consensus and EPS Surprise

3M Company Price, Consensus and EPS Surprise | 3M Company Quote

Our proven model provides some idea about stocks that are about to release their earnings results. Per the model, a stock needs a combination of a positive Earnings ESP (the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate) and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for a likely earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Currently, 3M Company carries a Zacks Rank #4 (Sell) and Earnings ESP of -0.90%. The company is dealing with adverse impacts of inflation in raw material costs, rising freight expenses and others. Also, the company faces competition from local players in the country that it serves.

However, the Zacks Consensus Estimate for the company’s Industrial, and Safety and Graphics segments’ revenues are pegged at $3,147 million and $1,827 million, reflecting year-over-year growth of 15.7% and 18.1%, respectively.

Over the past 60 days, the Zacks Consensus Estimate for the second quarter has remained stable at $2.59 per share. (For more please read: What's in the Offing for 3M Company in Q2 Earnings?)

Note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing a negative estimate revision momentum.

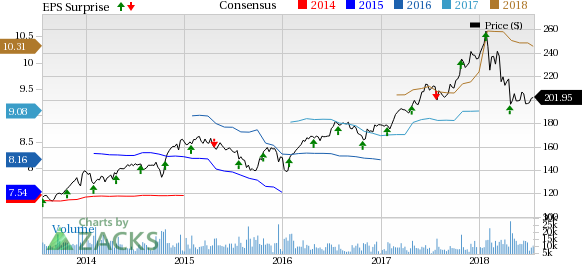

United Technologies Corporation UTX: The company recorded better-than-expected results in each of the trailing four quarters, with an average positive earnings surprise of 6.82%.

United Technologies Corporation Price, Consensus and EPS Surprise

United Technologies Corporation Price, Consensus and EPS Surprise | United Technologies Corporation Quote

Currently, United Technologies carries a Zacks Rank #3 and has an Earnings ESP of +0.18%. The company’s diversified business structure, strong cash flow, sound capital-allocation strategies and initiatives to introduce innovative products will be beneficial. Also, strengthening aftermarket business might boost top-line results.

For the second quarter, the Zacks Consensus Estimate for the company’s Pratt & Whitney, UTC Climate Control and Security, and UTC Aerospace Systems segments’ revenues are currently pegged at $4,526 million, $4,942 million and $3,774 million, respectively, reflecting year-over-year growth of 11.2%, 4.9% and 3.7%, respectively.

Over the past 60 days, the Zacks Consensus Estimate for the second quarter increased 0.5% to $1.85. (For more please read: United Technologies Q2 Earnings: Is a Beat in Store?)

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

3M Company (MMM) : Free Stock Analysis Report

United Technologies Corporation (UTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research