Model N (MODN) Tops Q2 Earnings Estimates on Revenue Growth

Model N, Inc. MODN reported second-quarter fiscal 2022 results with year-over-year increase in revenues and non-GAAP earnings driven by healthy demand trends and record bookings. The company aims to continue this growth momentum in the future with the gradual transition to the cloud.

Quarter Details

GAAP loss for the reported quarter were $8 million or a loss of 22 cents per share compared with a net loss of $10.7 million or a loss of 30 cents per share in the year-ago quarter. Non-GAAP earnings of 14 cents per share surpassed the Zacks Consensus Estimate of 7 cents and increased 250% year over year.

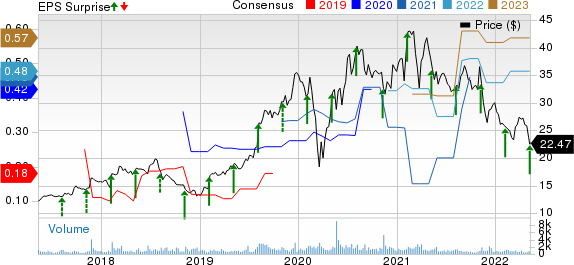

Model N, Inc. Price, Consensus and EPS Surprise

Model N, Inc. price-consensus-eps-surprise-chart | Model N, Inc. Quote

Revenues were $53.5 million, which beat the Zacks Consensus Estimate by 4% and increased 11% year over year.

During the quarter, Model N inked two additional Software-as-a-Service (SaaS) transactions and had success selling new products. The company also launched Model N Ngage, an application to aid its customers with better experience and drive continuous process improvements.

Subscription revenues (71.8% of total revenues) were $38.2 million, up 6.4% year over year. Professional Services revenues (28.2% of total revenues) were $15 million, up 22.7% year over year.

Operating Details

Non-GAAP gross margin increased 300 basis points (bps) from the year-ago quarter’s figure to 60%. Non-GAAP subscription gross margin moved up 70 bps from the prior-year quarter’s levels to 66.8%. Non-GAAP professional services gross margin expanded 1,280 bps to 42%.

Adjusted EBITDA was $6.6 million, which was up 104.8% year over year. Non-GAAP operating income more than doubled to $6.4 million.

Cash Flow & Liquidity

For the six months of fiscal 2022, Model N reported net cash from operating activities at $2.9 million compared with 3.1 million. As of Mar 31, 2022, the company had cash and cash equivalents of $170.4 million and $129.8 million of long-term debt.

Guidance

The company anticipates third-quarter fiscal 2022 total revenues between $54.5 million and $55 million. Subscription revenues are projected in the range of $39.2-$39.7 million. Adjusted EBITDA is expected between $7 million and $7.5 million. Non-GAAP income from operations is expected in the range of $6.7-$7.2 million. Non-GAAP earnings per share are anticipated in the range of 14-16 cents per share.

For fiscal 2022, Model N expects total revenues in the band of $215.5 - $216.5 million. Subscription revenues are estimated in the range of $156-$157 million. Adjusted EBITDA is projected within $27.5-$28.5 million. Non-GAAP operating income is expected in the range of $26.5-$27.5 million. Non-GAAP earnings are expected to be 56-59 cents per share.

Zacks Rank & Stocks to Consider

Model N currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Duck Creek Technologies, Inc. DCT is a better-ranked stock in the broader Zacks Computer and Technology sector, sporting a Zacks Rank #1. The current-year estimate has been revised up by 400% over the past year, while that for the next year is up by 40% in the same time frame.

The long-term earnings growth expectation for Duck Creek is 50%.

Avalara, Inc. AVLR carries a Zacks Rank #2 (Buy). The consensus estimate for current-year earnings has been revised 80% downward.

Avalara delivered a trailing four-quarter negative earnings surprise of 13.51%, on average.

InterDigital, Inc. IDCC, with a Zacks Rank #2, is another solid pick for investors. It has long-term earnings growth rate expectation of 15%.

Earnings estimates for the current year have moved up to 28.9% over the past year. InterDigital is focused on pursuing agreements with unlicensed customers in the handset and consumer electronics market.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

InterDigital, Inc. (IDCC) : Free Stock Analysis Report

Duck Creek Technologies, Inc. (DCT) : Free Stock Analysis Report

Model N, Inc. (MODN) : Free Stock Analysis Report

Avalara, Inc. (AVLR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research