Moderna vaccine news strikes 'stay at home' stocks like Zoom and Peloton, but less dramatically than last week

Moderna on Monday morning announced that its COVID-19 vaccine candidate is 94.5% effective in trials and can last longer in refrigeration than previously predicted. The news sent the Dow soaring along with shares in airlines, cruise lines, hotels, restaurants, and other forms of in-person travel and entertainment.

And predictably, the news had the opposite effect on “stay at home” stocks that have surged during the pandemic, sending them starkly lower—at first.

Zoom, Peloton, Slack, and CrowdStrike, tech names that have all surged during the pandemic, each fell in pre-market trading. Connected-fitness brand Peloton (PTON) fell by as much as 5%, video-conferencing platform Zoom (ZM) dove 7%, cybersecurity firm CrowdStrike (CRWD) fell 4%, and work chat app Slack (WORK) fell 2% before the market opened on Monday.

The same effect happened exactly one week ago when Pfizer announced the efficacy of its COVID-19 vaccine candidate, and the effect then was far more dramatic: Peloton fell by as much as 25%; Logitech (LOGI) fell 19%; Zoom fell 17%; even Netflix (NFLX) and Roku (ROKU) dipped.

This time, by noon, Zoom had pared its losses to 4%, CrowdStrike was down 1%, Peloton was flat, and Slack was trading in the green.

Perhaps this time, investors realized the folly of last week’s stay-at-home selloff.

The post-pandemic prospects for at-home work tools

It’s obvious why the news of multiple imminent COVID-19 vaccines stokes optimism in the reopening of the economy and a return to normalcy. It’s obvious why restaurants, hotels, theme parks and airlines are cheering the vaccine news—their businesses depend on it.

But the idea that the end of the pandemic will mean the end of the run for growth names like Zoom and Peloton is quite a leap.

In Peloton’s case, the bikes have been so popular that there are wait times of more than two months. Peloton’s Q4 sales surged 172% and gave the company its first profitable quarter. Once the pandemic ends, will all of the recent Peloton converts stop using their new bike and return to gyms? The company also continues to reap subscription fees from its previous buyers.

In the case of enterprise software names like Zoom, Slack, and CrowdStrike, companies that have embraced them will continue to rely on them in the future, even once they’ve brought employees back to the office. And what happened to the widespread consensus that remote work (or “hybrid” or “flexible” work) will remain the norm for many workers, even beyond the pandemic?

Zoom and Peloton stock had climbed high before COVID-19. Remote work and at-home connected fitness were growing trends before the pandemic. The likelihood is they’ll continue to spread even when there’s a vaccine available.

Rotation from growth back to value

Of course, the recent fading appeal of the stay-at-home trade isn’t all about investors giving up on those growth names. In many cases, it’s a natural rotation: firms are selling the tech names that have surged so high and re-investing their gains in the value names that have been hammered by the pandemic.

As we continue to get positive vaccine news, “The rotation into value stocks that started last week will continue,” says David Trainer, CEO of investment research firm New Constructs. “The overblown work-from-home trade is beginning to unwind because some of those stocks had baked in no vaccine at all... Momentum strategies are dangerous because they are so attractive when they work, but they are brutally painful when they expire.”

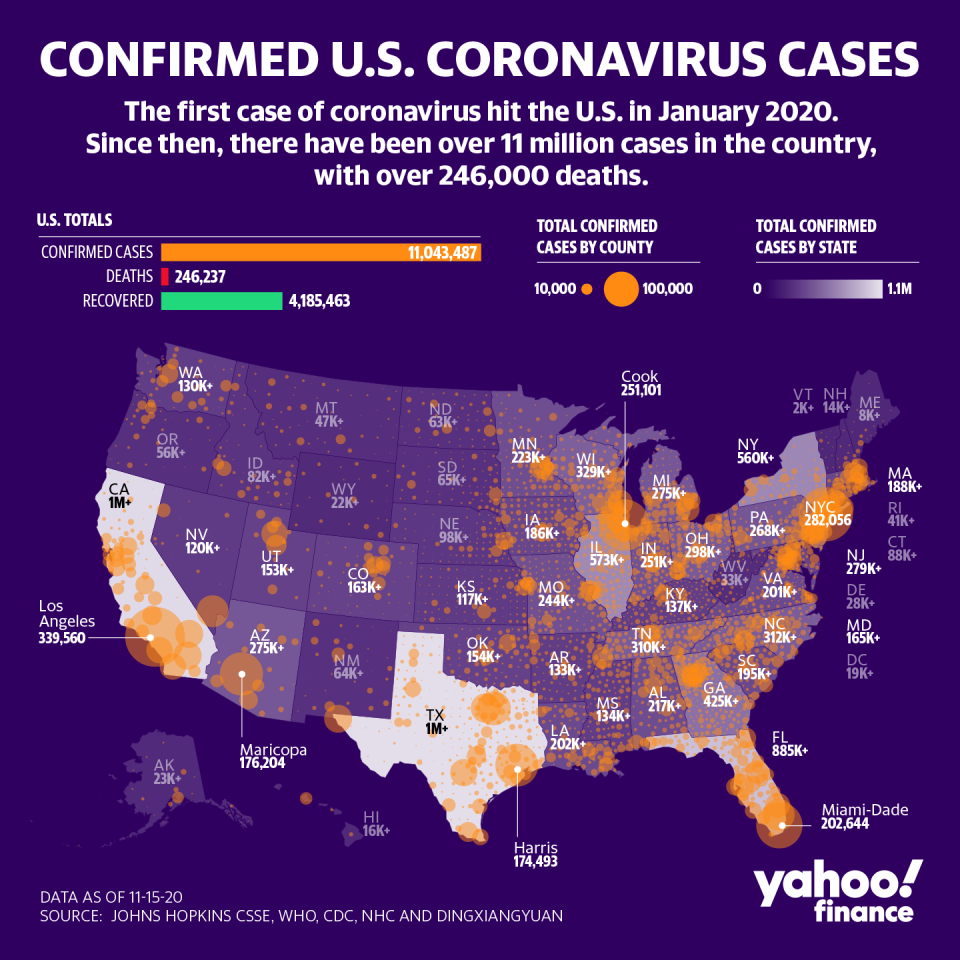

Is the stay-at-home trade really about to “expire”? Over the next few weeks and months, with COVID-19 cases spiking in the U.S. the question will play out in daily markets.

—

Daniel Roberts is an editor-at-large at Yahoo Finance and closely covers tech. Follow him on Twitter at @readDanwrite.

Read more:

Pandemic 'stay at home stocks' like Peloton, Zoom, Roku tank on Pfizer vaccine news—overreaction?

Logitech CEO: 4 ‘secular’ trends are driving our sales boost, not just the pandemic

AMC’s outlook is extremely dire as pandemic drags on

Netflix's Q3 demonstrates the dreaded 'pandemic pull-forward in demand'

Curbside pickup is ‘extremely sticky’ and will continue post-pandemic: McKinsey retail analyst

Walmart and Target huge e-commerce gains are a blaring siren to brick-and-mortar retail

2 key numbers show how quickly Nike is bouncing back from the pandemic

Why Restoration Hardware stock is up 270% during the pandemic

Why Wayfair stock is up 250% this year

Why Dick’s Sporting Goods is wildly outperforming amid the pandemic