Mohawk (MHK) Q3 Earnings Beat, Sales Miss, Q4 View Tepid

Mohawk Industries, Inc. MHK reported mixed results for third-quarter fiscal 2021 (ended Oct 2). The top line lagged the Zacks Consensus Estimate but the bottom line marginally topped the same. Nonetheless, both the metrics improved on a year-over-year basis.

Third-quarter results were driven by robust housing sales and remodeling activities across the world. Commercial projects are improving on the back of global economic recovery. Mohawk’s strategies to enhance organizational flexibility, reduce product and operational complexity as well as align pricing with costs aided third-quarter growth.

Yet, its shares fell 1.4% in the after-hours trading session on Oct 28. Investors’ sentiment might have been hurt by a tepid earnings view for the fourth quarter.

Jeffrey S. Lorberbaum, chairman and CEO of Mohawk, said, “Rather than improving as expected, the availability of labor, materials and transportation became more challenging, resulting in higher costs in the period. Tight chemical supplies, in particular, reduced the output of our LVT, carpet, laminate and board panels. For the near term, we do not foresee significant changes in these external pressures. Due to supply shortages, government regulations and political issues, natural gas costs in Europe are presently about four times higher than earlier in the year. This adds a temporary challenge to our European businesses as the higher costs are reflected in gas, electricity and materials.”

Inside the Numbers

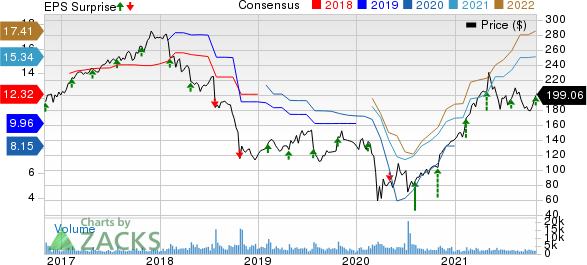

Mohawk reported adjusted earnings of $3.95 per share, surpassing the consensus mark of $3.94 by 0.3%. The metric increased 21.2% year over year.

Mohawk Industries, Inc. Price, Consensus and EPS Surprise

Mohawk Industries, Inc. price-consensus-eps-surprise-chart | Mohawk Industries, Inc. Quote

Net sales of $2.82 billion lagged the consensus estimate of $2.95 billion by 4.4% but increased 9.4% from the year-ago figure of $2.57 billion. On a constant-currency basis, net sales were up 8.7% year over year.

Operating Highlights

Adjusted gross profit of $838.1 million was up 14.8% year over year. Adjusted selling, general and administrative expenses — as a percentage of net sales — were marginally up from the year-ago period. Adjusted operating income totaled $361.3 million, which rose 22.4% year over year.

Segment Details

Global Ceramic: Sales in the segment totaled $998.4 million, up 9.6% year over year. Also, the metric improved 9.1% on a constant-currency basis. Adjusted operating income increased to $119.1 million from $94.1 million a year ago. The segment’s operating margin expanded 400 bps to 12%. The upside was primarily due to pricing and mix improvements and favorable productivity, partially offset by inflation.

Flooring North America: Net sales at the segment amounted to $1,050.5 million, up 6.9% year over year as reported and on a constant-currency basis. The segment registered an adjusted operating income of $120 million for the quarter compared with $80.3 million reported in the prior-year period. Operating margin was 11%, up 300 bps from 8% reported a year ago. Favorable price and mix, and productivity improvements were partially offset by inflation.

Flooring Rest of the World: Net sales in the segment increased 13% year over year to $768.1 million. On a constant-currency basis, sales were up 11% from the year-ago level. Adjusted operating income was $133.4 million, up from $131.2 million reported a year ago. The segment’s operating margin contracted 190 bps to 17.4%. Pricing and mix improvements were offset by inflation, a return to more normal seasonality as well as COVID restrictions.

Financial Highlights

As of Oct 2, 2021, it had cash and cash equivalents of $1.13 billion compared with $781.2 million on Sep 26, 2020. Long-term debt — less current portion — at fiscal third quarter-end was $1.71 billion compared with $2.28 billion on Sep 26, 2020.

For the fiscal third quarter, the company generated free cash flow of $351 million, down from $529.4 million a year ago. Backed by $1.9 billion of EBITDA generated for the trailing 12 months, Mohawk’s board increased the stock purchase program by an additional $500 million.

Fourth-Quarter Fiscal 2021 View

It anticipates typical seasonal slowing from the third quarter. The company intends to run operations at high levels to support sales, improve service and increase inventories. Mohawk has been experiencing increased material, energy and transportation inflation. Hence, the company intends to increase investments to expand the production of some categories that are being limited by its manufacturing capacities.

For the fourth quarter, record-high natural gas prices are likely to increase net costs by $25 million in the Ceramic Europe business. Given the current situation and 6% fewer days than the prior year, Mohawk expects fourth-quarter adjusted earnings to be $2.80-$2.90, excluding restructuring charges, indicating a decline from the year-ago figure of $3.54. The Zacks Consensus Estimate for fourth-quarter adjusted earnings is pegged at $3.46 per share.

Zacks Rank

Mohawk currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Earnings Releases

Hilton Worldwide Holdings Inc. HLT reported third-quarter 2021 results, with earnings missing the Zacks Consensus Estimate and revenues beating the same. However, the top and bottom line increased on a year-over-year basis. Global recovery from the COVID-19 pandemic along with upward trend in travel and tourism contributed to the company’s performance.

JAKKS Pacific, Inc. JAKK reported mixed third-quarter 2021 results, wherein earnings beat the Zacks Consensus Estimate but revenues missed the same. While the top line missed the consensus mark after beating the same in the preceding five quarters, the bottom line beat the estimates for the fifth consecutive quarter.

Hasbro, Inc. HAS reported solid third-quarter fiscal 2021 results, with earnings and revenues surpassing the Zacks Consensus Estimate. The bottom line outpaced the consensus mark for the fifth straight quarter, while the top line beat the same for the second consecutive quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

JAKKS Pacific, Inc. (JAKK) : Free Stock Analysis Report

Mohawk Industries, Inc. (MHK) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.