monday.com (NASDAQ:MNDY) adds US$245m to market cap in the past 7 days, though investors from a year ago are still down 51%

monday.com Ltd. (NASDAQ:MNDY) shareholders should be happy to see the share price up 17% in the last month. But that doesn't change the fact that the returns over the last year have been disappointing. Like an arid lake in a warming world, shareholder value has evaporated, with the share price down 51% in that time. So the bounce should be viewed in that context. It may be that the fall was an overreaction.

The recent uptick of 5.0% could be a positive sign of things to come, so let's take a lot at historical fundamentals.

View our latest analysis for monday.com

Because monday.com made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, monday.com increased its revenue by 90%. That's a strong result which is better than most other loss making companies. In contrast the share price is down 51% over twelve months. Yes, the market can be a fickle mistress. Typically a growth stock like this will be volatile, with some shareholders concerned about the red ink on the bottom line (that is, the losses). We'd definitely consider it a positive if the company is trending towards profitability. If you can see that happening, then perhaps consider adding this stock to your watchlist.

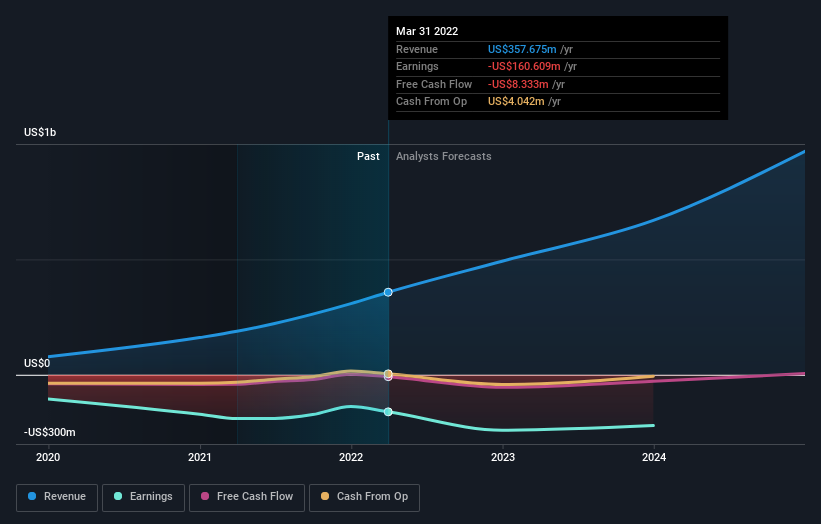

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

monday.com is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling monday.com stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We doubt monday.com shareholders are happy with the loss of 51% over twelve months. That falls short of the market, which lost 16%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. The share price decline has continued throughout the most recent three months, down 20%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand monday.com better, we need to consider many other factors. To that end, you should learn about the 4 warning signs we've spotted with monday.com (including 1 which is concerning) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here