Monday’s Vital Data: Advanced Micro Devices, Inc. (AMD), Bank of America Corp (BAC) and Tesla Inc (TSLA)

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

U.S. stock futures are pointing toward a broadly positive open, as sentiment on Wall Street is bolstered by a third consecutive day of rising oil prices. Meanwhile, economic data may help bolster the positive mood, with May durable goods orders and the May Chicago Federal Reserve national activity index both on tap later this morning.

Against this backdrop, futures on the Dow Jones Industrial Average are up 0.31%, S&P 500 futures have added 0.26% and Nasdaq-100 futures have risen 0.46%.

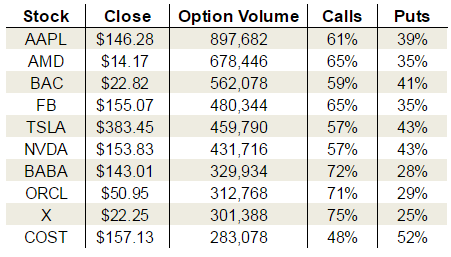

On the options front, volume remained fairly average on Friday, with about 15.3 million calls and 12.6 million puts changing hands. On the CBOE, the single-session equity put/call volume ratio rose slightly to 0.54, though the recent attention to calls dropped the 10-day moving average to 0.64 from Thursday’s two-month high of 0.66.

Turning to Friday’s options activity, Advanced Micro Devices, Inc. (NASDAQ:AMD) attracted plenty of call traders after Rosenblatt Securities said that AMD bulls were “denying reality” and failing to give the company credit for its new Epyc CPUs. Meanwhile, Bank of America Corp (NYSE:BAC) saw mixed options activity despite the banking giant passing the Fed’s first round of stress tests. Finally, Tesla Inc (NASDAQ:TSLA) drew mixed options volume after the company announced it has once again expanded its credit capacity.

Advanced Micro Devices, Inc. (AMD)

Rosenblatt Securities analyst Hans Mosesmann reiterated a $20 price target and a “buy” rating on AMD stock on Friday amid rather tongue-in-cheek bullish commentary on the company. Mosesmann noted that the consensus only-time-will-tell approach to AMD’s new Epyc data server chips is quite amusing.

“The positioning of this narrative requires a substantial intellectual effort to deny reality after a multitude of PC OEM, server OEM, hyperscale player support for EPYC/Ryzen,” Mosesmann noted. He also predicted that, without an appropriate response for Epyc, Intel Corporation (NASDAQ:INTC) will have to cut prices.

While AMD stock dipped roughly 1.5% on Friday, options traders appeared to heed Mosesmann’s words and take advantage of the dip. Volume topped 678,000 contracts on the day, with calls snapping up 65% of the day’s take.

Furthermore, the July put/call open interest ratio continues to fall, arriving at 0.50 on Friday, with calls doubling puts among options set to expire next month. Peak call OI for July still rests at the $14 strike, totaling roughly 59,700 contracts. However, OI at the $15 strike is on the rise, jumping to more than 53,000 contracts by the close on

Friday. Finally, if you got into the July $12/$13 bull call spread I recommended on June 16, you should close that trade out for a profit of about 150% if you haven’t already.

Bank of America Corp (BAC)

Bank of America cleared the first round of stress tests, the Federal Reserve announced on Friday. Although the biggest banks could suffer loan losses totaling $383 billion, they would still survive a severe recession. What’s more, the figure was an improvement over the same tests a year ago. Results from the second part of the test will be released this Wednesday, and will detail whether the Fed will approves or deny banks’ capital plans. This second test is huge for BAC shareholders, as it could dictate whether or not BofA is able to raise its dividend payout.

BAC options traders didn’t seem that enthused about the first round of tests. Volume rose to 562,000 contracts, with calls only pulling together 59% of the day’s take. However, July options paint a different picture, with the put/call OI ratio arriving at 0.46, with calls more than doubling puts among near-term options. This high level of call OI could be a sign that options traders are expecting a positive outcome from the second round of testing, and a potential dividend hike from Bank of America as a result.

Tesla Inc. (TSLA)

Tesla continues to burn through cash in its efforts to bring the Model 3 to market. CEO Elon Musk is all but betting the farm on the Model 3, with Tesla increasing its credit capacity once again — this time by $800 million — to a total of $3.825 billion. Rising debt appears to be old hat to TSLA stock investors at this point, however, as the shares rose nearly a quarter point on Friday and hit a new all-time high just shy of $387.

TSLA options traders were not quite as blasé about the rising debt level. Volume came in at over 459,000 contracts, with calls only managing 57% of the day’s take. What’s more, the July put/call OI ratio has risen to a more cautious reading of 1.00, with calls and puts in parity among front-month options.

Peak call OI for the month currently totals 5,597 contracts at the $400 strike, while July peak put OI numbers 3,370 contracts at the $320 strike.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Monday’s Vital Data: Advanced Micro Devices, Inc. (AMD), Bank of America Corp (BAC) and Tesla Inc (TSLA) appeared first on InvestorPlace.