Monday’s Vital Data: Teva Pharmaceuticals, Inc. (TEVA), Oracle Corporation (ORCL) and Nvida Corporation (NVDA)

U.S. stock futures are in rally mode this morning, with Dow Jones Industrial Average futures up more than 100 points in premarket trading. Tax plan optimism is the big driver heading into the week before the holiday break, as Republican’s now appear to have the votes to pass the much anticipated legislation.

Specifically, Treasury Secretary Steven Mnuchin said over the weekend that he has no doubt that the Republican tax plan will make it to the president’s desk this week, after Senators Bob Corker (R-Tenn.) and Marco Rubio (R-Fl.) ended their holdouts and said they’d support the bill.

Against this backdrop, Dow futures have soared 0.64%, S&P 500 futures have climbed 0.37% and Nasdaq-100 futures have jumped 0.37%.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

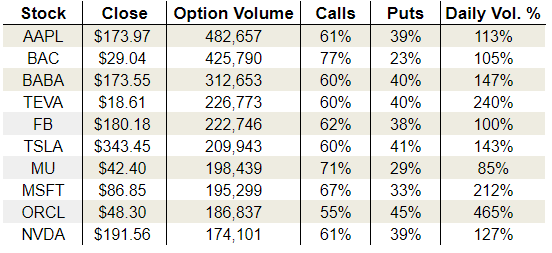

On the options front, volume was over the top on Friday, with more than 24.2 million calls and 17.7 million puts changing hands on the session. Traders, it appears, are already preparing to go on break as the holiday season draws to a close. As for the CBOE, the single-session equity put/call volume ratio rose to 0.57, while the 10-day moving average ticked higher to 0.59.

Turning to Friday’s options activity, Teva Pharmaceutical Industries Ltd (ADR) (NASDAQ:TEVA) was upgraded at Credit Suisse for announcing layoffs, but Israel’s largest labor union effectively shut the country down for half a day in protest. Elsewhere, Oracle Corporation (NASDAQ:ORCL) drew mixed options activity after a poorly received quarterly earnings report. Finally, Nvidia Corporation (NASDAQ:NVDA) rallied following a bullish note on GPU makers and cryptocurrencies.

Teva Pharmaceutical Industries Ltd (ADR) (TEVA)

TEVA stock surged more than 7% on on Friday after Credit Suisse upgraded the shares to “neutral” from “underperform” and lifted its price target to $20 from $8. The brokerage firm praised Israel-based Teva’s plan to layoff 10,000 employees as a positive turnaround move for investors.

However, the layoffs had the unintended consequence of practically shutting down Israel for half a day. The country’s biggest labor union went on strike for half of Sunday, closing the airport, stock exchange, banks and all government ministries in protest of the mass layoffs.

TEVA options traders clearly focused on the positives for the country. Volume topped 226,000 contracts, with activity rising to roughly 2.6 times TEVA’s daily average. Calls made up 60% of the day’s take. That said, January 2018 options activity reveals a bit of profit taking on TEVA.

Specifically, the January 2018 put/call open interest ratio rose last week from 0.55 on Monday to 0.64 as of this morning. Call volume remained heavy throughout the week, meaning that existing call positions were closed for a profit, or traders rolled their positions higher and into a later month to benefit from continued gains.

Oracle Corporation (ORCL)

Oracle released its quarterly earnings report last week, and the results were not well received at all. The company topped quarterly earnings and revenue expectations, but issued guidance below Wall Street’s targets. Specifically, Oracle said it expected revenue growth of 2%-4% with adjusted earnings of 68-70 cents per share, below the analyst estimate of 72 cents.

Furthermore, cloud growth, while solid for Oracle, remained well below that of competitors Microsoft Corporation (NASDAQ:MSFT) and Amazon.com, Inc. (NASDAQ:AMZN).

But ORCL stock is up this morning after announcing that the company was buying Australia’s Aconex Ltd for $1.19 billion. Aconex specializes in web-based project management software that could help boost Oracle’s presence in business cloud offerings.

ORCL options traders were mixed on last week’s earnings performance. Volume spiked to 186,000 contracts, or nearly five times Oracle’s daily average. That said, calls only made up 55% of the day’s take, as puts gained momentum on ORCL stock.

Furthermore, the January 2018 put/call OI ratio indicates a fair amount of pessimism, arriving at 0.91. Currently, peak put OI for the series totals 45,000 contracts at the out-of-the-money $40 strike.

Nvidia Corporation (NVDA)

NVDA stock has taken a bit of a beating in the past month, as analysts fret of the implosion of demand from cryptocurrency miners. However, RBC Capital Markets thinks the risks are being overstated. According to the ratings firm, while bitcoin and ethereum will both see less mining demand, every other cryptocurrency on the market is still going strong. As a result, Nvidia should continue to see strong demand for GPUs to mine these other currencies.

NVDA options traders gobbled up the bullish news. Volume jumped to 174,000 contracts on Friday, with calls making up 61% of the day’s take. What’s more, the attention to calls could mark a reversal in sentiment for NVDA.

Currently, the January 2018 put/call OI ratio arrives at a lofty 1.18 for NVDA stock. However, this reading has trended lower in recent weeks, as traders banked off a rebound in NVDA stock. Additional leverage from analyst notes on cryptocurrency miners could add fuel to this fire, and help push NVDA steadily higher heading into 2018.

As of this writing, Joseph Hargett did not hold a position in any of the aforementioned securities.

More From InvestorPlace

The post Monday’s Vital Data: Teva Pharmaceuticals, Inc. (TEVA), Oracle Corporation (ORCL) and Nvida Corporation (NVDA) appeared first on InvestorPlace.