Can Monster Beverage (MNST) Beat Q3 Earnings Amid Supply Woes?

Monster Beverage Corporation MNST is expected to report third-quarter 2021 results on Nov 4, after the closing bell. The beverage company is anticipated to have witnessed revenue and earnings growth in the to-be-reported quarter.

The Zacks Consensus Estimate for third-quarter earnings of 66 cents per share suggests a gain of 1.5% from 65 cents reported in the year-ago quarter. The consensus mark has been unchanged in the past 30 days. The consensus mark for revenues is pegged at $1.39 billion, indicating growth of 11.4% from that reported in the year-ago quarter.

In the last reported quarter, the company’s earnings beat the Zacks Consensus Estimate by 11.9%. It has delivered an earnings surprise of 4.2%, on average, in the trailing four quarters.

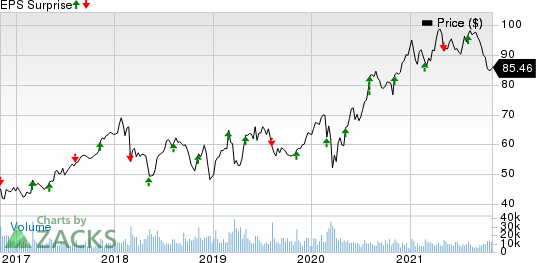

Monster Beverage Corporation Price and EPS Surprise

Monster Beverage Corporation price-eps-surprise | Monster Beverage Corporation Quote

Key Factors to Note

Monster Beverage has been experiencing continued strength in its energy drinks category, particularly the Monster Energy brand, driving its performance. Management is optimistic about strength in the energy drinks category, with the Monster Energy brand growing significantly. Gains from strong demand for energy drinks are expected to have aided its third-quarter revenues.

The company is expected to have witnessed momentous growth in e-commerce, club store, mass merchandiser and grocery-related businesses. Foot traffic at its largest convenience and gas channel has been witnessing improved trends, which is anticipated to have continued in the to-be-reported quarter.

Monster Beverage has been committed to product launches and innovation to boost growth. Management has been optimistic about the significant growth potential of its Monster Energy brand. Product launches across the Monster family are expected to have driven the company’s overall top and bottom lines in the to-be-reported quarter.

However, Monster Beverage has been facing hardships due to logistics and supply-chain challenges, which weighed on margins in the second quarter. The company continued to witness shortages in its aluminum can requirements in North America and Europe, owing to its higher volume growth and the ongoing supply constraints in the aluminum can industry.

The company has also been witnessing delays in the procurement of certain ingredients, both domestically and internationally. This has led to heightened challenges in meeting the increased consumer demand in North America and EMEA. Continued supply-chain disruptions are expected to get reflected in the company’s third-quarter results.

It has also been facing freight inefficiencies as well as significant increases in domestic and international freight costs. It has been experiencing higher input costs, particularly for aluminum, and other costs in the current environment. These headwinds are expected to have led to higher cost of sales as well as increased operating expenses in the third quarter, impacting both gross and operating margins.

On the last reported quarter’s earnings call, management indicated that it expects logistical issues, including shortages of shipping containers and global port of entry congestion, to delay the arrival of imported cans, with deliveries likely to increase sequentially in the second half of 2021. It expects challenges related to the supply constraints in the aluminum can industry, shortages of shipping containers, global port congestions, and higher freight and input costs to continue for the next few months. This is likely to have adversely impacted gross margin rates in the third quarter.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Monster Beverage this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Monster Beverage has a Zacks Rank #3 and an Earnings ESP of -1.53%.

Stocks Poised to Beat Earnings Estimates

Here are a few companies you may want to consider, as our model shows that these have the right combination to post an earnings beat:

Greenlane Holdings GNLN has an Earnings ESP of +5.88% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Coty COTY currently has an Earnings ESP of +50.00% and a Zacks Rank #3.

General Mills GIS currently has an Earnings ESP of +5.26% and a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Monster Beverage Corporation (MNST) : Free Stock Analysis Report

Coty (COTY) : Free Stock Analysis Report

Greenlane Holdings, Inc. (GNLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.