Monster Trends, Monster Profits: How to Spot Market Winners in 2023

The price action in the stock market this year has illustrated how important it is to remain disciplined and follow a rule-based strategy. A strategy that is mainly mechanical can free investors from emotional decision-making. Emotions can prevent investors from making sound decisions and are one of our biggest threats to achieving an acceptable rate of return on our investments.

Rule-based strategies remove the reliance of making decisions based on predictions or guesswork. Investing using a clear set of rules allows investors to follow a disciplined approach. And here at Zacks, we provide our subscribers with a rule-based strategy that has consistently outperformed the market year after year.

At the heart of this strategy is the Zacks Rank, which analyzes earnings estimate revisions. These earnings revisions have been shown to be the most powerful force impacting stock prices. Stocks with rising estimates have significantly outperformed the S&P 500. That’s why it is so crucial to keep an eye on which stocks are ranked favorably by the Zacks Rank system. Let’s take a look at a current example in today’s investment climate.

The Zacks Rank Leads Us to the Best Profit Opportunities

Terex Corporation TEX, a Zacks Rank #2 (Buy), has led the charge this year after breaking out of a powerful cup-with-handle basing pattern in late 2022. TEX sports the highest Zacks Growth Style Score of ‘A’, indicating a strong possibility that the stock continues to propel higher on favorable growth metrics.

The company is part of the Zacks Manufacturing – Construction and Mining industry group, which ranks in the top 9% out of more than 250 Zacks Ranked Industries. Because this group is ranked in the top half of all industries, we expect it to continue to outperform the market over the next 3 to 6 months. Also note the favorable metrics for this industry group below:

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Terex manufactures and sells aerial work platforms and materials processing machinery worldwide. Its products include portable material lifts, utility equipment, telehandlers, cranes, concrete mixer trucks and pavement, and conveyors.

Used in the construction, infrastructure, mining and recycling industries, Terex products are sold under recognized brands such as Terex, Fuchs, EvoQuip, Powerscreen and Cedarapids. TEX is in a great position for improved results in the near future. Solid demand and cost savings will help negate the impact of dwindling supply chain disruptions.

Earnings Trends and Future Estimates

TEX has built up an impressive earnings history, surpassing earnings estimates in each of the past four quarters. The company most recently reported Q4 earnings earlier this month of $1.34/share, a 18.58% surprise over the $1.13 consensus estimate. TEX has delivered a trailing four quarter average earnings surprise of 28.33%.

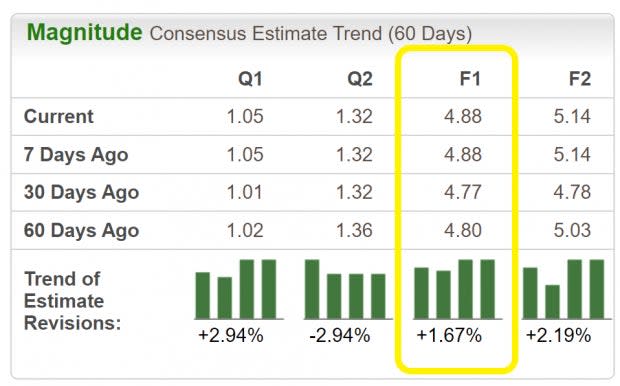

The TEX growth engine is expected to remain hot this year, as analysts covering the company have increased their 2023 EPS estimates by +1.67% in the past 60 days. The Zacks Consensus Estimate now stands at $4.88/share, reflecting potential growth of 12.96% relative to last year. Sales are anticipated to climb 7.42% to $4.75 billion.

Image Source: Zacks Investment Research

Stock Price Movement and Valuation

TEX shares have been hitting a series of 52-week highs this year on strong momentum. Only stocks that are in extremely powerful uptrends are able to make this type of price move. This is the kind of stock we want to include in our portfolio – one that is starting to trend well and receiving positive earnings estimate revisions.

Image Source: Zacks Investment Research

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Terex has recently witnessed positive revisions. As long as this trend remains intact (and TEX continues to deliver earnings beats), the stock will likely continue its bullish run this year.

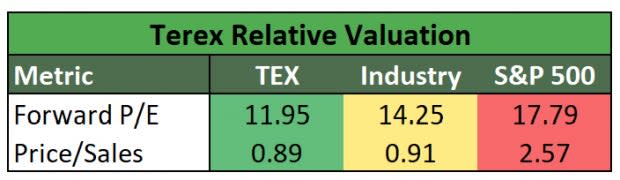

Despite the impressive price run off the lows, TEX currently remains relatively undervalued:

Image Source: Zacks Investment Research

Bottom Line

Backed by a leading industry group and robust history of earnings beats, this market winner is poised to continue its recent run. The Zacks Rank can help us identify stocks that are primed to surge in price. Make sure to take advantage of all that Zacks has to offer, uncovering stocks like TEX in the process.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Terex Corporation (TEX) : Free Stock Analysis Report