Moody's (MCO) Q4 Earnings Miss Estimates, Revenues Up Y/Y

Moody's MCO reported fourth-quarter 2021 adjusted earnings of $2.33 per share, which lagged the Zacks Consensus Estimate of $2.38. The bottom line, however, grew 22% from the year-ago quarter figure.

A rise in operating expenses was a major headwind. However, results benefited from a decent bond issuance volume and strategic buyouts, which led to revenue growth. The company’s liquidity position was robust during the quarter.

After taking into consideration certain non-recurring items, net income attributable to Moody's Corporation was $427 million or $2.28 per share, up from $314 million or $1.66 per share in the prior-year quarter.

In 2021, adjusted earnings per share of $12.29 lagged the consensus estimate of $12.34 but were up 21% year over year. Net income (GAAP basis) was $2.21 billion or $11.78 per share, up from $1.78 billion or $9.39 per share in 2020.

Revenues Improve, Costs Up

Revenues in the quarter were $1.54 billion, which beat the Zacks Consensus Estimate of $1.50 billion. The top line grew 19% year over year. Foreign currency translation unfavorably impacted revenues by 1%.

In 2021, revenues grew 16% to $6.22 billion. The top line also surpassed the consensus estimate of $6.18 billion

Total expenses were $1.03 billion, up 21% from the prior-year quarter. The rise was mainly due to operational and transaction-related costs related to the recent acquisitions. Foreign currency translation positively impacted operating expenses by 1%.

Adjusted operating income of $589 million was up 11%. Adjusted operating margin was 38.3%, down from 41.2% a year ago.

Solid Quarterly Segment Performance

Moody’s Investors Service revenues increased 19% year over year to $871 million. Foreign currency translation unfavorably impacted the segment’s revenues by 1%.

Corporate finance revenues rose, given the increase in U.S. leveraged loans for both M&A transactions and higher refinancing activity. Financial institutions’ revenues grew as issuers took advantage of the low-interest rates and tight spreads.

Structured finance revenues were up, mainly driven by a significant increase in new and refinanced collateralized loan obligation activity and commercial and residential mortgage-backed securities issuance. Public, project and infrastructure finance revenues fell from the year-ago level, given a reduction in U.S. public finance and EMEA sub-sovereign supply.

Moody’s Analytics revenues grew 20% to $668 million. Foreign currency translation unfavorably impacted the segment’s revenues by 1%.

The segment recorded growth in research, data and analytics revenues, as well as Enterprise Risk Solutions revenues.

Strong Balance Sheet

As of Dec 31, 2021, Moody’s had total cash, cash equivalents, and short-term investments of $1.9 billion, down from $2.7 billion on Dec 31, 2020. The company had $7.4 billion of outstanding debt and $1.25 billion in additional borrowing capacity under the revolving credit facility.

Share Repurchase Update

During the quarter, Moody's repurchased 0.3 million shares for $122 million.

2022 Guidance

The company expects adjusted earnings in the range of $12.40-$12.90 per share. On a GAAP basis, earnings are now projected within $11.50-$12.00 per share.

Moody’s projects revenues to increase in the high-single-digit percent range. Expenses are projected to rise in the low-double-digit percent range.

Our Take

Moody’s remains well-positioned for growth on the back of a solid market position, strength in diverse operations and strategic acquisitions. However, steadily increasing operating expenses are likely to hurt its financials to some extent.

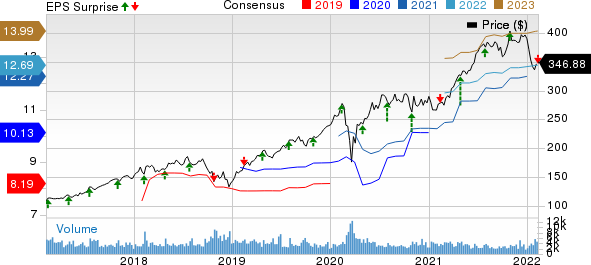

Moody's Corporation Price, Consensus and EPS Surprise

Moody's Corporation price-consensus-eps-surprise-chart | Moody's Corporation Quote

Currently, Moody’s carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Dates Other Finance Stocks

BGC Partners, Inc. BGCP is scheduled to announce quarterly numbers on Feb 16.

Over the past 30 days, the Zacks Consensus Estimate for BGC Partners’ quarterly earnings has moved 6.3% north to 17 cents, suggesting a 30.8% increase from the prior-year reported number.

Hercules Capital, Inc. HTGC is scheduled to announce quarterly numbers on Feb 22.

Over the past 30 days, the Zacks Consensus Estimate for Hercules Capital has been unchanged at 33 cents. This indicates a fall of 10.8% from the prior-year quarter reported number.

FS KKR Capital Corp. FSK is slated to announce quarterly numbers on Feb 28.

Over the past 30 days, the Zacks Consensus Estimate for FS KKR Capital’s quarterly earnings has been unchanged at 62 cents, implying a 13.9% decline from the prior-year reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

BGC Partners, Inc. (BGCP) : Free Stock Analysis Report

FS KKR Capital Corp. (FSK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research