Morgan Stanley Calls Labs 'Safe Havens': Stocks to Watch

It takes just one super deal to turn the odds in your favor. Did the clinical laboratory services market just spin the wheel of fortune? Let’s see what happened.

On May 24, Quest Diagnostics announced an expanded long-term strategic partnership agreement with UnitedHealthcare, a business of UnitedHealth Group UNH, to operate as a preferred national laboratory for all of the company’s members starting Jan 1, 2019. This expanded agreement will provide in-network access to Quest Diagnostics’ complete portfolio of laboratory services to more than 48 million eligible members.

Under the expanded tie-up, the companies are going to join forces on a variety of value-based programs.

At the same time, Laboratory Corporation of Americas Holdings LH, popularly known as LabCorp, has been hogging the spotlight on the news of the company losing its exclusive right to serve UnitedHealthcare post Jan 1.

Meanwhile, LabCorp announced the extension of its partnership agreement with Aetna AET the next day. Per the expanded agreement, LabCorp will serve as a preferred national laboratory for almost all of the company’s members starting next year. The extended agreement will provide in-network access to LabCorp’s complete portfolio of laboratory services to over 20 million eligible members.

According to CNBC, Quest Diagnostics will lose its exclusivity to serve as a preferred laboratory partner to Aetna’s members.

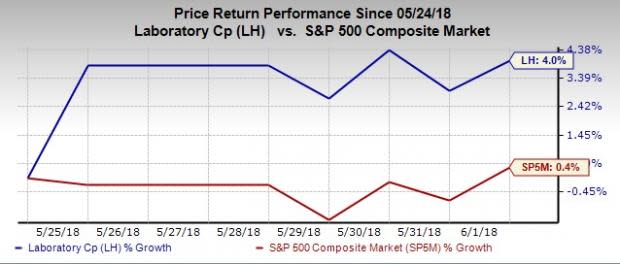

Notably, both the diagnostic testing lab stalwarts’ stocks have been trading higher than the S&P 500 index since May 24.

Per Morgan Stanley’s analyst Ricky Goldwasser, these deals will result in the elimination of the long-time problem of contract overhang and will thereby result in a cognitive environment for pricing in the near term. He also commented "... Labs are relative safe havens within the health care services sector."

Conforming to this idea, we believe that there are other factors which work as growth drivers for the clinical laboratory services market. Let’s delve deeper.

Here we need to consider MarketsandMarkets data which shows that the global clinical laboratory services market is headed to reach a worth of $146.41 billion by 2022, at a CAGR of 5.2% between 2017 and 2022.

Most of the analysts believe an aging demography is primarily acting in favor of this. Per an article commissioned by the National Institute on Aging, part of the National Institutes of Health, 8.5% of the global population is aged 65 years and above.

Strengthening emerging markets are also going to provide impetus to the burgeoning global clinical laboratory services market. According to an article published in Report Buyer, the Asia-Pacific (APAC) region will be the largest market for the clinical laboratory services between 2017 and 2022. Growing disposable income among the middle-class people along with increasing access to state-of-the art clinical laboratory technologies will drive the upside.

According to some analysts, technological advancements in the form of integrated workflow management systems and database management tools are helping the companies expand their sample processing ability every year. Meanwhile, enhancements in laboratory testing technology will continue to boost demand for laboratory services.

Stocks to Watch Out For

Here we highlight three companies that are striving to cash in on the bountiful opportunities in the clinical laboratory services market.

Genomic Health, Inc. GHDX: Based in Redwood City, CA, Genomic Health develops and markets genomic-based clinical laboratory services that analyze the underlying biology of cancer, enabling physicians and patients to make treatment-related decisions.

This Zacks Rank #1 (Strong Buy) company has delivered a positive earnings surprise in two of the trailing four quarters, the average beat being 226.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Quest Diagnostics DGX: Headquartered in Secaucus, NJ, Quest Diagnostics is a leading provider of diagnostic testing information and services in the United States and globally.

This Zacks Rank #3 (Hold) company has beat estimates in three of the trailing four quarters, the average earnings beat being 3.4%.

DaVita Inc. DVA: Headquartered in Denver, CO, DaVita is a leading provider of kidney dialysis services for patients suffering from chronic kidney failure or end stage renal disease. It also provides related lab services in outpatient dialysis centers.

This Zacks Rank #3 company has delivered positive earnings surprise in three of the last four quarters, the average beat being 0.9%.

PAMA: A Downer

Like all other markets, the clinical lab space has its own issues to deal with.

Changes in governmental regulations may have a significant impact on company operations. In the last couple of years, several reimbursement issues have been hurting revenues. Majority of the companies are concerned about the CMS' (Centers for Medicare & Medicaid Services) latest Medicare reimbursement reduction as a result of the implementation of the Protecting Access to Medicare Act (PAMA).

This has been a major dampener for testing laboratories. As said by LabCorp earlier, the new PAMA rates published by CMS do not reflect the intent of Congress when it directed CMS to implement market-based Medicare rates for lab testing. The statement says, “The process CMS followed to determine these rates was fatally flawed and failed to account for significant segments of the lab market by excluding 99 percent of all U.S. labs from reporting data and limiting data collection to 1 percent of laboratories, dominated by independent labs.”

However, per an article on GenomeWeb, companies like Myriad Genetics MYGN, Veracyte and Luminex Corporation among others, which have their own proprietary tests, will for obvious reasons enjoy an edge and more control over pricing.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Myriad Genetics, Inc. (MYGN) : Free Stock Analysis Report

Genomic Health, Inc. (GHDX) : Free Stock Analysis Report

Aetna Inc. (AET) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Quest Diagnostics Incorporated (DGX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research