Morgan Stanley, E-Trade merger underscores race for scale in financial services

Morgan Stanley (MS) made waves in the financial services industry on Thursday after it announced that it would be buying E-Trade (ETFC) in a $13 billion all-stock deal. Analysts say the deal is a matter of survival in a brokerage industry crushed by technology-driven trends in retail investing.

Odeon Capital Group analyst Dick Bove told Yahoo Finance Thursday that the industry is “pretty close to being in crisis.” The brokerage companies are facing enormous margin pressures as a result of the race to $0 commission fees, and the large banks are in a scramble for retail accounts to monetize.

Bove said scale is ultimately the answer. Whereas Goldman Sachs (GS) has opted to chase retail accounts by organically growing its Marcus brand, Morgan Stanley has turned to M&A to achieve the same goals.

“If you don’t merge, if you don’t get scale, if you don’t increase your customer base you’re going to be out,” Bove said. “Because Bank of America wants your business, JP Morgan wants your business.”

Morgan Stanley announced early on Thursday that it would be buying E-Trade for $58.74 a share. The Wall Street Journal originally reported the transaction and said the deal is the largest to be carried out by a big bank since the financial crisis.

Morgan Stanley says that E-Trade CEO Mike Pizzi will continue to run the business once the bank absorbs E-Trade’s 5.2 million client accounts holding over $360 billion of client assets.

Building Scale

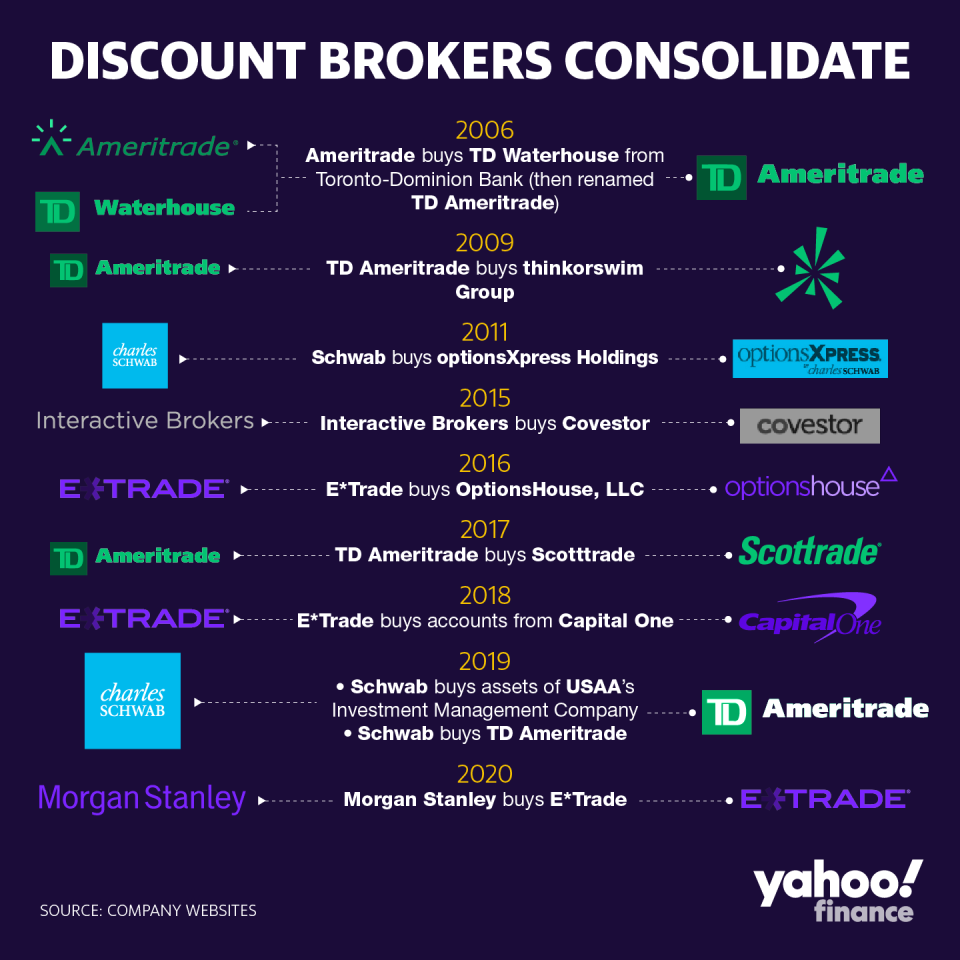

E-Trade was rumored to be an M&A target after Charles Schwab (SCHW) announced a power play to buy rival TD Ameritrade in a deal last November.

In October last year, the major brokerage firms lowered their commission fees to zero, effectively eliminating a revenue stream that the brokers had relied on for decades. The disruption: mobile stock-trading app Robinhood, which had amassed a user base of over 6 million users by offering zero commission trades.

The brokerage firms, which also included Fidelity and Interactive Brokers (IBKR), leaned into another way of making money off of retail accounts: selling order flow to wholesale market makers like Citadel Securities or Virtu Financial.

The middlemen then execute the trades in the market, splitting the spread made on those trades between themselves and the brokerages selling the order flow.

The Schwab and TD Ameritrade merger left E-Trade without a partner, raising speculation that it may need an acquirer to survive.

But analysts say Morgan Stanley may have something to gain from the merger, as well.

Bove says it will be “relatively easy” for Morgan Stanley to use cheap deposits (with interest rates so low) to market loans or other credit products that the bank could not otherwise peddle to high net-worth clients.

“You’ll see them ultimately selling auto loans and other loans, because those are the most profitable products that you can sell,” Bove said.

Timing right?

Wells Fargo Analyst Mike Mayo agrees that scale is important for the big banks, which are in a technological arms race to cut costs by beefing up their digital banking operations.

But Mayo worries that the E-Trade acquisition may be dilutive to the company’s earnings, tangible book value, and company culture. Mayo downgraded the stock to “equal weight” from “overweight.”

“Long-term, the road is littered with mergers like these that have not panned out,” Mayo told Yahoo Finance, pointing to the Schwab acquisition of wealth manager U.S. Trust in 2000, which it then sold in 2006.

Morgan Stanley CEO James Gorman says that E-Trade’s direct-to-consumer channel was attractive to the bank. The company says the merger could lead to potential cost savings of around $400 million.

“This continues the decade-long transition of our firm to a more balance sheet light business mix, emphasizing more durable sources of revenue,” Gorman said in a statement.

The deal is subject to approvals from bank regulators and E-Trade shareholders. Morgan Stanley said it expects the deal to close in the fourth quarter of 2020.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Dallas Fed's Kaplan: US economy 'likely at or past' full employment

Key GOP senators express worries over Trump nominee for the Fed

'We are all competing': Los Angeles finds new ways to tackle labor shortage

Fed Vice Chairman: Interest rates in 'good place' despite 'notable risks'

'This is the new normal': California businesses pessimistic on phase 2 deal

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.