Mortgage forbearance reaches close to 7% of loans: Mortgage Bankers Association survey

Almost 7% of mortgages are now in forbearance, according to a new survey.

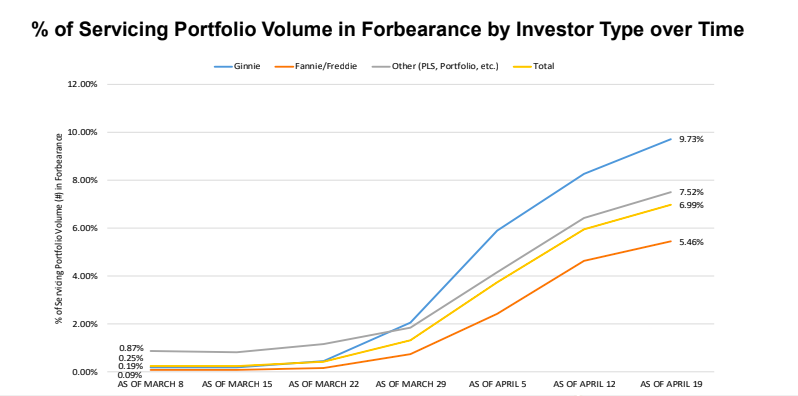

Some 6.99% of home loan borrowers are putting off mortgage payments with forbearance agreements, up from only 0.25% of loans before the pandemic set in the week of March 2, according to the Mortgage Bankers Association’s weekly forbearance and call volume survey, based on 38.3 million loans from April 13 to April 19.

“Over 26 million Americans have filed for unemployment over the last month, leading to nearly 7% — 3.5 million – of all mortgage borrowers asking to be put into forbearance plans,” said Mike Fratantoni, MBA’s senior vice president and chief economist.

Because April payment deadlines already passed for most borrowers, the number of calls requesting forbearance requests actually slowed for the period ending April 19. For the week ending April 12, 1.79% of borrowers requested forbearance, reaching 5.95% of loans in forbearance, while only 1.14% of borrowers requested forbearance for the week ending April 12. But forbearance requests may pick up again as May approaches, according to Fratantoni.

“While the pace of job losses have slowed from the astronomical heights of just a few weeks ago, millions of people continue to file for unemployment. We expect forbearance requests will pick up again as we approach May payment due dates,” said Fratantoni.

Some types of loans did better than others, according to the MBA. Ginnie Mae-backed loans had the greatest increase from the week prior, jumping to 9.73% from 8.25%. Loans backed by private label securities and portfolio loans increased to 7.52% from 6.43% forbearance, according to the results. Fannie Mae-and Freddie Mac-backed loans also increased from the week prior, but they outperformed mortgages in general, jumping to 5.46% from 4.64%.

Some relief for borrowers

Even though forbearance numbers are expected to continue to climb, the MBA expects forbearance requests to stabilize as the economy reopens.

“The combination of stimulus payments, expanded unemployment insurance benefits, further fiscal and monetary actions, and states reopening will hopefully begin to stabilize forbearance requests and the overall economy,” said Fratantoni.

And most borrowers will not be walloped with large repayment burdens on the road to recovery, the Federal Housing Administration announced Monday morning that Fannie Mae and Freddie Mac mortgages would not have to be repaid in a lump-sum when the pandemic passes, and encouraged private lenders to do the same.

“During this national health emergency, no one should be worried about losing their home,” Calabria said in the statement. “While today’s statement only covers Fannie Mae and Freddie Mac mortgages, I encourage all mortgage lenders to adopt a similar approach.”

Sarah Paynter is a reporter at Yahoo Finance. Follow her on Twitter @sarahapaynter

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

More from Sarah:

Coronavirus pandemic isn’t making home sellers lower prices: survey

Construction industry hit hard, even as states deem it an ‘essential service’

Coronavirus and economic uncertainty put home renovation market on ice