The Most Important Dividend Stock Chart You’ll Ever See

Altria (NYSE: MO) has been a great stock to own. The parent company of Philip Morris USA and Marlboro cigarettes, its share price has risen by 1,190% since the turn of the millennium.

As you can see below, that leaves the broader market in the dust.

Image source: Author. Data source: YCharts. Each year calculated on first trading date of the calendar. Last data point December 4, 2017.

But that's not the chart I want to show you about the power of dividends. In fact, as you'll soon see, returns from Altria's stock alone don't even tell half of the story.

The incomprehensible power of dividends

Bill Gates once quipped:

"Most people overestimate what they can do in one year and underestimate what they can do in 10 years."

The same could be said for dividends. If you own a $100 stock but it pays you just $0.50 per quarter, that doesn't move the needle. "How the heck are two quarters going to change anything?" you might think. And in reality, they'll make almost no difference ...over the short-term.

But just as the changes Gates described can compound over time, so, too, can dividends. As long as you take the proper steps -- more on that below -- the effects of dividends can be astounding.

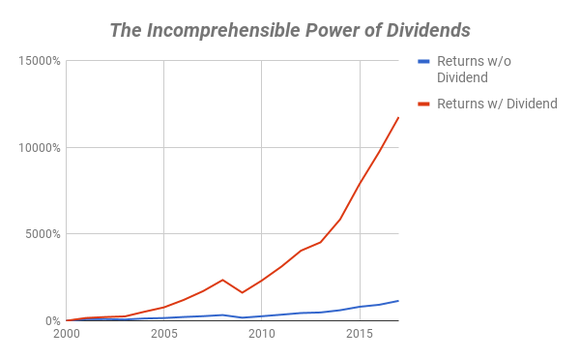

Now let me show you another graph. It's exactly the same as the one above, but with a twist. The blue line represents that amazing outperformance by Altria stock that I showed you above. But the red line shows what the real returns were for those who reinvested their dividends.

Image source: author. Data source: YCharts. Data for each year taken on first trading day of the calendar. Most recent data point as of December 4, 2017.

This isn't an error. While shares of Altria have returned 1,190%, total returns after including dividends top 12,500%!

Here are some other incredible stats to chew on:

Image source: Getty Images

A single share in 2000 would have cost $24. Today's dividend yield is $2.64, representing an 11% annual yield.

But it gets better: because of dividend reinvestment, a single share of stock bought in January 2000 has multiplied into over 4.3 shares.

So for every share purchased in January 2000, you get $11.36 in dividends moving forward -- an effective yield of 49%!

How to make sure you can benefit from the same trends

Obviously, I cherry-picked Altria for this article. Though I haven't done an exhaustive search, it would be hard to find another well-known stock that benefited this much from dividends. And without a doubt, there were some factors completely out of an investor's control that helped the company -- like the fact that judicial and legislative decisions about the dangers of smoking haven't killed the industry.

That being said, there are a few very simple principles you can follow as a dividend investor to benefit from the same compounding power:

Set up an automatic dividend reinvestment plan (DRIP) for such stocks.

Focus on stocks that consistently raise their dividends. Altria has done it 51 times in the last 48 years.

Only buy dividend payers that have a strong economic moat protecting their from competition. For Altria, this came from the strength of the Marlboro brand.

Make sure the dividend doesn't eat up more than 90% of the company's free cash flow.

HOLD THOSE SHARES FOR THE LONG-TERM.

While the first four steps require research and follow-through, the last one is the toughest. Behaviorally, it's difficult to hold through market downturns.

So if you find yourself in that position, reread this article, revisit your investment objectives, and remind yourself of the amazing power of dividends over time.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Brian Stoffel has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.