Motorola (MSI) Beats on Q4 Earnings Despite Soft Revenues

Motorola Solutions, Inc. MSI reported relatively modest fourth-quarter 2020 results, driven by diligent execution of operational plans. Despite surpassing the respective Zacks Consensus Estimate, revenues and adjusted earnings decreased year over year due to coronavirus-induced adversities.

Net Earnings

On a GAAP basis, net earnings in the reported quarter were $412 million or $2.37 per share compared with $244 million or $1.39 in the year-earlier quarter. The improvement, despite top-line contraction, was primarily due to higher non-cash charges in fourth-quarter 2019.

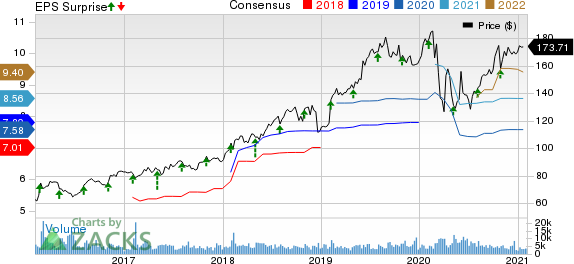

Excluding non-recurring items, non-GAAP earnings in the quarter were $2.86 per share compared with $2.94 in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by 12 cents.

Motorola Solutions, Inc. Price, Consensus and EPS Surprise

Motorola Solutions, Inc. price-consensus-eps-surprise-chart | Motorola Solutions, Inc. Quote

In full-year 2020, GAAP earnings improved to $949 million or $5.45 per share from $868 million or $4.95 in 2019, while non-GAAP earnings per share declined to $7.69 from $7.96 in 2019 largely due to lower sales.

Revenues

Quarterly net sales fell 4.4% year over year to $2,273 million due to lower demand in the Americas and the International business owing to the continued downturn in business led by the virus outbreak. The top line, however, exceeded the Zacks Consensus Estimate of $2,239 million.

Organic revenues decreased 6.9% year over year to $2,213 million. Acquisitions contributed $60 million to incremental revenues. Region wise, revenues were down 3.6% in North America to $1,548 million due to lower sales of public safety land mobile radio and professional and commercial radio products, partially offset by growth in video security and services. International revenues were down 6.1% to $725 million due to a decline in professional and commercial radio as well as public safety land mobile radio products.

Segmental Performance

Net sales from Products and Systems Integration fell 9.7% year over year to $1,510 million, largely due to a significant decline in demand for professional and commercial radio products across all regions. However, the segment witnessed solid demand for video security solutions from utility firms and government sectors. The segment’s backlog was down $38 million to $3.1 billion, primarily due to lower order trends owing to the virus outbreak.

Net sales from Services and Software were up to $763 million from $704 million a year ago, with solid performance across Command Center Software and services along with growth in land mobile radio services. The segment’s backlog increased $213 million to $8.3 billion, primarily due to multi-year agreements in the Americas and favorable foreign exchange effects, partially offset by revenue recognition for Airwave and ESN (Emergency Services Network).

Other Quarterly Details

GAAP operating earnings decreased to $555 million from $590 million in the prior-year quarter, while non-GAAP operating earnings were down 5.6% to $667 million. The company ended the quarter with a record backlog of $11.4 billion, up $175 million year over year.

Overall GAAP operating margin was 24.4%, down from 24.8% due to lower revenues. Non-GAAP operating margin was 29.3% compared with 29.7% in the year-ago quarter.

Non-GAAP operating earnings for Products and Systems Integration were down 16% to $408 million for the corresponding margin of 27%. Non-GAAP operating earnings for Services and Software were $259 million, up 16% year over year, driven by gross margin expansion and higher sales led by strong demand for Command Center Software solutions and continued growth in the services business. This resulted in non-GAAP operating margin of 33.9% for the segment, up from 31.7%.

Cash Flow and Liquidity

Motorola generated $1,613 million of cash from operating activities in 2020 compared with $1,823 million a year ago. Free cash flow for the year was $1,396 million. The company repurchased $171 million worth of stock during the fourth quarter.

As of Dec 31, 2020, the company had $1,254 million of cash and cash equivalents with $5,163 million of long-term debt compared with respective tallies of $1,001 million and $5,113 million a year ago. Motorola repaid $200 million of its unsecured revolving credit facility during the quarter.

Guidance

Despite the lack of clarity regarding the impact of the coronavirus pandemic on the business, the company offered guidance for the first quarter of 2021. Quarterly non-GAAP earnings are expected in the range of $1.58-$1.64 per share on year-over-year revenue growth of 5.5-6%.

For 2021, non-GAAP earnings are expected in the $8.50-$8.62 per share range on year-over-year revenue improvement of 7.3-8% with growth in both the segments as pent up demand picks up pace.

Moving Forward

Motorola is poised to gain from disciplined capital deployment and a strong balance sheet position. The company expects to witness strong demand across land mobile radio products, the video security portfolio, services and software while benefiting from a solid foundation.

Motorola currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader industry are Comtech Telecommunications Corp. CMTL, sporting a Zacks Rank #1 (Strong Buy), and Clearfield, Inc. CLFD and Sonim Technologies, Inc. SONM, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Comtech delivered a trailing four-quarter earnings surprise of 2%, on average.

Clearfield delivered a trailing four-quarter earnings surprise of 62.6%, on average.

Sonim pulled off a trailing four-quarter earnings surprise of 2.2%, on average.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

Sonim Technologies, Inc. (SONM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research