How Will MoviePass Stop Me From Putting It Out of Business?

It took less than two hours -- essentially as long as it took me to catch The Disaster Artist on Sunday night -- for me to become a money-losing subscriber for MoviePass and majority stakeholder Helios and Matheson (NASDAQ: HMNY). I finally joined the growing number of movie buffs willing to pay $9.95 a month for unlimited daily multiplex screenings, figuring I would enjoy the entertainment industry's most unsustainable business model from the inside before the cops of fiscal responsibility raid the party.

AMC Entertainment (NYSE: AMC) charged my MoviePass debit card $12.30 for the ticket, and the multiplex giant is charging the celluloid subscription service the full price for the admission. AMC is no fan of MoviePass since it devalues the movie-going value proposition, but it doesn't have a problem collecting an average of $11.88 per ticket from MoviePass purchases. AMC has no intention of discounting the tickets for the benefit of MoviePass the way that some smaller chains have done, and that's just one of the reasons why the platform is doomed at its current price point.

Image source: MoviePass.

Fade to red

The appeal of MoviePass is obvious for consumers, and we've seen its subscriber count grow from 20,000 to more than 600,000 since its mid-August move to slash its rate to $9.95 a month. This was also when data analytics specialist Helios and Matheson took what is now a roughly 53% share stake in the business. We haven't sees a subscriber update since late October, but it wouldn't be a surprise to see MoviePass cross 1 million members before the end of this year.

Overnight success has been humbling, if not fumbling, for MoviePass. It sometimes takes several weeks for new members to receive their debit cards that are used to purchase tickets that have been pre-authorized by app check-ins, and that's just the tip of the iceberg. Look up most MoviePass postings on social media and read the comments from irate members that have yet to receive their cards, can't activate them once they receive them, are being double-billed, or have had issues completing theater transactions.

I had one reader write me a couple of weeks ago, pointing out that he can log in through the website but can't do so through the app, which is required for everything from ticket purchases to managing billing preferences to ultimately cancelling the service. Creating support tickets and firing off emails haven't remedied the situation. Subscriber complaints may represent the minority of customers, but you have to feel for them since this model's going to implode sooner rather than later.

Image source: MoviePass.

Life imitates farce

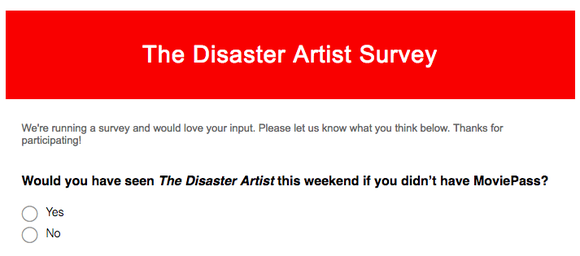

Helios and Matheson argues that MoviePass will make money by mining for selling data it collects and advertising. I was hit with a one-question survey after last night's showing. It can also offset some of its costs by promoting theatrical releases. MoviePass CEO Mitch Lowe told Deadline last month that while MoviePass accounts for 2% of all tickets currently purchased that films promoted by MoviePass -- particularly low-budget indies -- are seeing their MoviePass-purchased daily share of tickets sold in the low double digits. MoviePass is offering some more granularity on its success as a promoter this week, signing a marketing and performance-based revenue agreement with an independent movie distributor on Monday.

It's not going to be enough. Let's say I wind up going to a movie a week at my local AMC at the $11.88 average. Are four data points and my $9.95 going to cover the monthly tab that will average a little more than $50? If promoting individual films gets me to see even more movies instead of replacing ones I would have seen, won't that only shorten the fuse?

Investors have had a wild ride on Helios and Matheson. The stock traded as low as $2.42 a month after MoviePass' head-turning price cut, only to peak at $38.86 a month later on strong subscriber growth. The stock has fallen back to the single digits.

The MoviePass model isn't built to last, but I will continue to enjoy it until the raid comes. Sunday night's The Disaster Artist experience was great. Investing in the company with a controlling stake in the enterprise, well, that's an entirely different kind of disaster artist.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Rick Munarriz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.